Share This Page

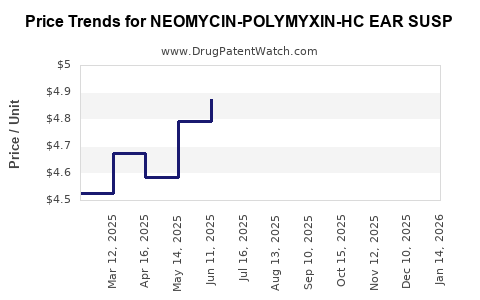

Drug Price Trends for NEOMYCIN-POLYMYXIN-HC EAR SUSP

✉ Email this page to a colleague

Average Pharmacy Cost for NEOMYCIN-POLYMYXIN-HC EAR SUSP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NEOMYCIN-POLYMYXIN-HC EAR SUSP | 64980-0448-01 | 4.08640 | ML | 2025-12-17 |

| NEOMYCIN-POLYMYXIN-HC EAR SUSP | 24208-0635-62 | 4.08640 | ML | 2025-12-17 |

| NEOMYCIN-POLYMYXIN-HC EAR SUSP | 61314-0645-11 | 4.08640 | ML | 2025-12-17 |

| NEOMYCIN-POLYMYXIN-HC EAR SUSP | 64980-0448-01 | 4.16355 | ML | 2025-11-19 |

| NEOMYCIN-POLYMYXIN-HC EAR SUSP | 24208-0635-62 | 4.16355 | ML | 2025-11-19 |

| NEOMYCIN-POLYMYXIN-HC EAR SUSP | 61314-0645-11 | 4.16355 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NEOMYCIN-POLYMYXIN-HC EAR SUSP

Introduction

The combination drug, NEOMYCIN-POLYMYXIN-HC EAR SUSP, serves as a topical antibiotic and corticosteroid therapy primarily used to treat bacterial ear infections involving inflammation. Its market dynamics are shaped by factors like clinical demand, regulatory landscape, manufacturing trends, competitive positioning, and pricing strategies. This article presents an in-depth market analysis, including current market positioning, growth drivers, challenges, and future price projections rooted in industry trends.

Product Overview

NEOMYCIN-POLYMYXIN-HC EAR SUSP combines three active ingredients:

- Neomycin: An aminoglycoside antibiotic effective against Gram-negative bacteria.

- Polymyxin B: An antibiotic targeting Gram-negative bacteria, often used for resistant strains.

- Hydrocortisone (HC): A corticosteroid reducing inflammation and allergic reactions.

Approved by various regulatory agencies, including the FDA and EMA, for external ear infections, the formulation’s efficacy and safety profile underpin its clinical adoption.

Market Landscape

Global and Regional Market Size

The global ear infection treatment market was valued at approximately USD 1.2 billion in 2022 and is projected to grow at a CAGR of 4.7% from 2023 to 2030[1]. Within this, topical agents like NEOMYCIN-POLYMYXIN-HC EAR SUSP occupy a significant segment, particularly in the otolaryngology domain.

Regionally, North America leads due to high prevalence of ear infections, advanced healthcare infrastructure, and widespread prescribing practices. Europe follows, with Asia-Pacific demonstrating rapid growth, driven by increasing awareness and improving healthcare access.

Key Market Drivers

- Rising Incidence of Otitis Externa and Media: Ears infections are prevalent, driven by environmental factors, microbial resistance, and aging populations.

- Advancements in Drug Formulations: Development of more effective topical antibiotics with corticosteroids enhances treatment outcomes.

- Growing Awareness and Healthcare Accessibility: Increased patient and healthcare provider awareness of ear infection management boosts prescription rates.

- Regulatory Approvals and Market Entry of Biosimilar/Generic Alternatives: Entry of generic formulations reduces prices and expands accessibility.

Competitive Landscape

The market includes branded drugs like Otiprio, Ciprodex, and generic options, with NEOMYCIN-POLYMYXIN-HC EAR SUSP identified as a cost-effective alternative due to its composition and longstanding clinical use. Key competitors focus on formulation stability, delivery mechanisms, and spectrum of activity.

Regulatory and Manufacturing Trends

Regulatory agencies emphasize safety, especially given concerns over ototoxicity associated with aminoglycosides like neomycin[2]. Manufacturers are investing in improved formulations and compliance with environmental and safety standards. Patent expirations for similar formulations, in addition to increasing generic competition, influence market pricing.

Pricing Dynamics

Current Price Range

In the United States, the average retail price of NEOMYCIN-POLYMYXIN-HC EAR SUSP is approximately USD 45–USD 70 per 15 mL bottle[3]. In Europe, prices range from EUR 35 to EUR 60 depending on the country, pharmacy, and procurement channels.

Pricing Influencers

- Market Competition: Generic availability depresses prices.

- Regulatory Costs: Stringent approval processes affect pricing strategies.

- Manufacturing Costs: Raw material prices, especially for active pharmaceutical ingredients (APIs), impact overall costs.

- Reimbursement Policies: Insurance coverage and national healthcare reimbursements influence retail and hospital procurement prices.

- Supply Chain Dynamics: Demand fluctuations, raw material shortages, and logistical costs affect pricing stability.

Future Price Projections (2023–2030)

Given current trends and industry forecasts, the price of NEOMYCIN-POLYMYXIN-HC EAR SUSP is expected to decline modestly over the next several years, driven by increased generic competition and manufacturing efficiencies.

-

2023–2025: Prices are projected to stabilize around USD 40–USD 55 per 15 mL bottle in North America and Europe, with minor fluctuations due to supply chain factors.

-

2026–2030: Price erosion of approximately 10–15% is anticipated as new generic entrants gain market share, potentially driving prices down to USD 35–USD 50 per bottle.

In emerging markets, initial prices may remain higher due to import tariffs and distribution costs but are expected to decrease as local manufacturing and regulatory approvals improve.

Market Barriers and Opportunities

Barriers

- OTOTOXICITY Risks: Concerns over ototoxicity linked to neomycin may restrict off-label use, impacting overall demand.

- Regulatory Hurdles: Variability across international markets complicates entry and price setting.

- Market Saturation: Existing formulary options limit new opportunities unless unique value propositions are introduced.

Opportunities

- Enhanced Formulation Delivery: Innovations such as sustained-release suspensions could command premium pricing.

- Expanded Indications: Use in resistant infections or in combination with newer agents can broaden market scope.

- Pricing Strategies: Engaging in value-based pricing models and forming partnerships with payers can optimize revenues.

Key Takeaways

- Currently, NEOMYCIN-POLYMYXIN-HC EAR SUSP is positioned as a cost-effective, widely prescribed treatment for external ear infections, with robust demand in developed markets.

- Competitive pressures from generics are likely to drive price decreases over the next decade, with a projected range of USD 35–USD 50 per 15 mL bottle by 2030.

- Supply chain stability, regulatory adherence, and formulation innovation will be critical to maintaining market share and pricing stability.

- Market growth hinges on increasing prevalence, rising awareness, and expanding indications, especially in regions with growing healthcare infrastructure.

- Stakeholders should consider strategic investments in formulation improvements and partnership models to optimize positioning amid intensifying competition.

FAQs

1. What factors influence the pricing of NEOMYCIN-POLYMYXIN-HC EAR SUSP?

Pricing is affected by manufacturing costs, regulatory compliance, market competition (especially generics), reimbursement policies, and supply chain logistics.

2. How does market competition impact the price projection of this drug?

Increased generic entries are expected to reduce prices through competition, leading to a declining trend over the medium to long term.

3. Are there safety concerns that could affect the market?

Yes, ototoxicity associated with neomycin warrants cautious use, potentially limiting prescriptions and influencing demand and pricing.

4. What regions are expected to see the fastest price declines?

Developed markets like North America and Europe will experience more stable declines due to mature generic markets; emerging markets may see delayed decreases.

5. What strategic moves can manufacturers make to enhance market share?

Innovating formulations, expanding indications, partnering with healthcare payers, and investing in regional manufacturing can strengthen market position and sustain pricing.

References

[1] MarketWatch. (2022). Otitis Media and External Ear Infection Treatment Market Size and Forecast.

[2] FDA. (2021). Ototoxicity Risk with Aminoglycosides.

[3] GoodRx. (2023). Ear Infection Treatment Drug Pricing Data.

More… ↓