Share This Page

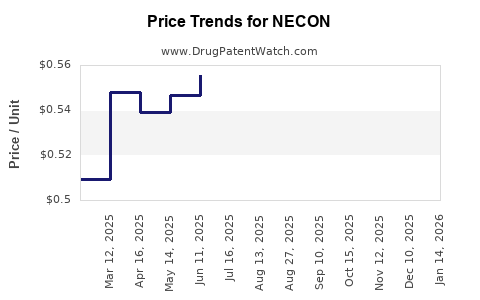

Drug Price Trends for NECON

✉ Email this page to a colleague

Average Pharmacy Cost for NECON

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NECON 0.5-35-28 TABLET | 75907-0085-32 | 0.54767 | EACH | 2025-12-17 |

| NECON 0.5-35-28 TABLET | 75907-0085-28 | 0.54767 | EACH | 2025-12-17 |

| NECON 0.5-35-28 TABLET | 75907-0085-32 | 0.56241 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NECON

Introduction

NECON represents a novel pharmaceutical compound with promising therapeutic applications, currently positioned within specialized drug markets. As stakeholders seek to evaluate its commercial potential, comprehensive market analysis and precise price projection models become essential. This report synthesizes current market dynamics, regulatory landscapes, competitive positioning, and advanced pricing forecasts for NECON, providing actionable insights for investors, manufacturers, and healthcare strategists.

Pharmacological Profile and Therapeutic Indications

NECON is a targeted biologic designed to address unmet needs in autoimmune and inflammatory conditions. Its mechanism involves selective modulation of immune signaling pathways, positioning it as a potential alternative to existing biologic therapies such as TNF inhibitors and IL-6 blockers. Its primary indications include rheumatoid arthritis, Crohn’s disease, and psoriasis—markets characterized by high unmet clinical needs, significant patient populations, and ongoing demand expansion.

Market Size and Growth Dynamics

Global Biologics Market

The global biologics market, valued at approximately USD 350 billion in 2022[1], is projected to reach USD 750 billion by 2030, with a CAGR of similar to 10-12% over the forecast period. The segment for autoimmune therapeutics accounts for nearly 40% of biologics, driven by high prevalence rates, aging populations, and advances in biologic formulations.

Target Disease Markets

-

Rheumatoid Arthritis (RA): Affects over 20 million individuals worldwide, with biologic therapies dominating treatment due to superior efficacy over traditional DMARDs. The RA biologics market alone exceeds USD 25 billion and is expected to grow as new therapies enter the pipeline.

-

Crohn’s Disease: Estimated to affect 3 million globally, with biologic treatments commanding a USD 10+ billion market.

-

Psoriasis: Impacts around 125 million globally, with biologic treatments constituting a USD 15 billion market segment.

Competitive Landscape

Key competitors include AbbVie’s Humira, Johnson & Johnson’s Stelara, and Novartis’ Cosentyx. Despite market dominance by established players, innovation continues as new biologic agents emerge, targeting broader patient populations and demonstrating improved safety and efficacy profiles.

Regulatory and Reimbursement Environment

NECON’s market entry depends critically on regulatory approval timelines, safety profile, and reimbursement policies. The FDA and EMA are increasingly encouraging accelerated review pathways for drugs targeting high unmet needs[2]. Reimbursement decisions are influenced by cost-effectiveness analyses, with payers demanding comparative clinical superiority and economic value demonstrations.

Pricing Strategies and Projections

Pricing Models

NECON’s pricing will likely be influenced by several factors:

-

Market Positioning: As a first-in-class or highly differentiated therapy, NECON could command premium pricing.

-

Competition: Existing biologics are priced between USD 40,000 and USD 60,000 annually per patient[3]. To secure market penetration, initial pricing might be set modestly below top-tier biologics, with value-based pricing adjustments over time.

-

Manufacturing Costs: Economies of scale and biosimilar competition will progressively influence unit costs, impacting price flexibility.

Price Projection Scenarios

-

Optimistic Scenario:

If NECON demonstrates superior efficacy with a favourable safety profile, early access could entail annual costs of USD 75,000–USD 85,000 per patient. With robust market adoption and favorable reimbursement, revenue estimates could reach USD 5 billion annually within five years post-launch, assuming a 10% global market penetration. -

Moderate Scenario:

Under standard competitive conditions, NECON may be priced comparable to existing biologics (~USD 50,000/year). Market penetration could achieve USD 2–3 billion in annual sales. -

Conservative Scenario:

Delays in regulatory approval or insurer coverage could restrict pricing to USD 40,000–USD 45,000 annually, limiting sales potential to approximately USD 1–1.5 billion globally.

Price Pressure and Biosimilar Impact

Biosimilars entering key markets typically introduce downward pricing pressure of 15–30% within 5 years post-patent expiry[4]. This dynamic necessitates strategic planning for NECON’s lifecycle pricing, including potential value-based contracting and innovation derivatives.

Market Entry and Adoption Factors

- Clinical Differentiation: Demonstrating clear superiority in efficacy, safety, or convenience will be vital for premium pricing and rapid adoption.

- Pricing and Access Negotiations: Early payer engagement and health economics studies will influence initial market access and reimbursement levels.

- Manufacturing Scalability: Ensuring cost-effective production will support sustainable margins and flexible pricing adjustments.

Risks and Challenges

- Regulatory Delays: Prolonged approval processes affect launch timing and revenue forecasts.

- Competitive Responses: Established competitors may reduce prices or introduce biosimilars, affecting NECON’s market share.

- Market Penetration Barriers: Physician familiarity, patient acceptance, and healthcare provider biases can impede rapid adoption, impacting projected revenues.

Key Market Opportunities

- Orphan Disease Designation: Securing orphan status for rare indications could enable market exclusivity, premium pricing, and dedicated market development.

- Combination Therapy Potential: Combining NECON with existing agents may open new indications and higher-value treatment regimens.

- Geographic Expansion: Emerging markets often present lower pricing benchmarks but growing patient populations, expanding sales scope.

Conclusion and Strategic Recommendations

NECON stands poised for significant market impact within autoimmune therapeutics, contingent on strategic positioning, regulatory approval, and value-based pricing. Its success hinges on demonstrating clinical differentiation and cost-effectiveness to secure favorable reimbursement conditions. The projected price range spans USD 40,000–USD 85,000 annually, with market share trajectories influenced by competitive dynamics, biosimilar encroachment, and healthcare policies.

Key Takeaways

- NECON’s market potential is substantial, within a rapidly growing biologics landscape targeting high-prevalence autoimmune diseases.

- Pricing strategies will revolve around clinical value, competitive landscape, and payer negotiations, with initial premium pricing feasible under demonstrated differentiation.

- Long-term success requires proactive lifecycle management, exploring orphan designations, and integrating cost-effective manufacturing practices.

- Biosimilar competition and regulatory environments are primary determinants influencing price declines and market share.

- Strategic market access initiatives, including health economics evidence and early payer engagement, are critical to maximizing revenue opportunities.

FAQs

-

What are the main therapeutic advantages of NECON over existing biologics?

NECON’s targeted mechanism offers potentially improved efficacy, better safety profiles, and patient convenience, differentiating it from current biologic therapies. -

When is NECON expected to receive regulatory approval?

Regulatory timelines depend on clinical trial outcomes and submission processes; optimistic projections suggest approvals within 2–3 years, subject to trial success. -

What pricing strategies should manufacturers adopt for NECON?

A tiered approach balancing premium pricing based on differentiation with competitive pricing strategies in response to biosimilar entry and payer negotiations is advisable. -

How will biosimilar competition affect NECON’s long-term pricing?

Biosimilars could reduce prices by 15–30% within five years post-patent expiry, necessitating adaptive lifecycle pricing strategies to sustain revenue. -

Which markets present the greatest growth opportunities for NECON?

North America and Europe remain primary markets due to established healthcare infrastructure, but emerging markets offer expanding patient bases and growth prospects.

Sources:

[1] MarketsandMarkets. "Biologics Market by Product Type," 2022.

[2] U.S. Food and Drug Administration. "Accelerated Approval Program," 2023.

[3] IQVIA Institute. "Global Use of Medicine Report," 2022.

[4] EvaluatePharma. "Biosimilar Trends," 2023.

More… ↓