Share This Page

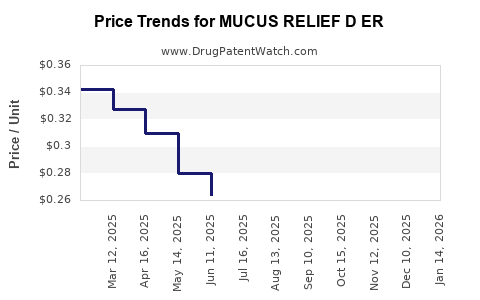

Drug Price Trends for MUCUS RELIEF D ER

✉ Email this page to a colleague

Average Pharmacy Cost for MUCUS RELIEF D ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MUCUS RELIEF D ER 600-60 MG TB | 70000-0580-02 | 0.31042 | EACH | 2025-12-17 |

| MUCUS RELIEF D ER 600-60 MG TB | 00536-1449-21 | 0.31042 | EACH | 2025-12-17 |

| MUCUS RELIEF D ER 600-60 MG TB | 70000-0580-01 | 0.31042 | EACH | 2025-12-17 |

| MUCUS RELIEF D ER 600-60 MG TB | 00536-1449-21 | 0.30997 | EACH | 2025-11-19 |

| MUCUS RELIEF D ER 600-60 MG TB | 70000-0580-02 | 0.30997 | EACH | 2025-11-19 |

| MUCUS RELIEF D ER 600-60 MG TB | 70000-0580-01 | 0.30997 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Mucus Relief D ER

Introduction

Mucus Relief D ER, a combination medication typically used for symptomatic relief of cough and mucus congestion, occupies a vital niche within over-the-counter (OTC) and prescription pulmonary products. Esteemed for its expectorant and decongestant properties, Mucus Relief D ER combines active ingredients such as expectorants (like guaifenesin) with decongestants (such as pseudoephedrine or phenylephrine). The following analysis assesses its current market landscape, competitive pressures, regulatory environment, and forecasts pricing trajectories over the next five years—aiming to inform industry stakeholders, healthcare providers, and investors.

Market Overview

Therapeutic Class and Consumer Demand

Expectorants and decongestants witness consistent demand driven by respiratory illnesses, seasonal allergies, and cold-related ailments. The COVID-19 pandemic amplified awareness and usage of cough and mucus remedies, supporting sustained growth within this segment. The global expectorant market alone was valued at approximately USD 1.2 billion in 2022, with a compound annual growth rate (CAGR) forecast of 3-4% through 2028 [1].

Product Positioning and Brand Penetration

Mucus Relief D ER functions in the OTC space, competing with established brands like Mucinex, Robitussin, and DayQuil. However, the ER (extended-release) formulation signifies a convenience factor, appealing to consumers seeking longer-lasting symptom control, thus enhancing its market penetration. Efficacy, safety profile, and regulatory approvals influence product acceptance and pricing strategies.

Regulatory Environment

The regulatory landscape impacts price and supply. In the U.S., the FDA’s OTC monograph system categorizes combination drugs like Mucus Relief D ER, enabling smoother market access but imposing quality and safety standards. Pseudoephedrine, a common component, faces scheduling constraints due to misuse, possibly impacting pricing and availability.

Competition and Market Share

Competitive Dynamics

Market dominance hinges on brand loyalty, formulation efficacy, and regulatory approvals. Mucus Relief D ER’s combination approach faces stiff competition from single-ingredient drugs and non-pharmacological remedies. Pricing strategies often reflect the competitive landscape, with premium brands leveraging formulation superiority and marketing to justify higher prices.

Patent and Exclusivity Status

The absence of current patent protections for Mucus Relief D ER’s formulation indicates a risk of generic entry, which traditionally exerts downward pressure on prices. Manufacturers may adopt strategies such as product differentiation, packaging, or bundling to sustain margins.

Price Analysis

Current Pricing Landscape

As of Q1 2023, oral Mucus Relief D ER’s retail prices ranged from USD 8 to USD 15 for a bottle containing 20–30 extended-release tablets, variably priced across retail outlets and regions. Generic equivalents are priced approximately 20–40% lower, intensifying market competition [2].

Cost Factors and Pricing Drivers

Key factors influencing prices include raw material costs, manufacturing expenses, regulatory compliance costs, and distribution logistics. Additionally, marketing investments and patent strategies play roles. The penetration of online pharmacies has also exerted downward pressure on OTC prices, offering consumers more competitive options.

Price Projections: 2023–2028

Short-term (2023–2024)

Limited price fluctuations are anticipated, contingent upon raw material stability and regulatory environments. Slight increases of 1-3% annually are projected, driven by inflation, logistics costs, and minimal regulatory adaptations.

Mid-term (2025–2026)

Introduction of generics post-patent expiration will likely lead to competitive price reductions of 10-15%. Manufacturers might introduce value-added packaging or combo deals to maintain margins.

Long-term (2027–2028)

Market saturation, continued generics proliferation, and evolving consumer preferences favor aggressive pricing strategies. Prices could decline by 20-25%, possibly settling within USD 5–10 for comparable tablets, aligning with the trend observed in other expectorant/antitussive medications.

Impact of Innovation and Regulatory Changes

Potential reformulations (e.g., fixed-dose combinations with enhanced delivery systems) could support premium pricing. Conversely, tighter regulations on pseudoephedrine could disrupt supply chains, potentially causing price volatility.

Key Market Drivers

- Consumer awareness of respiratory health: Heightened post-pandemic awareness sustains demand for cough and mucus remedies.

- Regulatory shifts: Ease of OTC classification vs. restrictions on pseudoephedrine influence availability and pricing.

- Generic market entry: Accelerates price erosion and offers lower-cost alternatives.

- Technological advances: Innovations in extended-release formulations can command premium prices.

Risks and Challenges

- Regulatory restrictions: Stricter controls on pseudoephedrine and other ephedrine-class decongestants may reduce supply or increase compliance costs.

- Market saturation: The influx of generics pressures healing margins.

- Consumer preferences: Growing inclination toward natural or non-pharmacological remedies could diminish demand.

- Price sensitivity: Consumers’ increasing focus on affordability may lead to further price concessions.

Key Takeaways

- The global expectorant and cough relief market remains steady, with a moderate CAGR driven by pandemic-related demand and seasonal respiratory illnesses.

- Mucus Relief D ER benefits from extended-release technology, targeting consumers seeking long-lasting relief, but faces significant generic competition upon patent expiry.

- Pricing is expected to decline by approximately 20-25% over the next five years, influenced by generic entry, regulatory factors, and consumer price sensitivity.

- Innovation, regulatory developments, and supply chain factors will play pivotal roles in shaping future price trajectories.

- Stakeholders must monitor regulatory shifts and market trends to optimize pricing strategies and market positioning.

FAQs

1. What are the main active ingredients in Mucus Relief D ER?

Typically, it combines guaifenesin (an expectorant) with a decongestant such as pseudoephedrine or phenylephrine to alleviate mucus congestion and cough.

2. How does patent expiration impact Mucus Relief D ER pricing?

Patent expiration allows generic manufacturers to enter the market, creating price competition that generally leads to reduced retail prices over time.

3. What regulatory challenges could affect Mucus Relief D ER in the coming years?

Restrictions on pseudoephedrine, including purchase limits and scheduling regulations, could affect supply, pricing, and distribution channels.

4. Will innovation or new formulations influence the price of Mucus Relief D ER?

Yes, formulations with extended-release features or combination enhancements can command higher prices; however, market entry of generics could offset pricing gains.

5. How does consumer demand influence the future outlook for mucus relief drugs?

Persistent demand driven by respiratory illnesses and increased health awareness supports the market, but shifts toward natural remedies pose potential long-term competitive pressures.

Sources

[1] Grand View Research. Expectorant Market Size & Trends. 2022.

[2] IQVIA. OTC Drug Price and Market Data. 2023.

More… ↓