Share This Page

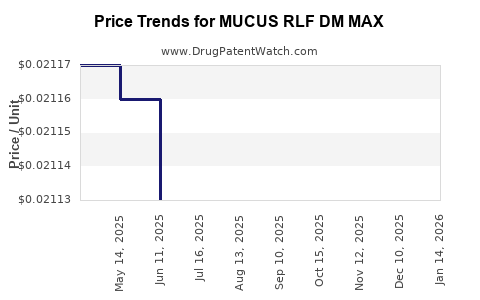

Drug Price Trends for MUCUS RLF DM MAX

✉ Email this page to a colleague

Average Pharmacy Cost for MUCUS RLF DM MAX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MUCUS RLF DM MAX 400-20 MG/20 ML | 70000-0707-01 | 0.02134 | ML | 2025-12-17 |

| MUCUS RLF DM MAX ER 1200-60 MG | 00536-1447-88 | 0.53895 | EACH | 2025-12-17 |

| MUCUS RLF DM MAX ER 1200-60 MG | 00536-1213-88 | 0.53895 | EACH | 2025-12-17 |

| MUCUS RLF DM MAX ER 1200-60 MG | 70000-0464-02 | 0.53895 | EACH | 2025-12-17 |

| MUCUS RLF DM MAX ER 1200-60 MG | 70000-0464-01 | 0.53895 | EACH | 2025-12-17 |

| MUCUS RLF DM MAX ER 1200-60 MG | 00536-1213-88 | 0.54629 | EACH | 2025-11-19 |

| MUCUS RLF DM MAX ER 1200-60 MG | 70000-0464-01 | 0.54629 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MUCUS RLF DM MAX

Introduction

MUCUS RLF DM MAX is a combination medication widely used to provide symptomatic relief for respiratory conditions characterized by excessive mucus, cough, and congestion. Comprising potent active ingredients such as guaifenesin, dextromethorphan, and potentially other adjuncts, its market adoption hinges on its efficacy, safety profile, and positioning within respiratory therapeutics. This analysis evaluates its current market landscape, competitive position, regulatory environment, and projects future price trajectories for stakeholders.

Product Overview

MUCUS RLF DM MAX combines expectorant and cough suppressant agents, primarily guaifenesin and dextromethorphan, targeting acute cough and mucus congestion associated with colds, flu, and respiratory infections. Over the counter (OTC) status in many regions facilitates broad accessibility, yet this segmentation faces challenges from both prescription medications and emerging alternative therapies.

Current Market Landscape

Demand Dynamics

The global respiratory drugs market, including OTC products like MUCUS RLF DM MAX, is driven by rising prevalence of respiratory conditions, especially in aging populations and regions with high pollution levels. The outbreak of respiratory illnesses such as COVID-19 has amplified demand, further highlighting the need for effective symptomatic remedies.

In the United States, the OTC cough and cold medication segment saw an estimated value of approximately USD 3 billion in 2022, with expectorants and antitussives comprising a substantial share.[1] While no exact figures for MUCUS RLF DM MAX specifically exist, branded and generic combination products collectively represent an incremental revenue stream for pharmaceutical companies serving this segment.

Competitive Landscape

Key competitors include major OTC brands such as Robitussin, Mucinex, and Delsym, alongside generics offered by pharmaceutical manufacturers. Notably, Mucinex DM, which shares a similar composition, remains a market leader owing to brand recognition and extensive marketing strategies.

The competitive edge for MUCUS RLF DM MAX hinges on specific formulation advantages, price points, and retail shelf presence. Its positioning often relies on aggressive price strategies, product bundling, and consumer loyalty in markets where OTC products are frequently purchased without consultation.

Regulatory and Reimbursement Factors

As an OTC medication, MUCUS RLF DM MAX benefits from regulatory ease in primary markets like the U.S., under FDA regulations. However, regulatory scrutiny concerning safety warnings, especially pertaining to Dextromethorphan's misuse potential, influences formulation labeling and marketing strategies.

Reimbursement is minimal for OTC drugs; costs are directly borne by consumers, placing price sensitivity at the forefront of market penetration strategies.

Pricing Analysis

Current Price Points

In mature markets, MUCUS RLF DM MAX retails typically between USD 7–USD 15 per bottle (usually 100 mL to 150 mL), depending on branding, formulation strength, and retail outlet.

Generic equivalents sold at lower prices—often 20–40% cheaper—pressure branded products to maintain market share. Notably, small-to-moderate price variations reflect geographic differences, retail channel markups, and regional regulatory costs.

Pricing Strategies and Consumer Behavior

Manufacturers prioritize price positioning to balance profit margins against volume sales. Promotional discounts, recurring retail promotions, and bundling with other OTC medications aim to enhance consumer uptake.

In East Asian and Latin American markets, local generics dominate due to price sensitivity, leading to narrower gross margins for brand-name formulations like MUCUS RLF DM MAX. Conversely, in North America and Europe, premium pricing is sustainable owing to higher purchasing power and consumer brand loyalty.

Forecasted Price Trends

Short-term Outlook (1–2 years)

The immediate future suggests稳定 prices, with minor fluctuations driven by:

-

Regulatory changes: Stricter labeling or safety warnings, especially around dextromethorphan misuse, could temporarily influence pricing strategies.

-

Market saturation: The high penetration of OTC cough remedies exerts downward pressure, compelling manufacturers to optimize pricing.

-

Supply chain factors: Raw material availability and manufacturing costs, notably for active ingredients, impact retail prices.

Overall, expect a stabilization with a potential slight decline (~2–5%) in generic markets, driven by increased competition and generic proliferation.

Medium-term Outlook (3–5 years)

Global respiratory illness trends and increased demand due to aging demographics likely sustain moderate growth in OTC sales volumes. However, regulatory scrutiny and consumer safety concerns may push prices within a competitive range, with potential for:

-

Price erosion in generics leading to 10–15% reduction in average retail prices for branded formulations.

-

Introduction of formula improvements or combination variants, possibly commanding premium pricing.

-

Emerging markets could see a compound annual growth rate (CAGR) of approximately 3–5%, with prices remaining stable or decreasing gradually.

Impact of Innovations and Emerging Therapies

Advances such as new drug delivery systems, novel active ingredients, or digital health integrations might shift consumer preferences, impacting prices unpredictably. If MUCUS RLF DM MAX or similar formulations incorporate innovative features or are repositioned as premium OTC solutions, prices could realign upwards within niche segments.

Regulatory and Market Influences on Pricing

The regulatory environment will heavily influence future pricing. Any tightening around dextromethorphan's misuse potential could lead to reformulation costs, influencing retail prices. Additionally, policies promoting transparency and pricing controls in certain jurisdictions could further compress profit margins.

In economies with healthcare reimbursement systems, such as select European countries, integration into broader respiratory therapy guidelines may also affect pricing structures, although OTC products generally see minimal reimbursement policies.

Strategic Implications for Stakeholders

-

Manufacturers should balance product differentiation, regulatory compliance, and competitive pricing to capitalize on increased respiratory illness prevalence.

-

Retailers should consider consumer purchasing behaviors, with promotional strategies to counter generic competition.

-

Investors can monitor evolving regulatory landscapes and emerging market trends to identify price stability or growth opportunities.

Key Takeaways

-

MUCUS RLF DM MAX operates in a highly competitive OTC respiratory segment, with demand driven by global respiratory health trends.

-

Current retail prices hover between USD 7–USD 15 per bottle, with generics exerting downward pricing pressure.

-

Price projections indicate stability in the short term, with potential minor declines (~2–5%) due to market saturation and generic competition.

-

Medium-term prospects forecast slight price erosion, though increased respiratory disease prevalence supports steady sales volumes.

-

Regulatory factors and innovation adoption remain key external influences shaping future pricing strategies.

FAQs

1. How does the regulatory environment influence the pricing of MUCUS RLF DM MAX?

Regulatory changes, especially safety warnings or labeling requirements, can increase manufacturing costs or limit product formulations, thereby impacting retail prices. Stricter regulations may also restrict marketing, affecting competitiveness and pricing strategies.

2. What are the main competitors to MUCUS RLF DM MAX in the OTC respiratory market?

Key competitors include brands like Mucinex DM, Delsym, Robitussin, and numerous generic brands. These products often compete on price, formulation, brand recognition, and distribution channels.

3. How do regional variations affect the pricing of MUCUS RLF DM MAX?

Economic factors, healthcare policies, and consumer purchasing power influence regional prices. Developed markets typically have higher retail prices due to higher income levels and brand loyalty, whereas emerging markets favor lower-priced generics to maintain competitiveness.

4. What factors could cause the price of MUCUS RLF DM MAX to increase in the future?

Introduction of innovative delivery systems, repositioning as a premium product, or shifts in regulatory policies increasing manufacturing costs are potential drivers for price increases.

5. How might the rise of alternative therapies impact the market for MUCUS RLF DM MAX?

Emerging natural remedies, digital health apps, or new pharmacological treatments could reduce reliance on traditional cough suppressants, exerting downward pressure on prices and sales volumes.

References

- IQVIA. "The Impact of COVID-19 on the Cough and Cold Market." 2022.

More… ↓