Last updated: July 28, 2025

Introduction

Moxifloxacin HCl, a broad-spectrum fluoroquinolone antibiotic, is widely prescribed to treat various bacterial infections, including respiratory tract infections, skin and soft tissue infections, and intra-abdominal infections. Since its market introduction, it has established a significant presence in the global antimicrobial market, driven by rising antibiotic resistance, expanding indications, and escalating demand for effective respiratory infection treatments. This analysis evaluates current market dynamics and projects future pricing trends for Moxifloxacin HCl, considering factors like patent status, manufacturing costs, competition, regulatory landscape, and healthcare policies.

Market Landscape Overview

Global Market Size and Growth Trends

The global fluoroquinolone market was valued at approximately USD 7.0 billion in 2022, with Moxifloxacin accounting for a substantial segment of this figure due to its broad-spectrum efficacy and favorable pharmacokinetics. The market is projected to grow at a compounded annual growth rate (CAGR) of around 4.5%-6% over the next five years, driven by increased prevalence of bacterial resistance, expanding therapeutic indications, and expanding healthcare infrastructure in emerging economies.

Key Regional Markets

- North America: Dominates due to high antibiotic consumption, advanced healthcare systems, and regulatory approvals. The U.S. accounts for over 40% of the regional market share.

- Europe: Significant for its stringent regulatory environment but also showing growth driven by antibiotic resistance concerns.

- Asia-Pacific: Expected to witness the highest growth rate (approx. 7%-8%), fueled by expanding healthcare infrastructure, rising incomes, and increased prevalence of respiratory infections.

- Latin America and Africa: Emerging markets with increasing demand, though constrained by regulatory hurdles and access issues.

Major Manufacturers and Market Players

Prominent companies include Bayer (original manufacturer of Moxifloxacin under the brand Avelox), Sandoz, Teva Pharmaceuticals, and Mylan. Patent expiry, generic proliferation, and biosimilar entry have intensified competition, influencing price dynamics and market penetration.

Regulatory and Patent Landscape

Patent Status

The original patent for Moxifloxacin expired around 2019-2021 in numerous jurisdictions, leading to generic manufacturing proliferation. This has heightened price competition, particularly in low and middle-income countries (LMICs). New formulations or combination therapies are under clinical development, potentially extending patent protections and influencing future market dynamics.

Regulatory Challenges

Regulatory agencies, notably the U.S. FDA and European Medicines Agency, impose strict approval requirements for new formulations, biosimilars, and combination therapies. Patent cliffs and regulatory hurdles significantly shape market entry timelines and pricing strategies for generics and biosimilars.

Price Dynamics and Projection Factors

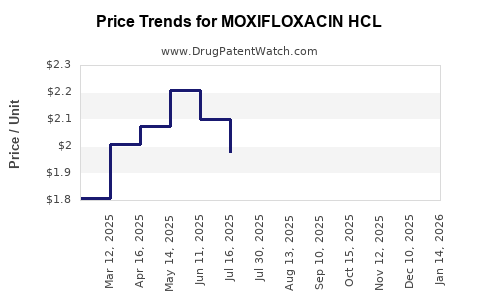

Current Pricing Context

- Branded Moxifloxacin: Estimated retail prices range from USD 10-30 per 10-tablet pack, depending on formulation, dosage, and geographic location.

- Generics: Prices have substantially decreased—some as low as USD 2-8 per pack—due to increased competition post-patent expiry.

- Insurance and Reimbursement: Dynamics vary greatly; in some regions, insurance coverage stabilizes prices, whereas in others, out-of-pocket expenditure dominates.

Factors Influencing Future Pricing

- Patent Expiry and Generics: As patents expire, a sharp decline in prices is expected, especially in markets with significant generic manufacturing.

- Manufacturing Costs: Supply chain efficiencies, economies of scale, and raw material costs influence manufacturing expenses, impacting retail prices.

- Regulatory Approvals: Delays or restrictions can restrict market entry of cheaper generics, maintaining higher prices temporarily.

- Market Penetration Strategies: Brand loyalty, marketing, and government procurement policies impact sales volume and pricing strategies.

- Emerging Competing Therapies: The development of novel antibiotics or combination therapies could reduce Moxifloxacin's market share and exert downward pressure on pricing.

Price Projections (2023-2028)

| Year |

Expected Brand Price (USD) per 10-tablet pack |

Expected Generic Price (USD) per 10-tablet pack |

Factors Influencing Price |

| 2023 |

USD 10-15 |

USD 2-8 |

Patent expiry imprint, market competition |

| 2024 |

USD 9-14 |

USD 1.5-6 |

Increased generic availability, economies of scale |

| 2025 |

USD 8-13 |

USD 1-5 |

Regulatory approvals, supply chain stabilization |

| 2026 |

USD 7-11 |

USD 1-4 |

Market saturation, new competitors |

| 2027 |

USD 7-10 |

USD 0.8-3 |

Price competition intensifies, biosimilars development |

| 2028 |

USD 6-9 |

USD 0.8-2.5 |

Market maturity, push for cost-effective therapies |

Note: Prices may vary based on region, healthcare policies, and market conditions.

Market Drivers and Challenges

Drivers

- Rising Antibiotic Resistance: Heightened demand for potent antibiotics like Moxifloxacin to combat resistant infections.

- Expanding Indications: New formulations, combination therapies, and expanded therapeutic use cases.

- Growing Healthcare Infrastructure: Particularly in emerging markets increasing access and affordability.

- Cost-Effective Generics: Entry of multiple generics lowering prices and increasing accessibility.

Challenges

- Regulatory Scrutiny: Concerns over side effects, such as tendinopathy and QT prolongation, influence prescribing patterns and market confidence.

- Antibiotic Stewardship: Governments and health authorities urge cautious use to prevent resistance, potentially impacting sales volume.

- Competition from New Antibiotics: Innovations in antimicrobial therapies may limit Moxifloxacin's long-term market share.

- Pricing Regulations: Price caps and reimbursement policies in various regions can constrain profit margins.

Strategic Outlook

The overall market for Moxifloxacin HCl is poised for decline in branded prices due to patent expiry, while generics will dominate the market segment with significantly lower prices. Manufacturers focusing on cost-efficient production, quality compliance, and strategic regional marketing will succeed in capturing market share. Investment in novel formulations, combination therapies, and biosimilar development could offer competitive advantages but will be contingent on regulatory pathways and clinical efficacy.

Key Takeaways

- Price declines are imminent post-patent expiry, with generic versions expected to dominate the market due to significantly lower costs.

- Regional dynamics are critical, with emerging markets witnessing higher growth rates driven by increasing healthcare access and antibiotic demand.

- Regulatory and safety concerns influence pricing strategies, especially in developed markets where approval processes are rigorous.

- Market competition, antibacterial stewardship, and therapy innovation are likely to moderate overall pricing and market size over the next five years.

- Strategic players should focus on cost containment, regulatory navigation, and expanding indications to sustain profitability amidst changing dynamics.

FAQs

1. When did the patent for Moxifloxacin expire, and how has this affected its market prices?

The patent for Moxifloxacin expired around 2019-2021 in many jurisdictions, leading to a surge in generic versions, which has substantially reduced retail prices and increased market competition.

2. What are the primary factors driving price reductions for Moxifloxacin globally?

Patent expirations, increased generic manufacturing, economies of scale, and intense competition drive prices downward while regulatory policies and safety concerns influence the pace of these reductions.

3. Which regions are expected to see the fastest growth in Moxifloxacin demand?

The Asia-Pacific region is projected to experience the fastest growth, fueled by expanding healthcare infrastructure, rising bacterial infection rates, and economic development.

4. How might emerging antibiotic resistance influence the price and utilization of Moxifloxacin?

Rising resistance may lead to increased usage in certain settings, potentially maintaining higher prices temporarily, but also could prompt stricter regulatory controls and favor newer antibiotics, challenging Moxifloxacin’s market share.

5. Are there upcoming innovations that could alter Moxifloxacin’s market trajectory?

Yes, development of new antibiotics, combination therapies, and biosimilars could impact demand, while reformulations and enhanced safety profiles may bolster its competitiveness.

Sources:

[1] Grand View Research. "Fluoroquinolone Market Size, Share & Trends Analysis," 2022.

[2] IQVIA. "Global Antibiotics Market Report," 2022.

[3] U.S. FDA. "Moxifloxacin (Avelox) Prescribing Information," 2022.

[4] European Medicines Agency (EMA). "Antibiotics Regulation & Market Data," 2022.

[5] Statista. "Antibiotic Market Revenue Forecast," 2022.