Share This Page

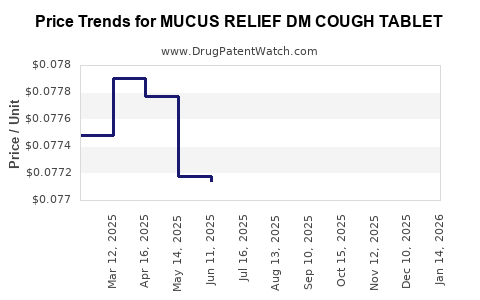

Drug Price Trends for MUCUS RELIEF DM COUGH TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for MUCUS RELIEF DM COUGH TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MUCUS RELIEF DM COUGH TABLET | 70000-0278-01 | 0.07864 | EACH | 2025-12-17 |

| MUCUS RELIEF DM COUGH TABLET | 70000-0278-01 | 0.07902 | EACH | 2025-11-19 |

| MUCUS RELIEF DM COUGH TABLET | 70000-0278-01 | 0.07884 | EACH | 2025-10-22 |

| MUCUS RELIEF DM COUGH TABLET | 70000-0278-01 | 0.07875 | EACH | 2025-09-17 |

| MUCUS RELIEF DM COUGH TABLET | 70000-0278-01 | 0.07822 | EACH | 2025-08-20 |

| MUCUS RELIEF DM COUGH TABLET | 70000-0278-01 | 0.07801 | EACH | 2025-07-23 |

| MUCUS RELIEF DM COUGH TABLET | 70000-0278-01 | 0.07714 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Mucus Relief DM Cough Tablet

Introduction

The pharmaceutical landscape for cough and cold remedies remains highly competitive, driven by increasing consumer demand for effective, accessible, and rapidly acting symptomatic relief. Mucus Relief DM Cough Tablet, a combination drug designed to address cough, chest congestion, and mucus production, occupies a significant niche within this segment. This analysis evaluates the current market environment, competitive positioning, regulatory considerations, and provides forward-looking price projections for Mucus Relief DM Cough Tablet.

Market Overview

Global and Regional Dynamics

The global expectorant and cough suppressant market was valued at approximately USD 8.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4% through 2030[^1]. North America dominates this market, benefitting from high health awareness, accessibility, and product availability, with Asia-Pacific anticipated to register the fastest growth due to expanding healthcare infrastructure and increasing OTC medication penetration.

Epidemiological Drivers

Incidence of respiratory infections, seasonal flu, and allergic conditions sustains robust demand for cough and mucus remedies. The COVID-19 pandemic further amplified consumer focus on respiratory health, spurring sales of OTC expectorants and cough suppressants.

Consumer Preferences

Modern consumers favor multi-symptom formulations such as Mucus Relief DM, which combines dextromethorphan (a cough suppressant) with guaifenesin (an expectorant). The preference for combination therapies minimizes medication intake and simplifies treatment regimens.

Regulatory Landscape

Regulatory Classification & Approval

Mucus Relief DM Cough Tablet, being an OTC medication, must comply with regulatory standards set by agencies like the FDA (U.S.), EMA (Europe), and local authorities in emerging markets. Its active ingredients, dextromethorphan and guaifenesin, are well-established and broadly recognized as safe when used within specified dosage limits[^2].

Recent Regulatory Trends

Regulatory agencies are increasingly scrutinizing codeine- and dextromethorphan-containing products to prevent abuse potential and misuse. Consequently, packaging and dispensing restrictions, such as age limits and purchase quantity controls, are being enforced globally, potentially impacting sales channels and pricing strategies.

Competitive Landscape

Key Players and Market Share

Major pharmaceutical firms in this segment include Johnson & Johnson, Reckitt Benckiser, and Novartis. These companies dominate OTC cough and cold products with diverse portfolios and extensive distribution networks. Generic manufacturers also hold significant market share, especially in price-sensitive regions.

Product Differentiation

Mucus Relief DM distinguishes itself with specific formulation advantages—combining effective decongestion with a potent cough suppressant—appealing to consumers seeking rapid symptom relief. Packaging innovation, flavor profiles, and branding also influence competitive positioning.

Pricing Strategy and Factors Influencing Price Points

Current Pricing Trends

In the United States, typical OTC Mucus Relief DM Tablets retail between USD 8– USD 12 per package of 20–30 tablets[^3], depending on brand, generic status, and retailer. Generic formulations tend to be priced 15–25% lower than branded counterparts, offering accessible options for price-sensitive consumers.

Cost Components

Pricing is influenced by active ingredient costs, manufacturing, packaging, distribution expenses, regulatory compliance, and marketing. Moreover, rising raw material prices—such as dextromethorphan—may pressure profit margins, leading to slight price adjustments.

Market Access and Distribution Channels

OTC drug prices are heavily impacted by the distribution network—pharmacies, supermarkets, online platforms—each with varying pricing strategies. Direct-to-consumer online channels have surged, offering competitive pricing and discounts, further shaping market equilibrium.

Price Projection Analysis

Short-term Outlook (Next 1–2 Years)

Given the current regulatory environment and competitive pressures, average retail prices for Mucus Relief DM Tablets in Western markets are expected to remain stable with minor fluctuations (±5%). Price stability is underpinned by mature markets, established supplier agreements, and predictable raw material costs.

Medium to Long-term Outlook (3–5 Years)

Projected trends indicate a gradual price increase driven by inflation, raw material cost escalations, and regulatory compliance costs. Additionally, patent expirations and an influx of generic versions will exert downward pressure on prices, possibly leading to a price decline of 10–15% in highly genericized markets. Conversely, premium formulations or combination products with added functionalities could command premium pricing, increasing average prices by 5–8%.

Impact of Regional Variances

Emerging markets are likely to see lower price points (USD 4–USD 8 per package) due to intense price competition and consumer sensitivity, whereas developed markets will sustain higher retail prices owing to higher disposable incomes and established regulatory frameworks.

Implications for Stakeholders

Pharmaceutical companies should monitor regulatory changes closely, especially restrictions on cough suppressant formulations. Leveraging brand differentiation, quality assurance, and distribution channel optimization offers avenues to maintain profitability amid price competition.

Investors and distributors should note that the mature OTC market’s stable pricing environment offers steady cash flow prospects but limited growth potential unless product innovation or new formulations are introduced.

Remote and online sales channels promise margin improvements through cost efficiencies, with targeted marketing campaigns reinforcing brand loyalty and justifying premium pricing for value-added formulations.

Key Market Drivers

- Increasing respiratory illness prevalence due to urbanization, pollution, and seasonal factors.

- Consumer shift towards multi-symptom OTC remedies like Mucus Relief DM.

- Regulatory scrutiny influencing formulation composition and packaging.

- Growing online OTC sales, impacting distribution and pricing.

Key Challenges

- Regulatory limitations reducing maximum permissible dosages.

- Rising raw material and manufacturing costs squeezing margins.

- Price volatility driven by generic substitution.

- Potential abuse and misuse concerns restricting sales channels.

Key Takeaways

- The global OTC cough and mucus relief market remains robust, with steady growth driven by respiratory health awareness.

- Mucus Relief DM’s dual-action formulation positions it favorably, though stricter regulations may impact formulations and sales strategies.

- Current pricing in developed markets hovers between USD 8–USD 12, with an expected modest increase of 3–5% over the next two years.

- Generic competition and regulatory costs will exert downward pressure on prices in the medium term, especially in emerging markets.

- Online and multichannel distribution will increasingly influence pricing strategies, offering avenues for premium branding and margins.

FAQs

1. What are the primary active ingredients in Mucus Relief DM Cough Tablet?

Dextromethorphan (a cough suppressant) and guaifenesin (an expectorant).

2. How does regulatory oversight affect the pricing of OTC cough remedies like Mucus Relief DM?

Regulatory restrictions on ingredients, packaging, and sale limits increase compliance costs, potentially raising prices. Conversely, patent expirations and generic entries exert downward pressure on pricing.

3. What are the key factors influencing the price of Mucus Relief DM in emerging markets?

Market competition, regulatory requirements, raw material costs, and consumer purchasing power.

4. How does brand differentiation impact pricing strategy?

Premium brands with added benefits or higher perceived quality can command higher prices, while generic versions compete primarily on price.

5. What is the outlook for online sales of OTC cough remedies?

Online channels are expected to grow significantly, offering price advantages, convenience, and broad accessibility, shaping future pricing dynamics.

References

[^1]: MarketResearch.com, "Global Cough and Cold Remedies Market Report," 2022.

[^2]: FDA, "Dextromethorphan and Guaifenesin Drug Facts," 2023.

[^3]: Nielsen Retail Measurement Data, 2023.

More… ↓