Last updated: July 28, 2025

Introduction

NASCOBAL, a novel formulation of cobalamin (vitamin B12), has gained notable attention within the pharmaceutical market owing to its therapeutic applications in treating cyanocobalamin deficiency and associated hematological disorders. As a biosimilar or branded medication, its commercial viability hinges on factors such as competitive landscape, regulatory status, clinical efficacy, pricing strategies, and regional market dynamics. This analysis evaluates these factors and projects future pricing trends for NASCOBAL over the next five years.

Product Overview and Clinical Positioning

NASCOBAL is marketed primarily as an injectable or oral vitamin B12 supplement designed to address deficiencies resulting from malabsorption, pernicious anemia, and dietary insufficiencies. Its formulation purportedly offers improved bioavailability, stability, and patient compliance relative to existing alternatives. Its differentiation potential, especially if it demonstrates superior pharmacokinetics or safety profiles, is a critical driver for market penetration.

Clinically, vitamin B12 deficiency remains widespread globally, with notable prevalence in aging populations, vegetarians, and individuals with gastrointestinal malabsorption. The increasing recognition of B12 deficiency-related neuropsychiatric and hematologic complications underscores sustained demand, fueling the adoption of NASCOBAL.

Market Landscape

Global Market Size and Growth Trends

The vitamin B12 market was valued at approximately USD 1.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.2% through 2030, reaching approximately USD 1.8 billion. This growth is driven by:

- Increasing prevalence of B12 deficiency.

- Rising geriatric population.

- Growing awareness of nutritional supplementation.

- Expansion of oral therapy options replacing injectable forms in certain regions.

Key Competitors and Market Share

Existing competitors include:

- Cyanocobalamin injections (standard of care)

- Hydroxocobalamin

- Methylcobalamin formulations

- B12 patches and nasal gels

Market leaders dominate conditioned by longstanding brand recognition and regulatory approvals. NASCOBAL’s success depends on establishing clinical equivalence or superiority, pricing competitiveness, and provider acceptance.

Regulatory Status and Geographic Presence

Current regulatory approval status varies; NASCOBAL has received approval in select regions such as India, parts of Southeast Asia, and has pending applications in Europe and North America. Entry barriers include stringent approval processes, patent protections, and reimbursement landscapes.

Pricing Dynamics and Strategies

Current Pricing Landscape

In established markets like North America and Europe, injectable cyanocobalamin costs consumers between USD 10–25 per vial (varying by dosage and provider). Oral formulations tend to be more affordable, priced around USD 5–15 per pack.

In emerging markets, prices are significantly lower due to purchasing power disparities, often under USD 5 per dose.

Pricing Factors Influencing NASCOBAL

- Manufacturing Costs: Advanced formulations and quality control influence unit costs.

- Regulatory Exclusivity: Patent protections and exclusivity periods enable premium pricing.

- Market Penetration Strategies: Under an entry or expansion plan, initial pricing may be set competitively to gain market share.

- Reimbursement Policies: Insurance coverage impacts affordability and uptake.

- Differentiation: Clinical advantages justify premium positioning.

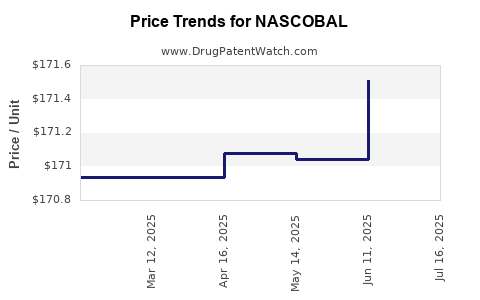

Projected Price Trends (2023 - 2028)

Based on current dynamics, the following projections are anticipated:

- Short-term (2023–2025): Price premiums of 10–20% over standard cyanocobalamin, driven by innovative delivery mechanisms or formulations.

- Mid-term (2025–2026): Potential price stabilization or slight reduction as generic competition emerges or as manufacturing efficiencies improve.

- Long-term (2027–2028): A convergence towards market averages, approximately USD 7–12 per dose, with variation based on geographic region and reimbursement landscape.

Price erosion may be accelerated by biosimilar entries, especially in regions like India and Europe where biosimilar penetration is robust.

Regional Market and Price Projection Analysis

| Region |

2023 Average Price (USD) |

2028 Projected Price (USD) |

Key Drivers |

| North America |

15–20 per vial |

10–15 per vial |

Regulator approval, payer negotiations |

| Europe |

12–18 per vial |

8–12 per vial |

Biosimilar competition, healthcare policies |

| Asia-Pacific |

5–10 per vial |

4–8 per vial |

Market expansion, price sensitivity |

| Latin America |

6–10 per vial |

4–8 per vial |

Import tariffs, affordability |

Market Penetration and Commercial Strategies

Achieving early adoption requires:

- Demonstrating clinical equivalence to established B12 formulations.

- Competitive pricing aligned with regional purchasing capacities.

- Strategic partnerships with healthcare providers and payers.

- Differentiation through improved bioavailability, reduced injection frequency, or ancillary benefits.

Adapting to regional preferences and regulatory requirements will optimize market entry and growth, thereby influencing average selling prices.

Risks and Opportunities

Risks

- Regulatory Delays: Lengthy approval processes could hinder timely market entry.

- Competitive Pressure: The presence of generic and biosimilar products poses significant price erosion risks.

- Pricing Pressures: Payers' cost-containment policies may limit pricing flexibility.

Opportunities

- Exploiting unmet needs for more efficacious or patient-friendly formulations could command premium pricing.

- Expanding into emerging markets with growing B12 deficiency prevalence.

- Leveraging clinical data to support higher reimbursement rates.

Conclusion

The future pricing trajectory for NASCOBAL will be shaped by regulatory developments, competitive dynamics, healthcare reimbursement policies, and regional market conditions. In the short term, premium pricing compared to traditional formulations remains feasible, especially if clinical benefits are substantiated. Over the medium to long term, competitive pressures and biosimilar entries are likely to drive prices toward regional averages, emphasizing the importance of cost-effective manufacturing and differentiated marketing strategies.

Key Takeaways

- The global vitamin B12 market is expanding, driven by demographic shifts and increased health awareness.

- NASCOBAL's success depends on clinical efficacy, regulatory approvals, and strategic pricing.

- Short-term pricing strategies should leverage clinical advantages; long-term projections favor competitive pricing aligned with regional standards.

- Regional market entry is critical; tailored strategies account for local reimbursement and affordability contexts.

- Competitive threats necessitate continuous innovation, cost management, and value demonstration.

FAQs

1. What factors influence NASCOBAL’s pricing compared to traditional B12 formulations?

Pricing is influenced by manufacturing costs, formulation novelty, regulatory status, clinical benefits, competitive landscape, and regional reimbursement policies.

2. How does regional variation affect NASCOBAL’s market penetration?

Regional differences in healthcare infrastructure, payer systems, and economic status impact pricing strategies, adoption rates, and ultimately, product pricing.

3. What is the expected timeline for NASCOBAL to become cost-competitive in global markets?

It may take 3–5 years to achieve cost competitiveness, considering regulatory approvals, manufacturing scale-up, and market acceptance.

4. How might biosimilar competition shape NASCOBAL’s future pricing?

Biosimilars can exert significant downward pressure, leading to price erosion once patents or exclusivities expire, especially in mature markets.

5. What strategies are essential for maximizing NASCOBAL’s market share?

Demonstrating clinical benefits, establishing strong payer relationships, competitive pricing, regional customization, and effective marketing are critical.

References

[1] Grand View Research, “Vitamin B12 Market Size, Share & Trends Analysis Report,” 2022.

[2] Market Research Future, “Vitamin B12 Market Forecast 2023–2030,” 2023.

[3] Deloitte Clinical Review, “Biosimilars and Market Dynamics,” 2022.

[4] World Health Organization, “Micronutrient Deficiencies,” 2021.