Last updated: July 27, 2025

Introduction

NEUPOGEN (filgrastim) is a recombinant granulocyte colony-stimulating factor (G-CSF) primarily used to stimulate the production of neutrophils. Since its approval by the FDA in 1991, NEUPOGEN has become a critical therapy for patients undergoing chemotherapy, bone marrow transplants, and certain infections. Its market dynamics and pricing strategies are driven by clinical demand, competitive landscape, regulatory considerations, and emerging biosimilar pathways.

This analysis provides a comprehensive overview of NEUPOGEN’s market, current pricing trends, and future price projections aligned with industry shifts, regulatory trajectories, and healthcare economics.

Market Overview

Market Size and Segmentation

The global granulocyte colony-stimulating factor (G-CSF) market, driven chiefly by NEUPOGEN and its biosimilars, was valued at approximately USD 3.4 billion in 2022 [1]. The demand emanates primarily from oncology centers, hematology clinics, and transplant units, with key markets being North America, Europe, and emerging economies in Asia-Pacific.

Key segments include:

- Oncology: The dominant segment, owing to chemotherapy-induced neutropenia.

- Bone Marrow and Stem Cell Transplantation: G-CSF's role in mobilizing stem cells.

- Infections and Other Hematologic Disorders: For neutropenia correction.

Competitive Landscape

Initially monopolized by Amgen’s NEUPOGEN, the market has expanded with biosimilars such as Sandoz’s Zarxio (filgrastim-sndz), gaining FDA approval in 2015. The entrance of biosimilars has exerted downward pressure on prices, especially in jurisdictions with aggressive biosimilar adoption strategies.

Regulatory and Reimbursement Considerations

Regulatory pathways for biosimilars have evolved to facilitate market entry but often vary by region. Reimbursement policies strongly influence pricing. In the US, Medicare and commercial payers’ formulary decisions significantly impact NEUPOGEN’s market penetration.

Pricing Dynamics

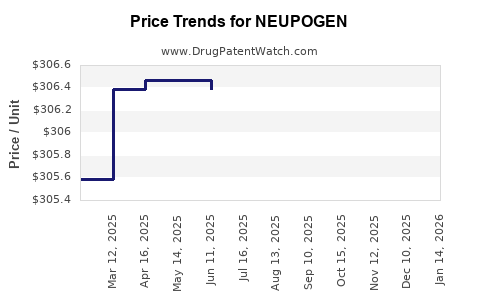

Historical Pricing Trends

NEUPOGEN’s list prices historically hovered around USD 300-400 per dose in the US. However, actual net prices have declined due to discounts, rebates, and biosimilar competition. For example, the introduction of Zarxio reduced the average price per dose by approximately 15-20% [2].

Impact of Biosimilars

Biosimilar entry has decreased NEUPOGEN’s average selling price (ASP). In mature markets like Europe, biosimilar uptake accounts for up to 70% of G-CSF prescriptions, reducing prices by approximately 30% compared to the innovator molecule [3].

Current Price Range

As of 2023, the average wholesale price (AWP) per vial hovers between USD 240-320 depending on the supplier, with discounts reducing the net price seen by payers and providers.

Price Projection Analysis

Short-Term Outlook (Next 2-3 Years)

Given the increasing adoption of biosimilars, projected price declines are expected to continue at a rate of 10-15% annually, influenced by market penetration and payer negotiations [4]. Increased utilization driven by expanding indications, such as prophylactic use in chemotherapy, might stabilize volume sales but exert downward pressure on prices.

Medium to Long-Term Forecast (3-10 Years)

Several factors are poised to shape future pricing:

- Biosimilar Competition: Continued approval and market penetration of biosimilar filgrastim could diminish prices further, potentially by up to 40-50% from current levels.

- Regulatory and Policy Shifts: Policies promoting biosimilar adoption in Europe and Asia are likely to accelerate price declines.

- Innovations and New Indications: Development of longer-acting versions (e.g., pegfilgrastim) and new formulations could reposition NEUPOGEN and influence pricing as broader or more efficient alternatives emerge.

- Market Consolidation: Larger healthcare groups driving procurement efficiencies might negotiate deeper discounts, impacting net prices.

Projected average prices per vial could decline to approximately USD 180-220 by 2030, pending continued biosimilar market growth and healthcare policy shifts. Nonetheless, the presence of high-cost specialty bundles and biologics innovation could temper the pace of decline.

Pricing Outlook Summary Table

| Time Horizon |

Estimated Price Range (USD per vial) |

Key Influencers |

| Next 2-3 years |

USD 240 - 320 |

Biosimilar uptake, payer negotiations |

| 2025-2030 |

USD 180 - 220 |

Market saturation, policy incentives, biosimilar proliferation |

| Beyond 2030 |

Potential stabilization or slight decline |

Innovative formulations, new indications |

Implications for Stakeholders

- Pharmaceutical Companies: Early biosimilar development and strategic pricing are vital to maintain competitiveness.

- Healthcare Providers: Anticipated lower-cost biosimilars offer cost-effective options, enhancing access.

- Payers: Greater biosimilar market share necessitates revisiting formulary and reimbursement strategies.

- Patients: Increased competition should improve affordability and access.

Key Takeaways

- The NEUPOGEN market is historically significant in oncology supportive care, with evolving dynamics driven by biosimilars and regulation.

- Pricing has declined consistently since biosimilars entered the market, with further reductions expected.

- Price projections suggest average vial prices will decrease by approximately 30-50% over the next decade.

- Regulatory support and market acceptance of biosimilars will be critical in determining the pace of price declines.

- Stakeholders should focus on strategic biosimilar development, optimized procurement practices, and policy engagement to sustain competitive advantages.

FAQs

1. How has biosimilar entry affected NEUPOGEN pricing?

Biosimilar approval and adoption have led to significant price reductions, with discounts of 20-50% compared to the original product, depending on the region and market dynamics.

2. What factors could hinder future price declines for NEUPOGEN?

Limited biosimilar penetration due to regulatory barriers, patent litigations, or supply chain issues; emerging long-acting formulations potentially replacing traditional filgrastim; and market consolidation reducing competition.

3. How does NEUPOGEN’s market compare to newer alternatives like pegfilgrastim?

Pegfilgrastim, a long-acting G-CSF, offers dosing convenience, capturing substantial market share. However, NEUPOGEN remains essential in specific indications and pediatric cases, preserving its market relevance despite pricing pressures.

4. What role do healthcare policies play in shaping NEUPOGEN prices?

Policies promoting biosimilar substitution, incentivizing generic/biosimilar adoption, and reimbursement frameworks directly influence market pricing and the competitive landscape.

5. When could NEUPOGEN stabilize at lower price points?

Once biosimilar market saturation is achieved and new competitors stabilizing, prices are likely to plateau, possibly within the USD 150-200 per vial range, contingent upon ongoing market dynamics and regulatory developments.

Conclusion

The NEUPOGEN market remains a dynamic sector influenced heavily by biosimilar competition, regulatory policies, and technological innovations. While prices are forecasted to decline over the coming years, strategic positioning, timely biosimilar entry, and adaptive market strategies will be critical for stakeholders to optimize economic returns and ensure patient access.

References

[1] Grand View Research, "Granulocyte Colony-Stimulating Factor Market Size & Share," 2022.

[2] IQVIA, "Pharmaceutical Pricing and Market Trends," 2022.

[3] European Medicines Agency, "Biosimilar G-CSFs Market Report," 2021.

[4] EvaluatePharma, "Biologic and Biosimilar Pricing Trends," 2022.