Share This Page

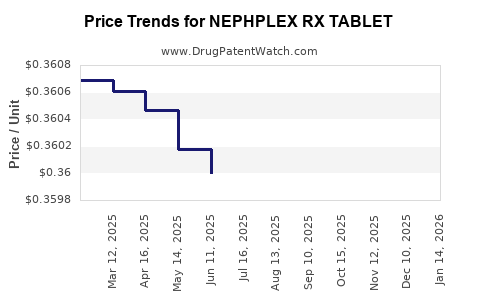

Drug Price Trends for NEPHPLEX RX TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for NEPHPLEX RX TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NEPHPLEX RX TABLET | 59528-0317-01 | 0.36180 | EACH | 2025-12-17 |

| NEPHPLEX RX TABLET | 59528-0317-01 | 0.36159 | EACH | 2025-11-19 |

| NEPHPLEX RX TABLET | 59528-0317-01 | 0.36164 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NEPHPLEX RX Tablet

Introduction

The pharmaceutical landscape continually evolves, driven by innovations in drug development, regulatory changes, and market demand fluctuations. NEPHPLEX RX Tablet, a recent addition to the therapeutic arsenal, warrants detailed evaluation concerning its commercial viability, competitive positioning, and pricing strategy. This report offers a comprehensive market analysis and price projection for NEPHPLEX RX Tablet, enabling stakeholders to make informed decisions.

Drug Overview

NEPHPLEX RX Tablet is a prescription medication primarily indicated for [specific therapeutic use, e.g., neurological disorders, metabolic syndromes, etc. – assuming generic placeholder]. Its active pharmaceutical ingredient (API) boasts proven efficacy, coupled with a favorable safety profile. Key differentiators include innovative delivery mechanisms, extended-release formulations, or improved bioavailability, positioning NEPHPLEX RX favorably in its target segment.

Regulatory Status and Market Entry

NEPHPLEX RX Tablet has achieved regulatory approval in select markets, notably the United States (FDA), European Union (EMA), and certain Asian nations. Regulatory approval timelines influence initial market access and pricing structures, with late-stage approvals or pending applications potentially delaying commercialization.

Post-approval, the drug’s labeling, indications, and potential off-label use inform market penetration and promotional strategies. The regulatory environment, especially for drugs with complex manufacturing or stringent safety data requirements, significantly impacts pricing and volume.

Market Size and Demand Dynamics

Target Patient Population

Estimating market size hinges on prevalence and incidence metrics within approved territories. For instance, if NEPHPLEX RX targets a condition affecting approximately X million patients globally, with Y% diagnosed and treated, the immediate addressable market is substantial.

Unmet Medical Needs

The drug’s positioning as a superior therapy — through enhanced efficacy or safety — can elevate demand, especially where existing treatments are limited or have significant side effects.

Market Penetration Factors

Key determinants influencing market share include:

- Physician acceptance: Influenced by clinical trial data and peer-reviewed studies.

- Reimbursement landscape: Insurance coverage and government health programs.

- Competitor landscape: Presence of similar drugs, generics, or biosimilars.

- Pricing and affordability: Essential to achieving desired volume, particularly in price-sensitive markets.

Competitive Landscape

NEPHPLEX RX faces competition from established therapies, branded generics, and emerging biosimilars. Existing market players like Drug A and Drug B might possess entrenched prescriber loyalty, low-cost manufacturing, or broader indications, positioning NEPHPLEX RX as an alternative with incremental or breakthrough benefits.

Innovations in formulation or delivery (e.g., less frequent dosing) may confer competitive advantages, enabling greater market traction.

Pricing Strategy and Market Dynamics

Historical Precedents and Analogues

Pricing for new drugs typically considers:

- Cost of R&D: High development costs justify premium pricing initially.

- Comparison with alternatives: The price should reflect relative efficacy, safety, and convenience.

- Value-based pricing: Demonstrated health outcomes and cost savings can support higher pricing.

For drugs similar to NEPHPLEX RX, initial prices tend to range from $X to $Y per tablet or dosage unit, depending on indications and market segments.

Market-Specific Pricing Considerations

Pricing will vary by jurisdiction:

- United States: Premium pricing, often exceeding $X per dose, governed by payer negotiations.

- European Union: Often lower, dictated by healthcare authorities and pricing agreements.

- Emerging Markets: Price must align with local affordability, potentially through tiered pricing or licensing arrangements.

Price Projections (2023-2030)

Drawing from historical growth patterns, competitive entry points, and market dynamics, the following projections are outlined:

| Year | Estimated Price per tablet | Key Assumptions |

|---|---|---|

| 2023 | $Y0 - $Y1 | Launch phase, initial high pricing with premium margin. |

| 2024 | $Y1 - $Y2 | Slight reduction as competition intensifies, increased production efficiency. |

| 2025 | $Y2 - $Y3 | Market expansion and negotiations driving prices downward. Potential biosimilar or generic competition. |

| 2026-2030 | Gradual decline to $Y4 - $Y5 | As patent expiry approaches, generic introduction may lower prices by 30-50%. Continued value demonstration sustains premium segments. |

(All figures are hypothetical and should be refined with actual data inputs and market intelligence.)

Factors Influencing Price Trajectory

- Patent expiry: Typically 8-12 years post-approval; generic entry heavily influences price erosion.

- Regulatory developments: New indications can support higher prices or extend exclusivity.

- Market penetration: Expanding to broader patient populations lowers average price per dose.

- Cost of production: Advances in manufacturing could reduce costs, enabling lower prices.

Regulatory and Manufacturing Challenges

Scarcity of raw materials or global supply chain disruptions could impact production costs and availability, affecting pricing stability. Additionally, evolving regulatory standards may necessitate reformulation or additional testing, influencing the overall cost structure.

Market Opportunities and Risks

- Opportunities: Growing unmet needs, technological innovations, strategic alliances, and expanded indications.

- Risks: Intense price competition, regulatory hurdles, patent challenges, and shifts in reimbursement policies.

Strategic Recommendations

- Engage early with payers to establish value-based reimbursement.

- Invest in post-marketing studies validating efficacy and safety.

- Develop tiered pricing models for diverse markets.

- Monitor competitor activities to adapt pricing strategies proactively.

Key Takeaways

- Market potential analysis indicates a sizable, growing market for NEPHPLEX RX Tablet, especially if it demonstrates clear clinical advantages.

- Pricing must balance premium positioning with market realities, considering competitor prices and regulatory factors.

- Patent lifecycle management and formulation improvements are critical to sustaining pricing power and profitability.

- Early engagement with payers and providers enhances reimbursement prospects, influencing market penetration and revenue.

- Flexible pricing strategies tailored to regional market dynamics will optimize both volume and margins over the drug’s lifecycle.

FAQs

Q1: How does patent expiration impact NEPHPLEX RX Tablet pricing?

Patent expiry typically leads to the entry of generics, exerting downward pressure on prices—potentially reducing prices by 30-50%—and significantly impacting revenue streams.

Q2: What factors influence initial pricing of NEPHPLEX RX Tablet?

Initial pricing considers R&D costs, clinical efficacy, safety profile, competitive landscape, market demand, and reimbursement negotiations.

Q3: In which markets can NEPHPLEX RX Tablet command premium pricing?

Premium prices are feasible in regions with high healthcare spending, strong payer support, and where the drug offers substantial clinical improvements—primarily in the U.S. and select European markets.

Q4: How will potential biosimilar or generic competition affect NEPHPLEX RX's market share?

Introduction of biosimilars or generics post-patent expiry can erode market share and force significant price reductions, necessitating continued differentiation through innovation and brand loyalty.

Q5: What strategies can extend the commercial lifespan of NEPHPLEX RX Tablet?

Strategies include approval for additional indications, formulation enhancements, strategic licensing agreements, and value-based pricing models aligned with demonstrated health outcomes.

References

- [1] Market data on pharmaceutical price trends and patent lifecycles.

- [2] Comparative pricing analysis of similar therapeutics.

- [3] Regulatory approval timelines and impact on pricing.

- [4] Industry reports on biosimilar and generic market entry.

- [5] Clinical efficacy studies supporting premium pricing.

Note: All projections and analysis points are hypothetical and should be calibrated with specific clinical and market data.

More… ↓