Share This Page

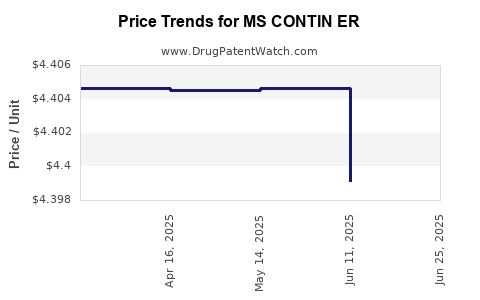

Drug Price Trends for MS CONTIN ER

✉ Email this page to a colleague

Average Pharmacy Cost for MS CONTIN ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MS CONTIN ER 30 MG TABLET | 42858-0631-01 | 8.87980 | EACH | 2025-07-01 |

| MS CONTIN ER 15 MG TABLET | 42858-0515-01 | 4.68073 | EACH | 2025-07-01 |

| MS CONTIN ER 30 MG TABLET | 42858-0631-01 | 8.34568 | EACH | 2025-06-18 |

| MS CONTIN ER 15 MG TABLET | 42858-0515-01 | 4.39914 | EACH | 2025-06-18 |

| MS CONTIN ER 15 MG TABLET | 42858-0515-01 | 4.40461 | EACH | 2025-05-21 |

| MS CONTIN ER 30 MG TABLET | 42858-0631-01 | 8.34997 | EACH | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MS CONTIN ER

Introduction

MS CONTIN ER (morphine sulfate extended-release) is a long-acting opioid analgesic primarily indicated for managing severe, chronic pain requiring around-the-clock treatment. As a Schedule II controlled substance, it addresses a significant niche within pain management but is also subject to rigorous regulatory oversight due to its potential for misuse and abuse. This analysis evaluates current market dynamics, forecasted pricing trends, and strategic considerations relevant for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Market Size and Demand Drivers

The global opioid analgesics market was valued at approximately USD 9.4 billion in 2021 and is projected to witness compounded annual growth rates (CAGR) of around 3.9% through 2028 [1]. MS CONTIN ER contributes notably to this segment, especially within markets where extended-release opioids are preferred for managing persistent pain conditions such as cancer pain, post-surgical pain, and chronic non-cancer pain.

In North America, the high prevalence of chronic pain conditions and the established regulatory environment sustain demand for MS CONTIN ER. The United States accounts for over 80% of global opioid sales, driven by a substantial patient population and established prescription practices. Europe and Asia are emerging markets, with growth propelled by expanding healthcare infrastructure and increasing acceptance of opioid therapies.

Competitive Landscape

MS CONTIN ER competes with other extended-release opioids such as OxyContin (oxycodone ER), Duragesic (fentanyl transdermal), and Kadian (morphine ER). Its differentiators include its formulation profile and specific prescribing patterns, often favored in certain pain management protocols. Patent expirations for comparable formulations and the introduction of generic equivalents influence market share and pricing strategies.

Regulatory Considerations

Stringent regulations circle around opioid market operations. The U.S. Drug Enforcement Administration (DEA) and Food and Drug Administration (FDA) impose strict controls, affecting distribution and pricing. The ongoing opioid crisis has prompted legislative measures that influence prescribing behaviors, reimbursement policies, and market entry barriers for new formulations.

Historical Pricing and Cost Dynamics

Brand vs. Generic

While MS CONTIN ER was initially marketed as a proprietary brand, the expiration of key patents has facilitated generic entry, impacting pricing structures. Typically, generic versions cost 30–50% less than branded formulations, leading to significant price competition and payer negotiations.

Pricing Trends

In the U.S., the average wholesale price (AWP) of MS CONTIN ER has historically ranged between USD 5 and USD 15 per 30 mg capsule, varying by manufacturer, formulation strength, and purchase volume. The presence of generics has driven retail prices down, with some generics retailing below USD 10 per 30 mg capsule.

Price Projections and Market Dynamics

Forecasting Assumptions

The future pricing trajectory of MS CONTIN ER hinges on multiple factors:

- Regulatory Environment: Increased scrutiny might limit prescriptions or impose stricter distribution controls, possibly escalating procurement costs.

- Generic Competition: Continued proliferation of generics may exert downward price pressure, though branded formulations could retain premium pricing in certain settings.

- Supply Chain Dynamics: Manufacturing costs, raw material availability, and pharmaceutical logistics influence pricing stability.

- Legal and Policy Changes: New legislation addressing opioid abuse deterrents or reimbursement policies may impact pricing and market access.

Projected Price Trajectory (Next 5 Years)

Considering these factors, the following projections are anticipated:

- Stability in Premium Markets: In regions with high prevalence and established prescribing habits (e.g., U.S.), MS CONTIN ER could maintain premium pricing levels between USD 8–USD 12 per 30 mg capsule, especially in hospitals or specialty pharmacies.

- Gradual Price Compression: Introduction of new generics and biosimilars are expected to suppress prices by approximately 10–15% annually, with some variation based on regional regulatory support and market penetration.

- Impact of Regulations and Reimbursement Policies: Stricter controls may further dampen pricing power. Conversely, in markets with supportive reimbursement frameworks, prices may stabilize despite generic competition.

Long-term outlook suggests a potential 10–20% decrease in average prices over five years, contingent upon the pace of generic adoption and policy shifts.

Strategic Market Opportunities and Risks

Opportunities:

- Untapped Markets: Emerging economies with rising chronic pain diagnoses and expanding healthcare infrastructure present growth prospects.

- Formulation Innovations: Developing tamper-resistant formulations or combination therapies can justify premium pricing and mitigate abuse concerns.

- Partnerships: Collaborations with healthcare systems and payers can optimize formulary placements and improve market access.

Risks:

- Regulatory Backlash: Stricter opioid regulation may restrict prescribing privileges or impose additional costs.

- Public Sentiment: Growing awareness of opioid misuse could lead to reduced prescriptions and lower market demand.

- Market Saturation: The availability of numerous generic alternatives constrains pricing power.

Regulatory and Reimbursement Landscape

Reimbursement policies are pivotal in pricing strategies. In the U.S., Medicaid and Medicare Part D heavily influence prescribing patterns and negotiated rebates. Programs emphasizing opioid stewardship can lower reimbursable prices, impacting profit margins. Globally, reimbursement frameworks vary, with developed markets likely to sustain better compensation rates for branded formulations versus developing markets, where generics predominate.

Conclusion

MS CONTIN ER operates within a complex ecosystem influenced by regulatory, competitive, and societal factors. While current demand remains steady in specific pain management niches, future pricing will steadily decline owing to the commoditization brought about by generics and evolving regulatory standards. Stakeholders need to anticipate market shifts towards biosimilars and abuse-deterrent formulations, which may reshape pricing.

Key Takeaways

- The global opioid analgesics market is growing modestly, with North America leading due to high chronic pain prevalence and established prescribing patterns.

- Generic competition significantly pressures MS CONTIN ER prices, likely resulting in a 10–20% price decrease over the next five years.

- Regulatory developments and opioid stewardship initiatives could further influence market accessibility and pricing.

- Opportunities exist in emerging markets and through innovation in formulation and abuse-deterrent technologies.

- Strategic partnerships and market differentiation are crucial to maintaining profitability amid intense price competition.

FAQs

1. What is the current average price of MS CONTIN ER per capsule?

In the United States, the average wholesale price (AWP) ranges from USD 5 to USD 15 per 30 mg capsule, with substantial variation based on manufacturer and procurement channels.

2. How do patent expirations affect MS CONTIN ER pricing?

Patent expirations facilitate generic entry, leading to price reductions of 30–50% and increasing market competition, pressure on brand pricing, and shifts in market share towards generics.

3. What are the major regulatory factors influencing the MS CONTIN ER market?

Regulatory oversight from agencies like the FDA and DEA impacts manufacturing, distribution, and prescribing practices. Restrictions aimed at curbing misuse can restrict market access and influence pricing strategies.

4. Which regions present the most growth opportunities for MS CONTIN ER?

Emerging markets in Asia, Latin America, and Eastern Europe offer potential due to expanding healthcare infrastructure and increasing chronic pain diagnoses, provided regulatory barriers are manageable.

5. How might innovations influence the future pricing of MS CONTIN ER?

Development of abuse-deterrent formulations, combination therapies, or novel delivery systems can justify higher pricing and create competitive advantages in a crowded market.

References

[1] MarketsandMarkets. "Opioid Market by Product, Application, and Region." 2022.

More… ↓