Share This Page

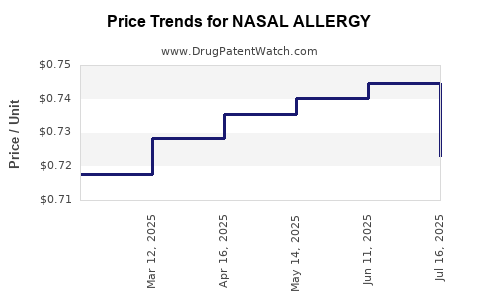

Drug Price Trends for NASAL ALLERGY

✉ Email this page to a colleague

Average Pharmacy Cost for NASAL ALLERGY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NASAL ALLERGY 24HR SPRAY | 70000-0204-01 | 0.72294 | ML | 2025-07-23 |

| NASAL ALLERGY 24HR SPRAY | 70000-0204-01 | 0.74452 | ML | 2025-06-18 |

| NASAL ALLERGY 24HR SPRAY | 70000-0204-01 | 0.74021 | ML | 2025-05-21 |

| NASAL ALLERGY 24HR SPRAY | 70000-0204-01 | 0.73559 | ML | 2025-04-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Nasal Allergy Drugs

Introduction

Nasal allergy medications, also known as intranasal antihistamines or corticosteroids, constitute a significant segment of the allergy treatment market. With rising prevalence of allergic rhinitis globally (estimated at over 400 million people), the demand for effective nasal allergy therapies continues to grow. This article offers an in-depth market analysis and price projection, emphasizing current trends, key players, regulatory considerations, and future prospects.

Market Overview

Global Prevalence and Demand

The increasing incidence of allergic rhinitis worldwide fuels demand for nasal allergy drugs. Epidemiological studies indicate a prevalence rate of approximately 10-30% among adults and children, with urbanization, environmental pollution, and climate change contributing to rising cases. The Asia-Pacific region, notably, exhibits rapid growth due to urban lifestyles and increasing awareness.

Existing Therapeutic Options

The nasal allergy market comprises primarily two classes:

- Intranasal corticosteroids (INCS): e.g., Fluticasone, Mometasone, Budesonide.

- Intranasal antihistamines: e.g., Azelastine, Olopatadine.

Combination therapies and newer formulations—such as saline nasal sprays and mast cell stabilizers—also enhance treatment options. The market is characterized by high efficacy, minimal systemic side effects, and improved delivery mechanisms.

Market Segments

The market's segmentation reflects progressively narrow categories:

- By Type: Corticosteroids, antihistamines, combination products.

- By Application: Seasonal allergic rhinitis, perennial allergic rhinitis.

- By Distribution Channel: Retail pharmacies, hospitals, online pharmacies.

- By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Key Market Drivers

- Rising Disease Prevalence: Increased environmental pollutants and allergen exposure.

- Innovations in Delivery Systems: Nasal sprays, powders, and targeted delivery improving patient compliance.

- Expanded Patient Population: Pediatric and geriatric populations increasingly treated.

- Growing Awareness and Diagnosis: Public health campaigns and improved diagnostic techniques.

Competitive Landscape

Major pharmaceutical companies dominate the market:

- GlaxoSmithKline (GSK): Mometasone furoate nasal spray.

- Boehringer Ingelheim: Azelastine-based products.

- Sanofi: Fluticasone nasal sprays.

- AstraZeneca: Olopatadine formulations.

- Others: Mergers, collaborations, and generic entrants shape the competitive landscape.

Innovation centers on formulations that reduce dosing frequency, minimize side effects, and optimize efficacy. Biosimilars and generics are expected to increasingly influence market share and pricing strategies.

Regulatory Environment

Regulatory authorities such as the FDA (U.S.) and EMA (Europe) maintain stringent safety and efficacy standards. Approvals for new nasal allergy drugs require comprehensive clinical trials, impacting drug development timelines and costs. Post-market surveillance further influences product lifecycle and pricing.

Market Trends and Innovations

- Personalized Medicine: Tailoring treatments to genetic and allergen profiles.

- Digital Integration: Mobile apps and telehealth services enhance adherence.

- Nanotechnology and Biotech: Enhanced drug delivery systems are under development.

- Market Entry of Biosimilars: Cost reduction and increased accessibility.

Price Analysis and Projections

Current Pricing Landscape

Drug pricing varies considerably across regions. In the United States:

- Brand-name nasal corticosteroids: $30–$45 per month.

- Generic equivalents: $10–$20 per month. In Europe and Asia-Pacific, prices are often lower due to regulatory and market dynamics, with generics playing a larger role.

Factors Influencing Price Trends

- Patent Expiry: Patent cliffs for key products lead to increased generic competition, lowering prices.

- Market Penetration: Larger patient bases accelerate economies of scale, reducing costs.

- Regulatory Approvals: New formulations and biosimilars entering the market often trigger price reductions.

- Reimbursement Policies: Insurance coverage significantly impacts out-of-pocket costs.

Projected Price Trends (Next 5-10 Years)

Based on current market dynamics:

- Generic and biosimilar drugs will account for over 70% of nasal allergy therapy sales by 2030, exerting downward pressure on prices.

- Pricing convergence: Expect stabilization with regional variations—e.g., developed markets maintaining higher prices than emerging markets.

- Innovation premiums: Premium formulations (e.g., sustained-release, targeted delivery) may command higher prices initially, but these premiums will decrease as competition intensifies.

- Impact of biosimilar entry: Biosimilars expected to reduce brand-name drug prices by 25-60% within 3-5 years post-launch.

Forecast Summary

- North America: Prices for branded nasal allergy drugs may decline by approximately 15-25% over the next five years, with generics capturing a significant market share.

- Europe: Market prices are projected to decrease by 10-20%, driven by healthcare reforms and biosimilar availability.

- Asia-Pacific: The fastest-growing segment, with prices stabilizing or slightly decreasing due to increased generics and local manufacturing.

Market Opportunities and Challenges

Opportunities

- Development of combination therapies enhancing adherence.

- Expansion into emerging markets with growing awareness.

- Digital health integrations improving patient outcomes.

- Entry of biosimilars reducing treatment costs.

Challenges

- Regulatory delays for new formulations.

- Competition from alternative allergy treatments.

- Pricing pressures from health authorities advocating for cost-effective therapies.

- Patent litigation risks delaying generic/biosimilar market entry.

Conclusion

The nasal allergy treatment market exhibits robust growth driven by rising allergic rhinitis prevalence and innovation, yet faces downward pricing pressures chiefly from generic and biosimilar competition. Strategic positioning, investment in innovative formulations, and navigating regulatory pathways will be critical for stakeholders seeking market expansion.

Key Takeaways

- The global nasal allergy drug market is projected to grow at a CAGR of around 5-7% through 2030, fueled by increasing disease prevalence.

- Price reductions of 15-25% in developed markets are expected over the next five years, primarily due to generic and biosimilar competition.

- Emerging markets present substantial growth opportunities, facilitated by lower prices and growing healthcare infrastructure.

- Innovations in drug delivery and personalized treatment strategies will influence both pricing and market share.

- Healthcare policy shifts towards value-based care and generic utilization will impact pricing strategies for nasal allergy medications.

FAQs

1. What are the main factors driving the growth of nasal allergy drugs?

Rising prevalence of allergic rhinitis, innovations in drug delivery, expanding patient demographics, and increased diagnosis rate drive growth.

2. How do patent expirations affect nasal allergy drug pricing?

Patent expirations enable generic and biosimilar entrants, leading to significant price reductions and increased market competition.

3. What regions are expected to experience the highest growth in this market?

The Asia-Pacific region, driven by urbanization and increasing allergen exposure, is expected to see the fastest growth.

4. Are biosimilars impacting the nasal allergy drug market?

Yes, biosimilars are offering cost-effective alternatives, reducing prices and expanding access.

5. What are the key innovation trends in nasal allergy therapy?

Favored trends include sustained-release formulations, targeted delivery systems, combination therapies, and digital health integration.

References

[1] Global Allergy and Asthma Market Analysis, 2022. MarketsandMarkets.

[2] Allergy Prevalence Data, World Allergy Organization, 2021.

[3] FDA Regulatory Guidelines for Nasal Sprays, 2022.

[4] Future Market Insights, Nasal Spray Market Forecast 2022–2032.

[5] European Medicines Agency, Pharmacovigilance Reports, 2022.

More… ↓