Share This Page

Drug Price Trends for MOTION SICKNESS

✉ Email this page to a colleague

Average Pharmacy Cost for MOTION SICKNESS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MOTION SICKNESS 50 MG TABLET | 46122-0536-53 | 0.05458 | EACH | 2025-12-17 |

| MOTION SICKNESS 50 MG TABLET | 70000-0404-01 | 0.05458 | EACH | 2025-12-17 |

| MOTION SICKNESS RLF 25 MG TAB | 70000-0097-01 | 0.12663 | EACH | 2025-12-17 |

| MOTION SICKNESS RLF 25 MG TAB | 46122-0535-51 | 0.12663 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Motion Sickness Drugs

Introduction

Motion sickness remains a prevalent health concern, affecting an estimated 40% of travelers worldwide, according to the Mayo Clinic. The condition results from a dissonance between visual cues and the vestibular system's perception of movement, leading to symptoms such as nausea, dizziness, and vomiting. The global market for motion sickness therapeutics encompasses a range of pharmacological and non-pharmacological interventions, creating significant opportunities for pharmaceutical manufacturers, especially amid increasing global travel and expanding therapeutic indications. This analysis dissects current market dynamics, evaluates key factors influencing drug pricing, and projects future price trajectories.

Market Overview

Global Market Size and Growth Trends

The motion sickness treatment market was valued at approximately USD 850 million in 2022, with projections indicating a Compound Annual Growth Rate (CAGR) of 4.5% from 2023 to 2030, reaching an estimated USD 1.2 billion by 2030 (source: Grand View Research). Growth drivers include rising international travel, increased awareness of treatment options, and the development of innovative formulations.

Key Players and Therapeutics

The market predominantly comprises over-the-counter (OTC) medications such as Dimenhydrinate, Meclizine, and Cyclizine, alongside prescription drugs like Scopolamine patches. Notably, newer formulations and combination therapies, including transdermal and IV options, are entering the market, reflecting ongoing innovation. Major pharmaceutical companies with a focus on antiemetics and vestibular agents, such as Johnson & Johnson, Novartis, and Teva, maintain substantial market shares.

Segment Analysis

- OTC Drugs: Dominant due to widespread availability, cost-effectiveness, and familiarity. They account for over 70% of sales.

- Prescription Medications: Used for severe or chronic symptoms, representing a growing niche owing to advanced formulations and targeted indications.

- Non-pharmacological Interventions: Include acupressure wristbands and behavioral strategies; while not quantitatively dominant, their role enhances overall treatment modalities.

Market Drivers & Challenges

Drivers

- Increase in Travel & Tourism: Post-pandemic recovery has accelerated travel, expanding the consumer base.

- Aging Population: Older adults are more susceptible, increasing demand for effective management.

- Innovation & New Delivery Systems: Transdermal patches, inhalers, and nasal sprays improve user compliance and efficacy.

Challenges

- Regulatory Hurdles: Approval pathways for new formulations can delay market entry.

- Generic Competition: Low-cost generics exert pricing pressure.

- Limited Awareness of Novel Therapies: Consumers often prefer OTC options, impacting adoption of prescription-based drugs.

Price Analysis of Existing Drugs

Over-the-counter (OTC) Medications

-

Dimenhydrinate: Average retail price ranges from USD 8 to USD 15 for a 50-count pack (source: GoodRx). The low price point sustains high accessibility but constrains profit margins.

-

Meclizine: Typically priced between USD 10 to USD 20 for a similar pack size. Its popularity for chronic use increases volume sales.

-

Cyclizine: Less prevalent in some markets; priced approximately USD 12 to USD 18 per pack.

Prescription-Level Drugs

- Scopolamine Patch: Historically priced between USD 100 to USD 150 per patch/package (~3 days of use). The higher cost is justified by convenience and the drug’s efficacy in high-risk scenarios like long-haul flights and voyages.

Emerging Innovative Therapies

- Transdermal and Nasal Delivery Systems: Currently pending widespread commercialization. Pricing models suggest premiums of 20-40% over existing treatments due to perceived added value and convenience.

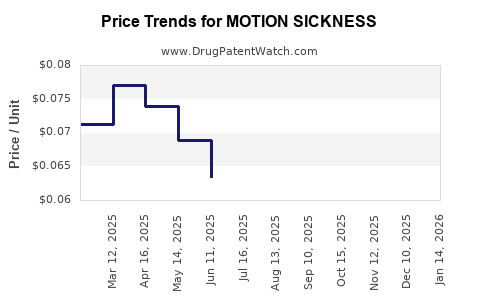

Price Trends

The general trend indicates modest price stability for generics, with slight variations driven by manufacturing costs, regulatory changes, and market competition. Innovative, branded formulations often command 2-3 times the price of generics, contingent on patent status and formulation advantages.

Future Price Projections (2023-2030)

Based on current market dynamics:

- OTC drugs are expected to remain price-stable with minor fluctuations (~2-3% CAGR) owing to high competition and generic prevalence.

- Prescription medications, especially novel delivery systems, are projected to see a compound annual increase of 5-7%, driven by technological innovations and therapeutic advancements.

- Premium formulations and combination therapies could command premium pricing, with expected increases of 10-15% annually, fueled by differentiation and patent protections.

The total market value forecasts reflect these trends, with predictable stabilization of prices for established OTC products and accelerated growth for new, innovative therapies.

Regulatory and Market Access Impact

Regulatory approval processes, especially in pivotal markets like the U.S. and Europe, influence pricing strategies. Drugs with blockbuster potential or those qualifying for orphan status may command higher prices initially, with subsequent generic entries gradually reducing costs. Market access considerations, including formulary inclusion and insurance reimbursement policies, also shape real-world prices.

Conclusion

The global motion sickness market exhibits steady growth fueled by travel trends, demographic shifts, and technological innovation. Price margins for established OTC drugs remain compressed, whereas prescription and premium formulations are positioned for incremental price increases. Stakeholders are advised to monitor regulatory pathways and technological developments, which will notably influence future pricing strategies.

Key Takeaways

- Market Growth: The global motion sickness drug market is set to grow at ~4.5% CAGR through 2030, driven chiefly by increased travel activity.

- Price Dynamics: Established OTC therapies remain low-cost, but innovative formulations such as transdermal patches may command higher premiums.

- Innovation Impact: Investment in novel delivery systems could lead to higher price points and market share for innovative therapies.

- Competitive Landscape: The prevalence of generics limits price inflation, but branded and proprietary formulations will sustain premium pricing.

- Regulatory Environment: Approval timelines and reimbursement policies critically influence drug pricing and market penetration.

FAQs

1. What factors influence the pricing of motion sickness drugs?

Drug prices are impacted by formulation complexity, brand status, market competition, regulatory approval costs, and reimbursement policies. Innovative delivery systems tend to command higher prices due to convenience and efficacy.

2. How will technological innovations affect future prices?

Advancements such as transdermal patches and nasal sprays are expected to be priced higher initially, reflecting manufacturing costs and added value, but may see price reductions as patents expire and generic versions enter the market.

3. Are OTC motion sickness drugs likely to see significant price increases?

Due to intense competition and high market saturation, OTC drug prices are expected to remain relatively stable with minimal increases.

4. What is the potential impact of emerging therapies on pricing?

Emerging therapies with superior efficacy or convenience could command premiums, influencing overall market pricing dynamics, especially if patent protection is secured.

5. How does regional regulation influence drug pricing?

Stringent regulatory requirements in regions like the U.S. and Europe can increase development costs, leading to higher initial prices. Conversely, less regulated markets may see lower prices but with differing quality standards.

Sources:

[1] Grand View Research, "Motion Sickness Drugs Market Size, Share & Trends Analysis" (2022).

[2] Mayo Clinic, "Motion Sickness," (2023).

[3] GoodRx, "Price Comparison for Motion Sickness Medications" (2023).

More… ↓