Share This Page

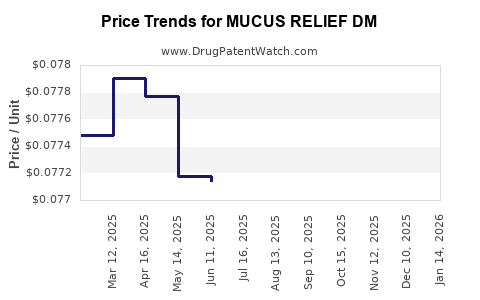

Drug Price Trends for MUCUS RELIEF DM

✉ Email this page to a colleague

Average Pharmacy Cost for MUCUS RELIEF DM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MUCUS RELIEF DM COUGH TABLET | 70000-0278-01 | 0.07864 | EACH | 2025-12-17 |

| MUCUS RELIEF DM MAX LIQUID | 70000-0565-01 | 0.02134 | ML | 2025-12-17 |

| MUCUS RELIEF DM COUGH TABLET | 70000-0278-01 | 0.07902 | EACH | 2025-11-19 |

| MUCUS RELIEF DM MAX LIQUID | 70000-0565-01 | 0.02143 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Mucus Relief DM

Overview of Mucus Relief DM

Mucus Relief DM is an over-the-counter (OTC) medication combining dextromethorphan (DXM) and guaifenesin. It addresses symptoms of cough and mucus congestion, positioning itself within the cold and cough treatment segment. Its formulation aims to suppress dry coughs through DXM, a cough suppressant, while facilitating mucus clearance with guaifenesin, an expectorant.

Pharmacological Profile and Market Position

Mucus Relief DM competes in the multi-billion-dollar cold, cough, and flu segment. According to IQVIA, the US OTC cough and cold market alone exceeds $3 billion annually, driven by seasonal demand and consumer preference for OTC remedies over prescription drugs [1]. Positioned as combination therapy, Mucus Relief DM appeals to consumers seeking symptom relief with a single product. Its formulation aligns with consumer trends favoring multi-symptom relief, which enhances its market penetration potential.

Current Market Landscape

Industry Overview

The OTC cough and cold market expands annually, driven by increased health awareness, aging populations, and seasonal surges. The key drivers include product efficacy, safety profiles, pricing strategies, and regulatory outlooks. Notably, the increasing prevalence of respiratory illnesses such as influenza and COVID-19 sustains demand for symptom relief medications.

Competitive Environment

Mucus Relief DM faces competition from brands like Robitussin, Mucinex DM, Delsym, and generic equivalents. Mucinex DM, featuring guaifenesin and dextromethorphan, holds substantial market share owing to established brand trust and extensive distribution channels [2]. Generic formulations often price lower, intensifying price competition. Consumer preference for natural or multipurpose remedies slightly shifts demand but remains constrained by efficacy and safety considerations.

Regulatory Considerations

Regulatory bodies such as the FDA oversee active ingredients and labeling. Recent concerns about DXM abuse potential influence formulation and marketing restrictions [3]. Ensuring compliance is critical for market stability and expansion.

Price Analysis

Historical Pricing Trends

Historically, Mucus Relief DM’s retail price in the US ranges from $6.50 to $9.00 for a 4 fl oz (118 mL) bottle, depending on the retailer and pack size. Generic competitors offer similar formulations at approximately 10-20% lower prices, fostering competitive pressure.

Factors Affecting Price

- Brand Positioning: Established brands command higher prices due to consumer trust.

- Distribution Channels: Pharmacy chains and mass merchandisers set different pricing strategies.

- Regulatory Changes: Stricter oversight or ingredient reforms could influence production costs, impacting retail prices.

- Supply Chain Dynamics: Fluctuations in raw material costs, especially for active ingredients, directly affect pricing.

Market Projections

Short-Term Outlook (1-2 Years)

The immediate future anticipates steady demand driven by seasonal respiratory illnesses. Pricing is expected to remain stable with minor fluctuations influenced by supply chain costs and promotional activities. However, intensifying competition from generics may pressure retail prices downward by approximately 5-10%.

Medium to Long-Term Outlook (3-5 Years)

- Market Penetration: Increased awareness and expanded distribution channels could boost sales volumes.

- Pricing Strategies: Companies may adopt value-based models, either maintaining premium pricing for differentiated formulations or employing price reductions to capture market share.

- Regulatory Impact: Emerging regulations on dextromethorphan abuse management might increase manufacturing costs, potentially resulting in marginal price increases (approx. 3-5%).

Projected Price Range (2023-2028):

- Retail price for a 4 fl oz bottle is expected to fluctuate between $6.50 and $9.50, with a median around $7.75.

- The average annual price increase is projected at 2-3%, aligning with inflation and regulatory compliance costs.

Key Market Opportunities and Risks

Opportunities

- Expansion into New Markets: Emerging economies with growing healthcare infrastructure present expansion opportunities.

- Formulation Innovations: Introducing sugar-free, organic, or natural variants could attract health-conscious consumers.

- E-commerce Channels: Growth in online pharmacies provides avenues for direct-to-consumer engagement and potential premium pricing.

Risks

- Regulatory Challenges: Increased scrutiny on DXM formulations may restrict availability or elevate compliance costs.

- Pricing Pressure: The proliferation of generic alternatives may suppress margins.

- Consumer Preferences: Shift towards home remedies or natural products could marginalize OTC cough formulations.

Strategic Recommendations

- Pricing Optimization: Leverage consumer data to balance competitive pricing with profit margins.

- Brand Differentiation: Invest in marketing emphasizing efficacy, safety, and unique formulation features.

- Regulatory Monitoring: Stay ahead of regulatory changes to adapt formulations and marketing strategies swiftly.

- Market Diversification: Explore international markets with unmet needs in cough and mucus relief.

Key Takeaways

- Mucus Relief DM operates in a competitive OTC market with steady demand rooted in seasonal respiratory health needs.

- Its current retail pricing ranges between $6.50 and $9.00, with minor downward pressures anticipated from generic competition.

- Price projections over the next five years suggest a modest annual increase of 2-3%, with potential fluctuations based on regulatory and supply chain factors.

- Strategic opportunities include market expansion, formulation diversification, and digital channel growth, while risks stem from increasing regulatory constraints and shifting consumer preferences.

- For stakeholders, maintaining agility in pricing and marketing strategies, coupled with ongoing regulatory vigilance, will be crucial to capturing and sustaining market share.

FAQs

1. What factors influence the retail price of Mucus Relief DM?

Manufacturing costs, brand positioning, competitive dynamics, supply chain logistics, regulatory compliance, and retailer pricing strategies primarily determine retail prices.

2. Is Mucus Relief DM likely to see significant price increases in the next five years?

No, significant increases are unlikely. Price adjustments will likely align with inflation, regulatory costs, and competitive pressures, resulting in modest annual increases of 2-3%.

3. How does the competition from generic options impact Mucus Relief DM’s pricing?

Generic competitors typically offer similar formulations at lower prices, exerting downward pressure on Mucus Relief DM’s pricing and margins.

4. What emerging trends could affect the market for Mucus Relief DM?

The rise of natural remedies, e-commerce growth, regulatory tightening concerning DXM, and international expansion opportunities could significantly influence the market landscape.

5. What key strategic actions should companies consider in this market?

Investing in formulation innovation, expanding distribution channels, closely monitoring regulatory developments, and tailoring marketing messages to consumer preferences are vital strategies.

References

[1] IQVIA. (2022). US OTC Cough and Cold Market Data.

[2] Statista. (2022). Market share of leading OTC cough medicine brands in the US.

[3] FDA. (2020). Regulations concerning Dextromethorphan and Abuse Potential.

More… ↓