Share This Page

Drug Price Trends for MUCUS RELIEF PE TABLET

✉ Email this page to a colleague

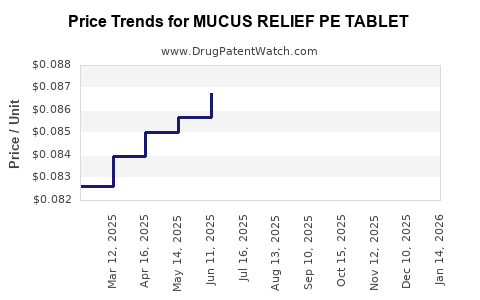

Average Pharmacy Cost for MUCUS RELIEF PE TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MUCUS RELIEF PE TABLET | 70000-0141-01 | 0.07782 | EACH | 2025-12-17 |

| MUCUS RELIEF PE TABLET | 70000-0141-01 | 0.07863 | EACH | 2025-11-19 |

| MUCUS RELIEF PE TABLET | 70000-0141-01 | 0.07863 | EACH | 2025-10-22 |

| MUCUS RELIEF PE TABLET | 70000-0141-01 | 0.07871 | EACH | 2025-09-17 |

| MUCUS RELIEF PE TABLET | 70000-0141-01 | 0.08165 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MUCUS RELIEF PE TABLET

Introduction

MUCUS RELIEF PE TABLET is a multi-ingredient therapeutic product designed to alleviate symptoms associated with excess mucus production. It generally combines decongestants, expectorants, and antihistamines, targeting respiratory conditions such as cold, flu, allergic rhinitis, and sinusitis. The global demand for mucus relief medications has grown notably, driven by increasing respiratory diseases, heightened health awareness, and the opioid crisis leading consumers towards over-the-counter (OTC) alternatives. This report provides an in-depth market analysis of MUCUS RELIEF PE TABLET, covering its current market landscape, competitive position, regulatory environment, and future price projections.

Market Overview

Global Respiratory Medications Market

The respiratory medication market, valued at approximately USD 25 billion in 2022, is anticipated to expand at a compound annual growth rate (CAGR) of around 6% through 2030 [1]. Key growth drivers include:

- The rising prevalence of respiratory conditions such as chronic bronchitis, COPD, and allergic rhinitis.

- Increased health awareness and self-medication practices.

- Expansion of OTC drug markets, especially in emerging economies.

MUCUS relief products constitute a significant segment within OTC respiratory therapeutics, with demand driven by seasonal illnesses and chronic respiratory issues.

Market Segmentation for Mucus Relief Products

Mucus relief formulations are distributed primarily via:

- Over-the-counter (OTC) channels in pharmacies and retail outlets.

- Prescription drugs in cases of severe symptoms or associated comorbidities.

The topical and oral formulations deployed include expectorants like guaifenesin, decongestants such as pseudoephedrine or phenylephrine, and antihistamines like chlorpheniramine, often combined for synergistic relief.

Product Profile: MUCUS RELIEF PE TABLET

Composition & Therapeutic Class:

- Expectant agents: Guaifenesin.

- Decongestants: Pseudoephedrine or phenylephrine.

- Antihistamines: Chlorpheniramine or diphenhydramine.

Indications:

- Symptomatic relief of cough, mucus congestion, nasal congestion, and allergy symptoms.

Unique Selling Propositions:

- Multi-symptom relief.

- Convenient oral tablet form.

- Widely accepted safety profile when used as directed.

The formulation's composition aligns with consumer preferences for multi-action OTC formulations, especially during peak cold and allergy seasons.

Market Dynamics

Competitive Landscape

Major players offering mucus relief tablets include multinational pharmaceutical companies and regional OTC manufacturers:

- Johnson & Johnson (TYLENOL Cold & Sinus)

- Bayer (Sudafed PE)

- GlaxoSmithKline (Alertec products)

- Local OTC brands in emerging markets.

Market entry is relatively accessible due to the availability of active ingredients and low regulatory barriers for OTC products, creating a highly competitive environment.

Regulatory Environment

Regulatory approval varies significantly across jurisdictions:

- United States: The FDA regulates OTC drugs under the OTC Drug Review process. Guaifenesin and phenylephrine are generally recognized as safe when used appropriately.

- European Union: The EMA oversees medicinal products; many ingredients are categorized as medicines needing prescription unless reformulated as food supplements.

- Emerging Markets: Regulatory pathways often include simplified registration, yet quality standards vary.

Stringent safety and efficacy requirements may impact product formulations, especially in markets considering combination formulations with regulated decongestants.

Market Challenges

- Regulatory Restrictions: Especially concerning pseudoephedrine in some jurisdictions due to its misuse potential.

- Consumer Preferences: Increasing shift towards natural and home remedies, potentially impacting OTC sales.

- Price Sensitivity: Particularly strong in emerging markets where consumers favor low-cost generics.

- Counterfeit and Substandard Products: As OTC markets expand, quality assurance becomes critical.

Price Projection Analysis

Current Price Benchmarks

In developed markets like the U.S., a typical MUCUS RELIEF PE TABLET pack (20-30 tablets) retails for USD 8-15, depending on branding, formulation, and packaging. Generic versions tend to lower prices by approximately 20-30%.

In developing nations, prices can be substantially lower, ranging from USD 2-6 per pack, driven by local manufacturing and lower regulatory costs.

Projected Pricing Trends (2023–2030)

-

Short-term (2023–2025): Prices are expected to remain relatively stable, with minor fluctuations driven by raw material costs, regulatory changes, and inflation. Market entry of generic and private-label brands will likely intensify price competition.

-

Mid-term (2026–2028): Introduction of longer-acting, innovative formulations with added natural ingredients may result in premium pricing segments, potentially increasing unit prices by 10-15%. Emphasis on convenience and combined therapies could lead to higher-value products.

-

Long-term (2029–2030): Advances in bio-based actives and sustained-release tablets could create premium niches, pushing prices upward by an estimated 15-20%. Conversely, increased manufacturing efficiency and globalized supply chains could further lower prices of basic formulations, especially in high-volume markets.

Influencing factors include:

- Ingredient cost fluctuations, particularly for decongestants and antihistamines.

- Regulatory shifts limiting certain active ingredients' availability.

- Adoption of digital channels and direct-to-consumer models reducing retail margins.

- Geographic expansion into emerging markets with price-sensitive consumers.

Strategic Opportunities & Recommendations

- Formulation Innovation: Developing natural or herbal-based mucus relief formulations may appeal to consumer trends, allowing premium pricing.

- Regulatory Navigation: Proactively engaging with authorities to shape favorable classification and labeling regimes can mitigate market entry barriers.

- Market Penetration: Targeting emerging markets with tailored pricing strategies and local partnerships can significantly expand reach.

- Brand Differentiation: Emphasizing efficacy, safety, and convenience can justify higher price points amid competitive pressures.

- Digital and E-Commerce Focus: Leveraging online sales channels to optimize margins and consumer engagement.

Key Takeaways

- The global mucus relief market is robust, driven by respiratory health needs and OTC product demand.

- MUCUS RELIEF PE TABLET faces intense competition but benefits from consumer demand for multi-symptom relief formulations.

- Price stability will persist short term, with gradual increases anticipated due to formulation innovations and premiumization in select segments.

- Regulatory environments across regions critically influence product positioning and pricing strategies.

- Emerging markets offer significant growth opportunities, albeit with price sensitivity requiring tailored approaches.

FAQs

1. What active ingredients are typically found in MUCUS RELIEF PE TABLET?

Common active ingredients include guaifenesin (expectorant), pseudoephedrine or phenylephrine (decongestants), and chlorpheniramine or diphenhydramine (antihistamines). These are combined to provide comprehensive symptom relief.

2. How is the regulatory landscape impacting the pricing of mucus relief tablets?

Stringent regulations, especially concerning pseudoephedrine’s diversion potential, may limit formulations, increase compliance costs, and influence retail pricing. Conversely, less regulated markets may see more competitive, lower-priced offerings.

3. Which geographic markets offer the most growth potential for MUCUS RELIEF PE TABLET?

Emerging markets in Asia, Africa, and Latin America present significant growth due to rising respiratory conditions, expanding OTC markets, and increasing healthcare awareness.

4. What are the primary challenges in maintaining competitive pricing?

Ingredient costs, regulatory restrictions, counterfeiting, and market saturation are key challenges that influence profit margins and pricing strategies.

5. How will technological innovation influence future pricing of mucus relief formulations?

Advances such as sustained-release technologies and natural ingredient integration could justify higher prices, while improved manufacturing efficiencies might lower costs, stabilizing retail prices.

References

[1] Market Research Future, “Respiratory Drugs Market Analysis & Trends,” 2022.

More… ↓