Share This Page

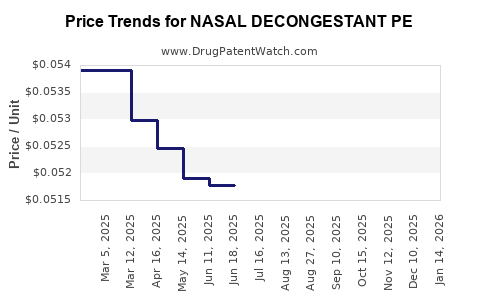

Drug Price Trends for NASAL DECONGESTANT PE

✉ Email this page to a colleague

Average Pharmacy Cost for NASAL DECONGESTANT PE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NASAL DECONGESTANT PE 10 MG TB | 70000-0126-01 | 0.05083 | EACH | 2025-12-17 |

| NASAL DECONGESTANT PE 10 MG TB | 70000-0126-01 | 0.05050 | EACH | 2025-11-19 |

| NASAL DECONGESTANT PE 10 MG TB | 70000-0126-01 | 0.05022 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Nasal Decongestant PE (Phenylephrine)

Introduction

Nasal decongestant phenylephrine (PE) is a key active pharmaceutical ingredient (API) used predominantly in over-the-counter (OTC) remedies for temporary relief from nasal congestion associated with colds, allergies, and sinusitis. Its extensive usage, regulatory landscape, and ongoing developments in formulation and delivery systems position it as a significant product within the respiratory therapeutics market. This analysis evaluates the current market dynamics, competitive landscape, regulatory environment, and projects future pricing trends for PE-based nasal decongestants.

Market Overview and Dynamics

Market Size and Growth Drivers

The global nasal decongestant market is projected to reach approximately USD 4.8 billion by 2025, driven by increasing prevalence of respiratory illnesses, expanding OTC product availability, and consumer preference for non-invasive remedies [1]. Phenylephrine, as a decongestant, holds substantial market share owing to its efficacy, safety profile, and widespread regulatory approval.

Regional Market Breakdown

- North America: The largest market segment, buoyed by high OTC consumption, patent expiries, and growing awareness of respiratory health.

- Europe: Demonstrates steady expansion, supported by aging populations and regulatory support for OTC medications.

- Asia-Pacific: The fastest-growing region, driven by urbanization, rising disposable incomes, and burgeoning healthcare infrastructure.

Market Challenges

- Regulatory Scrutiny: Recent debates over phenylephrine's efficacy when administered orally have prompted re-evaluation, influencing market perceptions.

- Generic Competition: Saturation of the API and finished formulations limits pricing power.

- Consumer Preference Shift: Growing preference for multi-symptom formulations sometimes diminishes sales of standalone PE products.

Regulatory Environment

Phenylephrine’s OTC approval status varies globally. The FDA in the US has maintained its stance on oral PE’s efficacy, with some recent reviews questioning bioavailability [2]. Despite this, nasal spray and drops form remain OTC-approved, supporting continuous demand.

In Europe, phenylephrine is approved within combination cold/allergy formulations. Regulatory agencies scrutinize formulations for safety, efficacy, and bioavailability, influencing market entry and pricing strategies.

Competitive Landscape

The market comprises global pharmaceutical giants such as Johnson & Johnson, GlaxoSmithKline, and Teva, alongside numerous regional and generic manufacturers. Competition hinges on API cost, formulation innovation (e.g., microemulsions and sustained-release), and branding.

API Suppliers and Manufacturing Trends

- Major API producers include India (e.g., Sun Pharma, Torrent Pharmaceuticals), China, and the US.

- Production costs are declining owing to advanced synthesis techniques, increasing supply and exerting downward pressure on API prices.

Price Analysis and Trends

Current Pricing

The wholesale price of phenylephrine API is approximately USD 300-500 per kilogram, depending on purity, supplier, and order volume [3]. Finished dosage forms—particularly OTC nasal sprays—are priced broadly in the USD 4-10 per unit range, with variations based on formulation and branding.

Pricing Factors

- Raw Material Costs: Fluctuations are influenced by raw material availability, geopolitical factors, and manufacturing efficiencies.

- Regulatory Changes: Revisions affecting efficacy claims or label claims may influence formulation costs and final sales prices.

- Market Competition: Increased generic entry leads to smaller profit margins, compelling companies to optimize supply chain efficiencies.

Forecasted Price Trends (2023-2028)

- API Prices: Expected to decline at 2-4% annually due to continuous manufacturing efficiencies and market saturation, stabilizing around USD 250-350/kg by 2028.

- Finished Formulation Prices: Anticipated to remain relatively stable, with slight reductions attributed to increased competition, potentially averaging USD 3-8 per unit.

Future Market and Price Projections

Emerging Formulation Modalities

Innovations like nasal powders, environmentally friendly inhalers, and combination therapies might influence demand and prices. Adoption of sustained-release formulations could command premium pricing, though the overall market for PE remains price-sensitive.

Regulatory and Consumer Trends

- Pending regulatory re-evaluations on efficacy could lead to reformulations or withdrawal, impacting pricing.

- Consumer inclination toward natural or alternative remedies may temper growth but sustain demand for established APIs like PE in combination contexts.

Competitive Pricing Strategies

- Suppliers focusing on cost reduction and scaling will likely maintain or reduce API prices.

- Brand differentiation, such as child-friendly or novel delivery systems, could sustain higher prices for certain finished products.

Overall Price Outlook

Over the next five years, API prices are projected to decrease modestly, stabilizing the cost basis for finished formulations, which will likely sustain the current price range amid competitive pressures and regulatory considerations.

Key Market Opportunities and Risks

Opportunities:

- Expansion into emerging markets with increasing OTC healthcare penetration.

- Development of proprietary delivery systems enhancing efficacy.

- Strategic partnerships with retail chains for exclusive formulations.

Risks:

- Regulatory setbacks questioning oral PE efficacy.

- Entrenched generic competition limiting pricing power.

- Shifts in consumer preferences towards alternative remedies.

Key Takeaways

- The nasal decongestant PE market is expected to grow steadily, supported by demographic trends and OTC demand.

- API prices are forecasted to decline gradually due to manufacturing efficiencies and market saturation.

- Regulatory developments could influence both pricing and formulation strategies.

- Innovation in delivery mechanisms provides avenues for premium pricing, but overall market remains price-sensitive.

- Companies should leverage regional market growth opportunities, particularly in Asia-Pacific, while closely monitoring regulatory shifts.

FAQs

1. How does regulatory scrutiny impact the pricing of phenylephrine-based nasal decongestants?

Regulatory reviews questioning phenylephrine’s efficacy may lead to formulation adjustments or market withdrawal, influencing supply availability and pricing strategies.

2. What are the key factors influencing API pricing for phenylephrine?

API prices depend on raw material costs, manufacturing efficiencies, competition among suppliers, and regulatory costs.

3. Which regions present the most growth opportunities for nasal decongestant products?

Asia-Pacific markets, due to rising incomes, urbanization, and expanding healthcare infrastructure, offer significant growth prospects.

4. How might technological innovations affect future pricing?

Novel delivery systems or formulations enhancing efficacy could command higher prices, offsetting API price declines.

5. What trends should manufacturers monitor to remain competitive?

Regulatory changes, consumer preferences, technological innovations, and regional market expansion are critical to strategic planning.

References

[1] MarketsandMarkets. “Nasal Decongestants Market Forecast,” 2021.

[2] U.S. Food and Drug Administration. “Review of Phenylephrine Efficacy,” 2022.

[3] Pharma Raw Materials. “API Price Trends Report,” 2022.

More… ↓