Last updated: August 4, 2025

Introduction

Naratriptan hydrochloride (HCl) is a selective serotonin receptor agonist, primarily used for the acute management of migraines with or without aura. Since its market introduction in the late 1990s, naratriptan has maintained a significant position within the triptan class, characterized by its favorable pharmacokinetic profile and tolerability. This analysis evaluates current market dynamics, competitive landscape, regulatory influences, and provides price projections for naratriptan HCl over the next five years, facilitating strategic decision-making for pharmaceutical stakeholders.

Market Overview

Global Demand and Epidemiology

Migraine remains a leading cause of disability worldwide, affecting approximately 15% of the global population[1]. The World Health Organization classifies migraine among the top neurological causes of years lost to disability. The increasing prevalence—driven by lifestyle factors, urbanization, and diagnostic awareness—augments demand for efficacious acute treatments like naratriptan.

Current Market Size

The global triptan market was valued at approximately USD 1.2 billion in 2022, with naratriptan accounting for an estimated 8-10% share, translating to roughly USD 100-120 million annually. It commands a niche but steady segment among triptans, distinguished by its longer half-life and lower side-effect profile relative to counterparts like sumatriptan or rizatriptan.

Key Markets

North America remains the largest market, driven by high migraine prevalence, robust healthcare infrastructure, and broad insurance coverage. Europe exhibits similar characteristics, with emerging markets in Asia-Pacific displaying accelerated growth due to increased healthcare spending and awareness.

Patent and Regulatory Status

Naratriptan was initially launched as a brand-name drug (e.g., Amerge in the US) in 1997; many patents have since expired, enabling generic manufacturing. Several generic formulations are available globally, increasing accessibility but exerting downward pressure on prices.

Competitive Landscape

Brand vs. Generic

While brand-name naratriptan enjoys initial premium pricing, the proliferation of generics has significantly eroded its price point. Generics account for over 80% of prescriptions in mature markets, following patent expirations.

Alternative Treatments

The triptan class faces competition from other acute migraine medications, including:

- Ditans (e.g., lasmiditan) — offering options for patients contraindicated for triptans.

- Gepants (e.g., ubrogepant, rimegepant) — newer oral agents with favorable safety profiles.

Additionally, non-pharmacological approaches and preventive therapies impact overall market volume.

Pricing Dynamics

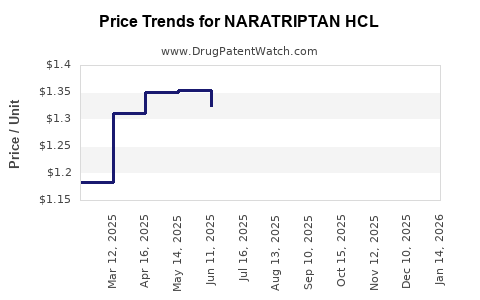

Historical Pricing Trends

- Brand-name naratriptan: Historically priced between USD 30–50 per package (6 tablets), depending on region.

- Generics: Prices have declined sharply post-patent expiry, with current average prices ranging USD 5–15 per package in developed markets. In emerging markets, prices can be significantly lower due to local regulatory and economic factors.

Factors Influencing Price Movements

- Generic Competition: Drives aggressive price erosion.

- Regulatory Policies: Price controls and reimbursement policies limit retail prices.

- Manufacturing Costs: Economies of scale and production efficiency affect pricing strategies.

- Market Penetration: Heavily penetrated markets experience diminishing prices over time.

Forecasting Price Trends (2023–2028)

Market Penetration and Regeneration

With patent expirations in many regions, the generic market dominance will persist, contributing to sustained low price levels. However, market saturation could stabilize, preventing further significant price declines.

Emerging Markets

In developing regions, prices are expected to remain relatively stable or slightly increase due to increasing demand and less intense price competition. The growing prevalence of migraines and expanding healthcare coverage will boost availability.

Influence of Novel Therapies

As gepants and ditans gain approval and market share, naratriptan’s relative price stability may be challenged. Access to newer agents, often priced higher, may pressure the market segment for traditional triptans, including naratriptan.

Projected Price Range

- North America and Europe: USD 5–15 per package (generic), with slight fluctuations based on policy and competition.

- Asia-Pacific and Emerging Markets: USD 2–8 per package, with potential for gradual increases aligned with economic development.

Over five years, prices are projected to decline marginally (5–10%) in mature markets due to sustained generic competition. In contrast, prices in developing markets may experience modest increases due to demand growth and regulatory shifts.

Regulatory and Policy Impact

Governmental agencies advocating for affordable migraine treatments will influence price ceilings, particularly in healthcare systems with centralized pricing controls. Furthermore, healthcare policies encouraging biosimilar and generic uptake will reinforce existing price trends.

Supply Chain and Manufacturing Considerations

Manufacturing efficiencies gained through scale and technological innovation could allow producers to maintain competitive pricing while ensuring margins. Quality standards and compliance costs, however, will influence profitability and pricing strategies.

Conclusion

The naratriptan HCl market presents a mature but stable landscape characterized by fierce generic competition and evolving treatment paradigms. While prices are expected to plateau or decline slightly in developed markets, emerging economies will likely see gradual price increases driven by demand expansion and regulatory liberalization. Innovations within the triptan class and new therapies may influence future market structure, but naratriptan’s role as a cost-effective, well-established treatment remains secure through 2028.

Key Takeaways

- Market stability: The naratriptan market will remain steady despite intensifying competition, primarily driven by generic availability.

- Price trajectory: Expect a slight overall decrease (5–10%) in developed markets, with stable or modestly rising prices in emerging regions.

- Competitive pressure: Newer agents and alternative therapies may limit growth but will not eliminate naratriptan’s niche.

- Regulatory influence: Policy trends toward affordability and access will maintain downward pricing pressures, particularly for generics.

- Strategic opportunities: Manufacturers should focus on cost efficiencies and expanding access in emerging markets to sustain profitability.

FAQs

-

What is the primary factor influencing naratriptan's price decline?

The expiration of patents and the subsequent proliferation of generics are the main drivers of price reduction, increasing market competitiveness.

-

Will brand-name naratriptan regain market share in the future?

Unlikely, given the dominance of generics and the availability of cost-effective alternatives; brand premiums are more prevalent in markets with high brand loyalty or limited generic penetration.

-

How do new migraine treatments impact naratriptan’s market?

The emergence of gepants and ditans offers alternative options, especially for patients contraindicated for triptans, potentially limiting naratriptan’s growth but not its core demand.

-

Are there regional variations in naratriptan pricing?

Yes, developed markets exhibit lower prices due to generic competition, while prices remain relatively higher in emerging markets until generics penetrate these regions.

-

What strategies can manufacturers implement to optimize profits?

Focus on cost-effective manufacturing, expanding access in high-growth markets, and engaging in strategic partnerships to mitigate pricing pressures and sustain market share.

Sources:

[1] World Health Organization. (2019). The Global Burden of Disease Study.