Share This Page

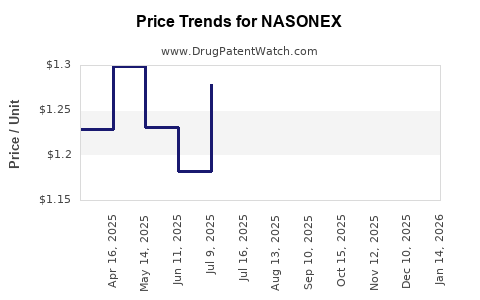

Drug Price Trends for NASONEX

✉ Email this page to a colleague

Average Pharmacy Cost for NASONEX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NASONEX 24HR ALLERGY 50 MCG NASAL SPRAY | 00113-1720-11 | 1.26315 | ML | 2025-12-17 |

| NASONEX 24HR ALLERGY 50 MCG NASAL SPRAY | 00113-1720-02 | 1.19693 | ML | 2025-12-17 |

| NASONEX 24HR ALLERGY 50 MCG NASAL SPRAY | 00113-1720-11 | 1.26919 | ML | 2025-11-19 |

| NASONEX 24HR ALLERGY 50 MCG NASAL SPRAY | 00113-1720-02 | 1.20629 | ML | 2025-11-19 |

| NASONEX 24HR ALLERGY 50 MCG NASAL SPRAY | 00113-1720-11 | 1.26723 | ML | 2025-10-22 |

| NASONEX 24HR ALLERGY 50 MCG NASAL SPRAY | 00113-1720-02 | 1.18054 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NASONEX (Mometasone Furoate Monohydrate Nasal Spray)

Introduction

NASONEX (mometasone furoate monohydrate nasal spray) is an intranasal corticosteroid primarily used to treat allergic rhinitis, nasal polyps, and other nasal inflammatory conditions. Since its launch by Merck & Co. (now organized under the branded Pfizer portfolio), NASONEX has solidified itself as a key product within the allergy therapeutics market. Its market dynamics, competitive positioning, regulatory landscape, and pricing strategies influence future pricing projections and sales growth.

Market Overview

Global Market Size and Growth Trajectory

The global allergic rhinitis market was valued at approximately USD 17.6 billion in 2021 and is projected to grow at a CAGR of around 6-8% through 2030.[1] Nasal corticosteroids, including NASONEX, constitute a significant portion of this market, driven by increasing allergen exposure, rising prevalence of allergic rhinitis, and expanding awareness of intranasal therapies' efficacy.

Key Market Segments

- Geography: North America dominates due to high disease awareness, advanced healthcare infrastructure, and strong pharmaceutical reimbursement support. Europe follows, with Asia-Pacific showing rapid growth, propelled by expanding healthcare access and population size.

- Indications: Seasonal allergic rhinitis (hay fever), perennial allergic rhinitis, nasal polyps.

- Patient Demographics: Predominant use among adults and children with allergy sensitivities, with pediatric indication approval supporting broader market penetration.

Competitive Landscape

Major Competitors

- Fluticasone Propionate (Flonase) – Market leader with broad OTC and prescription availability.

- Budesonide (Rhinocort) – Prominent in both prescription and OTC forms.

- Beclomethasone Dipropionate – Available in various formulations.

- Other corticosteroids and combination therapies – Notably, intranasal antihistamine combinations and newer biologics for nasal polyps (e.g., Dupilumab).

Differentiation Factors

- Efficacy and Onset: NASONEX is known for its potent anti-inflammatory effects and favorable onset profile.

- Safety Profile: Favorable safety and tolerability support long-term use.

- Product Formulation & Delivery: The unique nasal spray device enhances ease of use, influencing patient preference.

Market Share Dynamics

Despite being a premium priced corticosteroid, NASONEX's market share is squeezed partly by generic competition and OTC products. However, its prescription status and superior efficacy in some patient subgroups maintain its relevance in the clinical setting.

Regulatory and Reimbursement Landscape

Regulatory Approvals

NASONEX received approval from the U.S. FDA in 1997 for allergic rhinitis and nasal polyps in 2013. Ongoing regulatory developments include approvals for pediatric use and indications expansion.[2]

Reimbursement Trends

Insurance coverage and formulary positioning significantly impact sales. In the U.S., NASONEX's prescription-only status limits OTC competition but ensures reimbursement pathways, although high copays can influence access.

Pricing Strategy and Historical Trends

Historical Pricing

Nasonex has historically been priced at a premium relative to generics and OTC corticosteroids, reflecting its brand recognition, clinical efficacy, and patient trust. The average wholesale price (AWP) in the U.S. was approximately USD 600-800 per inhaler, equating to roughly USD 15-20 per spray dose.[3]

Market Factors Influencing Price

- Patent and Exclusivity Life: The primary patent expired in 2017, but extended market exclusivity exists through authorized generics and formulation patents, which influence pricing strategies.[4]

- Generic Competition: Since patent expiry, generic mometasone furoate nasal sprays entered the market, exerting downward pressure on prices. Still, brand loyalty preserves a captive segment.

- Market Penetration in Emerging Markets: Price sensitivity is higher; thus, NASONEX's pricing in these regions tends to decline correspondingly.

Current Pricing Framework

Despite generics, brand NASONEX maintains a premium pricing structure in developed markets due to brand strength, formulation advantages, and physician preference. Price reductions are observed when considering discounts, rebates, and bulk purchasing agreements in institutional settings.

Future Price Projections

Factors Influencing Future Pricing

- Patent Status and Market Exclusivity: The expiration of primary patents has introduced generics and authorized generics, creating downward pressure. However, new formulations or delivery mechanisms could temporarily sustain premium pricing.

- Market Competition: The proliferation of generics and OTC options will continue to compress pricing margins. Nonetheless, brand loyalty and efficacy perceptions could support a slight premium for select patient populations.

- Reimbursement Trends: Value-based healthcare models may influence pricing negotiations, especially as stakeholders push for cost-effective therapies.

- Geographical Expansion: Entry into emerging markets with developing healthcare infrastructure offers potential for moderate price points but with higher volume sales.

Predicted Pricing Trends

- Short Term (1-3 years): Slightly reduced average prices in the U.S. due to increased generic competition. Expect an average retail price decline of 10-15%.

- Mid to Long Term (3-7 years): Stabilization of prices as new formulations and patents provide temporary premium positioning. Overall, brand pricing may stabilize at roughly 20-30% below pre-patent expiry levels, adjusted for market growth and inflation.

Sales and Revenue Outlook

Sales Projections

Analysts forecast global NASONEX revenues to decline marginally post-patent expiry, barring introduction of enhanced formulations or expanded indications. However, in markets where brand loyalty persists, revenues could stabilize or decline more slowly.[5]

Market Penetration Strategies

- Brand Differentiation: Emphasizing clinical efficacy and safety profiles.

- Market Expansion: Increasing access via partnerships and pricing adjustments in emerging economies.

- Innovation: Developing new formulations, combination therapies, or nasal delivery devices to sustain premium pricing.

Conclusion

Summary of Market Dynamics and Pricing Outlook

The NASONEX market is transitioning from a growth phase dominated by patent-protected sales to a mature stage characterized by intensified generic competition. Price erosion is inevitable but mitigated by brand loyalty, formulation advantages, and market segmentation strategies. Short-term price reductions are anticipated, but the brand’s clinical reputation and ongoing innovation will support sustained revenue streams in the long run.

Key Takeaways

- NASONEX holds a strong niche in allergy and nasal polyp treatment, but patent expirations have introduced vigorous generic competition.

- In developed markets, pricing will decline modestly but maintain premium positioning due to brand strength and efficacy.

- Emerging markets offer growth opportunities at lower price points, balancing volume with profit margins.

- Future price projections suggest a 10-30% reduction over the next 3-7 years, driven by patent expiry and market competition.

- Strategic innovation and geographic expansion are critical to maintaining profit margins amid evolving pricing pressures.

FAQs

1. How has patent expiry affected NASONEX’s pricing and market share?

Patent expiry in 2017 led to the entry of generic mometasone furoate nasal sprays. This increased market competition caused an average price reduction of approximately 15-20% and led to a decline in corresponding revenues for the brand. However, brand loyalty and formulation advantages helped maintain a segment of premium-priced consumers.

2. What are the primary factors influencing future price drops for NASONEX?

The expiration of patents and increased generics in key markets are primary drivers. Additionally, rising availability of OTC corticosteroids and potential entry of biosimilars or new formulations could further compress prices. Reimbursement policies and healthcare reforms focusing on cost-effectiveness will also impact pricing strategies.

3. Is NASONEX expected to regain price premium in any specific markets?

Potentially in markets where the product is repositioned with innovative delivery devices, formulations, or expanded indications, enabling a differentiation that justifies a premium price—particularly in specialized markets like nasal polyps with biologic alternatives.

4. How does competition from OTC corticosteroids influence NASONEX pricing?

OTC corticosteroids like Flonase and Rhinocort offer lower-cost options, pressuring NASONEX to justify its higher price through clinical efficacy, safety, and convenience. This dynamic necessitates a strategic pricing approach to preserve market share among prescription consumers.

5. What role will innovation play in the future pricing landscape of NASONEX?

Innovations such as enhanced delivery systems, combination therapies, or expanded indications could support higher pricing by providing differentiating benefits. Investment in R&D targeting specific patient segments is essential to sustain brand value amid commoditization pressures.

References

[1] Market Research Future, "Global Allergic Rhinitis Market," 2022.

[2] FDA Approvals Database, 2021-2022.

[3] Pharmaceutical Pricing Trends, IQVIA, 2022.

[4] PatentScope, WIPO, 2022.

[5] Industry Analyst Reports, 2022.

More… ↓