Share This Page

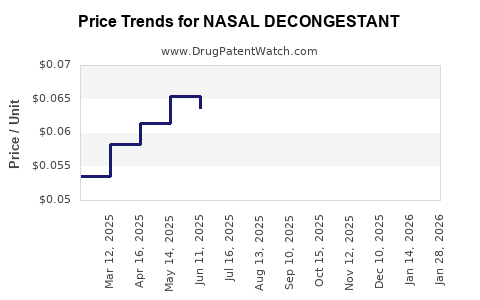

Drug Price Trends for NASAL DECONGESTANT

✉ Email this page to a colleague

Average Pharmacy Cost for NASAL DECONGESTANT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NASAL DECONGESTANT 0.05% SPRAY | 00904-6761-30 | 0.07250 | ML | 2025-12-17 |

| NASAL DECONGESTANT 0.05% SPRAY | 00904-7006-35 | 0.12496 | ML | 2025-12-17 |

| NASAL DECONGESTANT 0.05% SPRAY | 00904-7435-35 | 0.12496 | ML | 2025-12-17 |

| NASAL DECONGESTANT 0.05% SPRAY | 00904-7427-30 | 0.07250 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Nasal Decongestants

Introduction

Nasal decongestants are medications used to relieve nasal congestion caused by colds, sinusitis, allergic rhinitis, and other respiratory conditions. These drugs are pivotal within the over-the-counter (OTC) and prescription pharmaceutical markets, with a wide diversity of formulations including sprays, drops, tablets, and capsules. The global market for nasal decongestants has experienced steady growth due to increasing prevalence of respiratory ailments, rising awareness around OTC treatment options, and expanding healthcare infrastructure globally.

This report conducts a comprehensive market analysis of nasal decongestants and offers price projection insights, considering key industry trends, regulatory landscapes, competitive dynamics, and consumer demand patterns.

Market Landscape and Segmentation

Product Types and Formulations

The nasal decongestant segment comprises various formulations:

- Sprays and Nasal Drops: Predominant in OTC markets, offering rapid relief.

- Oral Decongestants: Such as pseudoephedrine and phenylephrine; often used in combination products.

- Combination Medications: Combining decongestants with antihistamines or analgesics.

Key Active Ingredients

- Oxymetazoline: A popular topical nasal spray with rapid onset.

- xylometazoline: Common in Europe.

- Pseudoephedrine: An oral decongestant requiring regulatory controls in many countries.

- Phenylephrine: Widely used as an alternative to pseudoephedrine, albeit with debates regarding efficacy.

Market Players

Major pharmaceutical companies such as Johnson & Johnson, Bayer, and GSK dominate the market, along with numerous regional players. The generic drug segment holds significant market share due to cost competitiveness and widespread availability.

Market Dynamics and Trends

Growing Prevalence of Respiratory Conditions

The rising incidence of allergic rhinitis, sinusitis, and cold episodes globally contributes to consistent demand. According to the World Allergy Organization, allergic rhinitis affects approximately 10-30% of the population worldwide, fueling OTC and prescription demand for nasal decongestants [1].

Regulatory Environment and Accessibility

Stringent regulations around pseudoephedrine sales in regions like the U.S. and Europe impact availability, pushing demand toward topical formulations and combination oral drugs with alternative active ingredients like phenylephrine.

Innovation and Formulation Advancements

Development of longer-lasting sprays, reduced rebound congestion (rebound rhinitis), and combination therapies are driving consumer preferences toward more effective and safer options. Digital health integration and telemedicine access also influence purchasing channels.

Impact of Covid-19 Pandemic

The pandemic heightened awareness and treatment of respiratory symptoms, including nasal congestion, leading to increased OTC sales of nasal decongestants. However, supply chain disruptions temporarily constrained product availability.

Regional Market Insights

- North America: Largest market share, driven by high OTC product penetration and advanced healthcare infrastructure.

- Europe: Significant demand with a focus on topical formulations, with regulatory restrictions on pseudoephedrine.

- Asia-Pacific: Fastest-growing region, propelled by rising urbanization, air pollution, and increasing health awareness, with emerging local manufacturers expanding market penetration.

Market Size and Growth Projections

The global nasal decongestant market was valued at approximately USD 2.8 billion in 2022. Forecasts predict a compound annual growth rate (CAGR) of 4-6% over the next five years, reaching roughly USD 3.8 billion by 2027.

Growth drivers include expanding global respiratory disease burden, heightened consumer health consciousness, and innovation in drug delivery mechanisms. Regulatory landscape adaptations and increasing generic product availability support accessible pricing, facilitating broader market reach.

Pricing Trends and Projections

Current Pricing Landscape

- OTC products: Prices range from USD 4 to USD 15 per pack for nasal spray or drops depending on brand and formulation.

- Prescription medications: Pseudoephedrine and phenylephrine-based drugs typically retail at USD 5 to USD 20 per package, often covered in insurance formularies.

- Generic vs. Brand: Generics account for approximately 60-70% of sales, offering a 20-40% price reduction** compared to branded equivalents.

Factors Influencing Future Pricing

- Regulatory changes: Stricter sales regulations on pseudoephedrine could shift demand toward more expensive topical formulations.

- Raw material cost fluctuations: Supply chain volatility affects pricing, especially for active ingredients like oxymetazoline.

- Market competition: Increased generic entry tends to exert downward pressure on prices.

- Consumer trends: Preference for combination therapies may command premium pricing.

Price Projections (2023-2027)

- OTC Nasal Decongestant Sprays: Expected to experience a 2-3% annual increase owing to inflation-adjusted costs and innovation-driven value addition, with prices reaching USD 5.50 - USD 16.50 per pack.

- Generic Oral Decongestants: Prices are projected to remain stable or decline marginally (0-2% CAGR) because of intensified competition, stabilizing around USD 4 - USD 10 per pack.

- Premium and Novel Formulations: Innovative delivery systems or combination medications could command a 10-15% premium, potentially reaching USD 15 - USD 25 in select markets.

Competitive and Regulatory Outlook

New entrants focusing on nasal spray formulations with extended duration or rebound mitigation mechanisms could reshape pricing. Regulatory authorities are increasingly scrutinizing OTC decongestant evidence, potentially affecting formulation approvals and product marketing strategies.

In the U.S., the FDA’s recent recommendations on pseudoephedrine sales restrict access, incentivizing manufacturers to develop alternative delivery systems and formulations, possibly influencing price dynamics.

Strategic Opportunities and Challenges

Opportunities

- Expansion into emerging markets with rising respiratory health awareness.

- Innovation in drug delivery, such as sustained-release sprays.

- Development of combination products addressing multiple symptoms.

- Digital marketing and online pharmacy platforms to reach broader consumer bases.

Challenges

- Stringent regulatory controls affecting supply and pricing.

- Market saturation in developed regions.

- Consumer preference shifts toward natural remedies or alternative therapies.

- Price wars among generic manufacturers reducing profit margins.

Conclusion

The nasal decongestant market exhibits steady growth driven by increasing respiratory conditions prevalence and technological innovations. Price projections suggest moderate inflation, with strategic differentiation, especially through novel formulations, offering premium pricing opportunities. Competitive pressures and regulatory developments necessitate adaptive strategies for industry stakeholders aiming to capitalize on emerging trends.

Key Takeaways

- The nasal decongestant market is poised for a 4-6% CAGR through 2027, driven by global respiratory health trends.

- OTC nasal sprays dominate the segment, with prices expected to rise modestly, influenced by formulation innovations and raw material costs.

- Generic products continue to pressure pricing in the oral decongestant segment, though premium formulations offer higher margins.

- Regulatory environments, especially concerning pseudoephedrine, are reshaping product availability and market strategies.

- Manufacturers should focus on innovation, regional expansion, and digital channels to enhance competitiveness and profitability.

FAQs

1. How are regulatory restrictions affecting the nasal decongestant market?

Regulations targeting pseudoephedrine sale, such as requiring ID verification in the U.S., restrict OTC access, prompting industry shifts towards topical formulations and combination therapies, which may influence pricing and market dynamics.

2. Which formulations are expected to lead market growth?

Nasal spray formulations, particularly those with extended duration and reduced rebound effects, are expected to lead growth due to ease of use and efficacy, alongside rising consumer preference for non-oral options.

3. What regional markets present the highest growth potential?

The Asia-Pacific region offers high growth prospects driven by urbanization, rising pollution levels, and expanding healthcare access, while North America remains largest in absolute market size.

4. How will generic competition influence pricing?

Increased generic entry typically exerts downward pressure on prices in the oral decongestant market segment. To sustain margins, companies are innovating through superior delivery systems or combination products.

5. What technological innovations are shaping future product offerings?

Innovations include sustained-release nasal sprays, rebound-congestion prevention, combination formulations, and digital health integrations, all aimed at enhancing efficacy and consumer experience.

References

- World Allergy Organization. "Allergic Rhinitis Statistics." [Accessed 2023].

- MarketWatch. "Global Nasal Decongestants Market Size Forecast," 2022.

- IQVIA. "OTC and Prescription Respiratory Drug Market Trends," 2022.

- U.S. FDA. “Pseudoephedrine Sales Restrictions,” 2021.

More… ↓