Share This Page

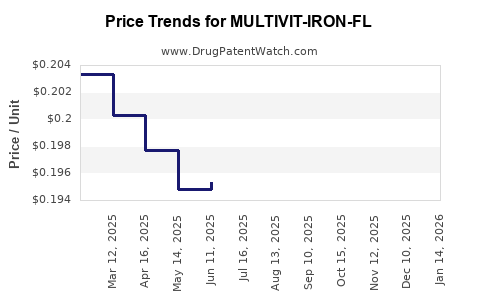

Drug Price Trends for MULTIVIT-IRON-FL

✉ Email this page to a colleague

Average Pharmacy Cost for MULTIVIT-IRON-FL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MULTIVIT-IRON-FLUOR 0.25 MG/ML | 61269-0163-50 | 0.19462 | ML | 2025-12-17 |

| MULTIVIT-IRON-FLUOR 0.25 MG/ML | 61269-0163-50 | 0.19475 | ML | 2025-11-19 |

| MULTIVIT-IRON-FLUOR 0.25 MG/ML | 61269-0163-50 | 0.19606 | ML | 2025-10-22 |

| MULTIVIT-IRON-FLUOR 0.25 MG/ML | 61269-0163-50 | 0.19859 | ML | 2025-09-17 |

| MULTIVIT-IRON-FLUOR 0.25 MG/ML | 61269-0163-50 | 0.19869 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MULTIVIT-IRON-FL

Introduction

The pharmaceutical landscape for multivitamin and mineral supplements intertwined with iron has grown significantly, driven by increasing prevalence of iron-deficiency anemia, rising consumer health awareness, and expanding pharmaceutical markets worldwide. MULTIVIT-IRON-FL, a purported formulation combining broad-spectrum multivitamins with iron supplementation, positions itself within this expanding segment. This analysis provides an in-depth overview of market dynamics, competitive landscape, regulatory considerations, and future pricing trajectories for MULTIVIT-IRON-FL.

Industry Overview: The Multivitamin and Iron Supplement Segment

The global market for dietary supplements, including multivitamins with iron, was valued at approximately USD 146.4 billion in 2022, with a CAGR projected around 8.6% through 2030 [1]. The increasing burden of nutritional deficiencies, especially iron deficiency anemia affecting over 1.62 billion people worldwide, underpins the rising demand. The demographic spectrum benefits from such supplements include women of reproductive age, pregnant women, children, and the elderly.

The multivitamin and mineral (MV&M) segment is characterized by numerous formulations targeting diverse consumer needs. Iron-content formulations have gained particular traction in regions with high anemia prevalence, such as South Asia, Africa, and parts of Latin America. This segment's growth is also augmented by policy initiatives promoting nutritional supplementation and the drive towards sustainable, bioavailable, and tolerable iron delivery mechanisms.

Market Drivers and Growth Factors

-

Rising Iron-Deficiency Anemia Prevalence: Anemia affects roughly 23% of the global population, predominantly due to iron deficiency [2]. As awareness grows, demand for effective supplements like MULTIVIT-IRON-FL increases.

-

Expanding Consumer Awareness: Increased health literacy and proactive health management fuel the adoption of multivitamins with iron, particularly in developed markets.

-

Regulatory Policies and Public Health Initiatives: Governments and organizations such as WHO advocate for iron supplementation programs, increasing market penetration.

-

Product Innovation: Advances in bioavailability and tolerability of iron compounds (e.g., ferrous bisglycinate) enhance consumer preference, promoting market expansion.

-

E-commerce and Direct-to-Consumer Sales: The proliferation of online retail channels facilitates broader access and marketing, especially critical for niche supplement formulators.

Competitive Landscape

Major global players include Pfizer, GSK, Bayer, and numerous regional firms. Niche formulations like MULTIVIT-IRON-FL compete primarily via differentiation features such as superior bioavailability, fewer gastrointestinal side effects, and comprehensive micronutrient coverage.

Key competitive considerations:

- Formulation Differentiation: Innovations that optimize absorption (e.g., liposomal iron forms, chelated minerals) provide competitive advantages.

- Regulatory Approvals: Gaining recognition in major markets (FDA, EMA, etc.) enhances market credibility.

- Pricing Strategies: Competitive pricing is critical, especially in low-income regions with high anemia prevalence.

Regulatory Landscape

Regulations governing supplements and pharmaceuticals vary globally:

- United States: Dietary supplements classified under DSHEA; health claims are tightly regulated.

- Europe: Supplements classified under Food Supplements Directive; safety and labeling are scrutinized.

- Emerging Markets: Regulatory controls vary, often less stringent, which can accelerate market entry but complicate compliance.

For MULTIVIT-IRON-FL, regulatory approval hinges on demonstrating safety, quality, and efficacy, particularly if health claims are involved. Patent protections can secure market exclusivity, influencing price strategies.

Price Analysis and Projection

Current Market Pricing Dynamics

Pricing for multivitamins with iron varies remarkably based on region, formulation complexity, brand positioning, and distribution channels:

- Premium Segment: Formulations with enhanced bioavailability or specialized delivery systems command higher prices (USD 10-30 per month).

- Mass Market: Standard over-the-counter products typically retail at USD 3-8 per month (or per pack).

In developing markets, price sensitivity is high, with consumers often opting for lower-cost, locally produced options.

Factors Influencing Price Trends

-

Ingredient Costs: Fluctuations in raw material prices, especially iron compounds, impact manufacturing costs.

-

Regulatory Approval Costs: Gaining approvals incurs expenses that can elevate product pricing.

-

Market Penetration and Competition: Increasing competition tends to compress margins and drive prices downward unless differentiation or premium positioning exist.

-

Innovation and Patented Formulations: Proprietary formulations with proven superior bioavailability can command premium prices.

Price Projection (2023-2030)

Based on current market trends and the expected product attributes of MULTIVIT-IRON-FL, the following projections are made:

-

Short-term (2023-2025): Introduction phase with moderate pricing, USD 8-12 per month, driven by early-stage market penetration, brand recognition efforts, and regulatory approval costs.

-

Mid-term (2026-2028): As market acceptance grows and manufacturing scales improve, prices could stabilize or slightly decrease, averaging USD 6-10 per month, especially in generic or branded generic segments.

-

Long-term (2029-2030): With increased competition and potential formulation improvements, prices are anticipated to decline further to USD 5-8 per month in mass markets, while premium formulations may retain USD 10-15 margins.

Key Price Influencers

-

Market Penetration Strategy: Entry pricing must balance competitiveness with recouping development costs.

-

Patent Saltation: Proprietary delivery mechanisms could allow premium pricing longer-term.

-

Regulatory Approvals and Claims: Successful endorsements can justify higher prices.

-

Consumer Preferences: Preferences for tolerability, bioavailability, and added micronutrients influence willingness to pay.

Opportunities and Risks

Opportunities

-

Targeting High-Prevalence Regions: Focused marketing in Asia, Africa, and Latin America where anemia is prevalent enables large-scale adoption.

-

Innovative Delivery System: If MULTIVIT-IRON-FL employs novel bioavailable iron forms, it can command premium pricing.

-

Partnerships with Public Health Programs: Collaborations can accelerate market penetration and stabilize demand.

Risks

-

Market Saturation: Numerous low-cost alternatives may limit sales potential.

-

Regulatory Hurdles: Delays or rejections could prolong time-to-market, affecting pricing strategies.

-

Price Erosion: Competition and genericization threaten to reduce margins over time.

-

Consumer Perception: Lack of differentiation may hinder adoption.

Key Takeaways

-

The global market for multivitamins with iron is expanding at a robust CAGR, driven primarily by anemia prevalence and heightened health consciousness.

-

Pricing strategies should consider regional income levels, competition, ingredient costs, and product differentiation.

-

Formulation innovation, especially regarding bioavailability and tolerability, offers opportunities for premium pricing.

-

Regulatory endorsement and strategic partnerships enhance market stability and profitability.

-

Long-term price declines are expected as generic competition increases and market saturation occurs, underscoring the importance of early differentiation and effective positioning.

Conclusion

MULTIVIT-IRON-FL is positioned within a dynamic, expanding segment of nutritional supplements catering to globally prevalent nutritional deficiencies. Its success depends on strategic formulation, regulatory navigation, targeted market entry, and competitive pricing. While initial pricing may be moderate to premium, the trajectory suggests potential for price compression aligned with market maturation, necessitating a tailored approach balancing affordability with sustainable margins.

FAQs

1. What are the key factors influencing the price of MULTIVIT-IRON-FL?

Ingredient costs, formulation complexity, regulatory expenses, competition, and regional market conditions primarily determine the product’s pricing.

2. Which regions present the largest market opportunities for MULTIVIT-IRON-FL?

High anemia prevalence regions such as South Asia, Sub-Saharan Africa, Latin America, and among certain populations in Europe and North America.

3. How does formulation innovation impact pricing strategy?

Innovative, bioavailable iron forms with fewer side effects justify premium pricing, enhance consumer acceptance, and differentiate the product from competitors.

4. What regulatory hurdles could affect the market entry and pricing?

Obtaining necessary approvals from authorities like the FDA or EMA, demonstrating safety and efficacy, and complying with local labeling and quality standards are critical.

5. What is the long-term outlook for the price of multivitamin with iron products like MULTIVIT-IRON-FL?

Prices are expected to decline gradually due to increased competition, genericization, and market saturation, emphasizing early differentiation and branding.

References

[1] Grand View Research, "Dietary Supplements Market Size, Share & Trends Analysis." 2022.

[2] WHO, "Erythroid Disorders — Iron Deficiency Anemia," 2021.

More… ↓