Share This Page

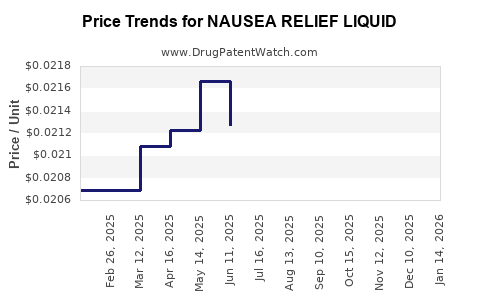

Drug Price Trends for NAUSEA RELIEF LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for NAUSEA RELIEF LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NAUSEA RELIEF LIQUID | 70000-0052-01 | 0.02256 | ML | 2025-12-17 |

| NAUSEA RELIEF LIQUID | 70000-0052-01 | 0.02230 | ML | 2025-11-19 |

| NAUSEA RELIEF LIQUID | 70000-0052-01 | 0.02245 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Nausea Relief Liquid

Introduction

Nausea Relief Liquid is a widely used over-the-counter (OTC) gastrointestinal remedy designed to alleviate nausea and vomiting symptoms. The product’s formulation typically includes active ingredients like dimenhydrinate, meclizine, or ginger extracts, tailored to provide rapid relief across diverse patient groups. This report examines current market dynamics, competitive landscape, regulatory factors, and price projections, providing business professionals with actionable insights for strategic decision-making.

Market Overview

Global Market Size and Growth Trajectory

The global nausea management market is projected to grow at a compound annual growth rate (CAGR) of approximately 5.2% from 2022 to 2028, driven primarily by increasing incidences of motion sickness, chemotherapy-induced nausea, and pregnancy-related nausea [1]. The OTC segment, including products like Nausea Relief Liquid, accounts for roughly 45% of this market, highlighting consumer preference for convenient, fast-acting relief solutions. In 2022, the global OTC nausea treatment market was valued at an estimated $2.3 billion and is expected to reach around $3.1 billion by 2028.

Key Market Drivers

- Rising awareness and self-medication: Consumers increasingly prefer OTC options for immediate relief, fueling demand.

- Growing prevalence of nausea-related conditions: Motion sickness, pregnancy, chemotherapy, and gastrointestinal disorders contribute significantly to the market's expansion.

- Product innovation and ease of use: Liquid formulations offer rapid absorption, appealing to both pediatric and adult populations.

- Emergence in emerging markets: Economic growth and healthcare infrastructure development in regions such as Asia-Pacific and Latin America bolster market penetration.

Regional Insights

- North America: Dominant market owing to high consumer health awareness, a well-established OTC market, and technological advancements.

- Europe: Steady growth driven by aging populations and increased recognition of nausea management.

- Asia-Pacific: Fastest-growing segment due to rising disposable incomes, expanding healthcare infrastructure, and traditional use of herbal nausea remedies.

- Latin America and Middle East: Emerging markets with increasing OTC consumption.

Competitive Landscape

Major Players

- Procter & Gamble (Dramamine): A leading OTC brand with strong distribution channels.

- Johnson & Johnson (Benadryl): Offers nausea relief products as part of broader antihistamines.

- GSK (Hydralazine-based formulations): Focuses on combination therapies.

- Herbal and Natural Brands: Ginger-based liquids and extracts catering to consumers seeking natural remedies.

Market Share Dynamics

Procter & Gamble commands approximately 35% of the OTC nausea relief market, leveraging brand recognition and extensive marketing. Herbal remedies, such as ginger liquids, hold a niche but rapidly expanding segment owing to consumer preference shifts towards natural products.

Innovative Trends

- Combination formulations for broader symptom management.

- Flavor enhancements to improve palatability for children.

- Packaging innovations like Individually wrapped doses for convenience and portability.

Regulatory & Pricing Landscape

Regulatory Environment

Nausea Relief Liquid products are regulated as OTC drugs, subject to oversight by agencies such as the FDA (U.S.) and EMA (Europe). Approval processes demand safety, efficacy, and quality assurance, varying by region but generally streamlined for established ingredients.

Pricing Strategies

Pricing is influenced by:

- Brand positioning: Premium brands command higher prices based on brand trust and formulation quality.

- Product formulation: Natural or organic variants usually cost more.

- Distribution channels: Pharmacy/retail versus online sales affect pricing margins.

- Regulatory costs: Compliance expenses can impact retail prices.

Price Projections (2023–2028)

Current Pricing Overview

- Average retail price (U.S.): $8–$12 per 4 oz bottle.

- Wholesale price (per unit): $4–$6, depending on bulk purchasing and distributor agreements.

- Price variability: Driven by brand, formulation, and sales channels.

Forecasted Price Trends

From 2023 to 2028, several factors will influence pricing:

- Increased demand: Rising nausea-related health conditions support price stability or slight hikes.

- Competition intensification: Entry of generic and natural brands will exert downward pressure.

- Raw material costs: Fluctuations in ingredients like ginger or pharmacological compounds may cause slight price increases.

- Regulatory costs: Stringent compliance could raise manufacturing expenses, impacting retail pricing.

Projected Retail Price Range in 2028: $9–$14 per 4 oz bottle, reflecting moderate inflation and competitive pressures.

Market Segmentation and Price Differentiation

| Segment | Expected 2028 Price Range | Key Factors |

|---|---|---|

| Conventional OTC | $8–$12 | Established brands, patent protections |

| Natural/Herbal | $10–$14 | Organic ingredients, perceived safety |

| Pediatric Formulations | $9–$13 | Flavor enhancements, ease of dosing |

Strategic Implications

- Innovation and diversification: Developing natural or combination formulations could command premium pricing.

- Targeted marketing: Positioning for specific demographics like pregnant women and elderly can sustain higher price points.

- Efficient supply chain management: Controlling manufacturing costs will be crucial amid raw material price volatility.

- Online and direct-to-consumer channels: These avenues often offer higher margins, enabling flexible pricing strategies.

Key Takeaways

- The global nausea relief liquid market is expanding, driven by increased incidence of nausea-inducing conditions and consumer preference for OTC, easy-to-use remedies.

- Established brands like Dramamine maintain significant market share, but natural, herbal, and innovative formulations are gaining traction.

- Pricing is projected to increase modestly by 2028, influenced by product formulation, competitive dynamics, and raw material costs.

- Strategic differentiation through product innovation, targeted marketing, and cost control will be essential for market players to maximize revenue and margins.

- The coming years will see price segmentation based on formulation type, target demographics, and distribution channels, shaping competitive positioning.

FAQs

1. What are the primary active ingredients in Nausea Relief Liquid?

Common ingredients include dimenhydrinate, meclizine, and ginger extract. Each offers different mechanisms—antihistamines for motion sickness, herbal remedies for natural relief.

2. How does the regulatory approval process impact pricing?

Regulatory compliance incurs costs related to clinical testing, quality assurance, and registration fees, which can translate into higher retail prices, especially for new formulations.

3. Which regions are expected to see the highest growth in Nausea Relief Liquid demand?

The Asia-Pacific region is forecasted to exhibit the fastest growth, driven by increasing healthcare infrastructure, rising disposable incomes, and cultural acceptance of herbal remedies.

4. How do natural formulations influence market pricing?

Natural and herbal formulations typically command a premium due to perceived safety and quality, and as consumer demand for organic products grows, prices are expected to trend higher.

5. What are the key factors that could drive prices downward?

Intensified competition, the introduction of generic or cheaper herbal variants, and raw material cost reductions could exert downward pressure on retail prices.

References

[1] MarketsandMarkets Research. “Nausea Management Market by Product, Severity, End-User, and Region – Global Forecast to 2028.”

More… ↓