Last updated: July 29, 2025

Introduction

Nateglinide, a rapid-onset, short-duration insulin secretagogue, has held a niche position in managing type 2 diabetes mellitus (T2DM). Approved by the FDA in 2008 for oral glucose control in adults, its market trajectory reflects advances in diabetes therapeutics, regulatory shifts, and competitive dynamics. As the diabetes drug market approaches a transformative phase driven by novel mechanisms and biosimilars, understanding nateglinide’s market position and price outlook is critical for stakeholders.

Market Overview

Therapeutic Profile and Clinical Positioning

Nateglinide functions by stimulating pancreatic beta cells to promptly release insulin postprandially. Its advantages include rapid action, minimal hypoglycemia risk, and ease of combination therapy, aligning with patient preferences for flexible dosing (1). Despite these benefits, nateglinide’s market penetration remains moderate, primarily constrained by the advent of newer agents, including SGLT2 inhibitors and GLP-1 receptor agonists, which offer comprehensive glycemic and cardiovascular benefits (2).

Market Dynamics and Competitors

Globally, the diabetes therapeutics market was valued at approximately $66 billion in 2022, with key players like Novo Nordisk, Eli Lilly, and AstraZeneca dominating amid a rising prevalence rate—estimated at over 700 million individuals with T2DM worldwide (3). Nateglinide's market share is confined mainly to specific segments such as combination therapy and regions with limited access to newer agents.

Regulatory and Market Entry Barriers

Nateglinide faces discontinuation or restricted use in certain markets due to limited clinical advantages over existing DPP-4 inhibitors and the lack of extensive cardiovascular outcome data, which has become a regulatory expectation. Some manufacturers have withdrawn nateglinide formulations considering limited profitability, affecting overall market continuity (4).

Price Analysis and Projections

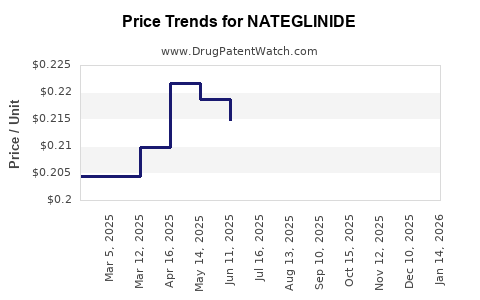

Historical Pricing Trends

Historically, nateglinide’s treatment costs ranged from $0.10 to $0.30 per tablet, based on manufacturer pricing and regional variations. Given that most patients require multiple daily doses, annual treatment costs are roughly $150–$300, positioning nateglinide as an affordable option relative to newer injectable agents.

Current Market Pricing

In regions where nateglinide remains on formularies—such as parts of Asia and Eastern Europe—prices are relatively stable. However, in markets with multiple options, utilization is diminishing, pressuring prices downward. Notably, patent exclusivity for original formulations has long expired, and no recent patent filings are evident, leading to the proliferation of generic versions that have further driven prices down.

Future Price Trajectory

The forecast suggests a continuing decline in nateglinide prices, driven by:

- Market Attrition: As newer agents dominate treatment guidelines, nateglinide’s prescribed volume declines.

- Generic Competition: Increased availability of generics constrains pricing power; prices could decline by an estimated 15–30% over the next five years.

- Regulatory Factors: Potential restrictions or delistings could eliminate clinical use altogether, effectively collapsing the price to negligible levels or zero.

Conversely, niche markets or regions with limited access to novel agents could sustain modest prices. Additionally, if new formulations or combination therapies emerge, there may be minor price upticks, but likely insufficient to alter overall downward trends.

Potential Influences on Market and Price

- Pipeline developments: No current pipeline initiatives for nateglinide are publicly known, reducing prospects for price resurgence.

- Regulatory changes: Emphasis on cardiovascular outcomes may deter approval in new markets, restricting growth.

- Market shifts: Integration of precision medicine and personalized therapy may further limit nateglinide’s application scope.

Strategic Implications for Stakeholders

- Manufacturers: Focus on niche markets or formulation enhancements to sustain value.

- Healthcare Payers: Prioritize newer, evidence-backed therapies; consider cost-effective generics.

- Investors: Recognize diminishing returns and reallocate resources toward innovation-driven assets in diabetes care.

Conclusion

Nateglinide’s market presence is steadily diminishing, with prices forecasted to decline further given generic competition and evolving treatment paradigms. While the drug may retain relevance in specific regions or niche applications, its overall commercial viability appears limited. Stakeholders should prepare for an era of reduced pricing and seek avenues for innovation or repositioning.

Key Takeaways

- Nateglinide’s global market share is shrinking owing to competition from newer agents with superior efficacy and safety profiles.

- Prices have historically been low and are projected to decline further by 15–30% over the next five years.

- Generics and market attrition will likely diminish nateglinide’s commercial viability, especially in developed markets.

- Niche markets may sustain minimal prices, but broader utilization is unlikely to recover.

- Stakeholders should reassess investment, manufacturing, and clinical strategies in light of these declining trends.

FAQs

1. What factors have contributed to the declining market share of nateglinide?

The advent of newer anti-diabetic agents with proven cardiovascular benefits, increased safety data, and convenient dosing has overshadowed nateglinide. Regulatory shifts emphasizing outcome-based evidence and market preferences for injectable therapies also limit its uptake (2).

2. Are there any new formulations or combinations of nateglinide under development?

No publicly known innovative formulations or combination products are currently in development, limiting prospects for lifecycle extension.

3. How does the price of nateglinide compare globally?

Prices vary significantly; in emerging markets, it remains relatively affordable, whereas in developed countries, its use is limited, resulting in reduced prices and sales volume.

4. Can nateglinide still be considered cost-effective?

In specific niches or regions with limited access to alternatives, nateglinide may remain cost-effective, but overall, its declining market diminishes its economic viability.

5. What is the impact of biosimilars or generics on nateglinide prices?

The availability of generics has exerted significant downward pressure on prices, accelerating the decline in its market value.

References

- Shubrook, J., & Vigersky, R. (2011). Emerging therapies for type 2 diabetes. Postgraduate Medicine, 123(4), 157-164.

- American Diabetes Association. (2022). Standards of Medical Care in Diabetes—2022. Diabetes Care, 45(Supplement 1).

- Grand View Research. (2023). Diabetes Drugs Market Size, Share & Trends Analysis Report.

- Novartis. (2011). Annual Report 2011.