Share This Page

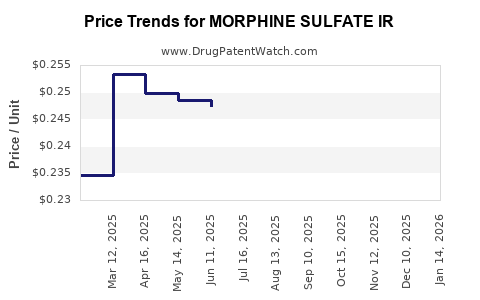

Drug Price Trends for MORPHINE SULFATE IR

✉ Email this page to a colleague

Average Pharmacy Cost for MORPHINE SULFATE IR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MORPHINE SULFATE IR 15 MG TAB | 00406-5118-01 | 0.29840 | EACH | 2025-12-17 |

| MORPHINE SULFATE IR 15 MG TAB | 00054-0235-25 | 0.29840 | EACH | 2025-12-17 |

| MORPHINE SULFATE IR 30 MG TAB | 67877-0671-01 | 0.44853 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Morphine Sulfate IR

Introduction

Morphine sulfate immediate-release (IR) remains a cornerstone in pain management, particularly for acute and postoperative pain. As a potent opioid analgesic, its prescription volume, regulatory landscape, and manufacturing dynamics significantly influence its market valuation and pricing trends. This analysis aims to delineate the current market environment for morphine sulfate IR, project future pricing trajectories, and provide strategic insights for stakeholders.

Market Overview

Demand Drivers

Morphine sulfate IR continues to serve as a gold standard for severe pain relief, especially in hospital settings. Its demand is driven by:

- Clinical Necessity: Chronic and acute pain management, particularly in postoperative, cancer, and palliative care.

- Regulatory Approvals: U.S. Food and Drug Administration (FDA) approval for multiple formulations sustains market confidence.

- Healthcare Infrastructure: Ongoing healthcare consolidation enhances procurement volumes.

Supply Dynamics

Major pharmaceutical companies, including Sun Pharmaceutical, Pfizer, and Purdue Pharma, dominate manufacturing. The global supply chain faces pressure from:

- Regulatory Scrutiny: Tightening opioid regulations influence manufacturing and distribution.

- Manufacturing Costs: Variances in raw material availability and compliance impact pricing.

- Market Entry Barriers: High regulatory standards curtail new entrants, consolidating market power among existing players.

Regulatory and Ethical Considerations

The ongoing opioid epidemic has prompted increased regulation:

- Prescription Restrictions: Stringent guidelines and oversight reduce overprescription.

- Reimbursement Policies: Payer policies influence formulary placements, affecting market access.

- Legal Risks: Liability concerns drive manufacturers to emphasize responsible marketing and distribution.

Current Market Size and Segment Analysis

Global Market Valuation

As of 2022, the global market for opioid analgesics, including morphine sulfate IR, was estimated at approximately USD 4 billion, with projections reaching USD 5.2 billion by 2027, CAGR of about 5.3% (Source: Markets and Markets). Morphine sulfate IR retains a dominant share due to its clinical efficacy and longstanding presence.

Segment Breakdown

- End-User Segments: Hospitals (70%), clinics (15%), and long-term care facilities (15%).

- Regional Distribution: North America leads with over 60% of consumption, driven by high healthcare spending, followed by Europe and Asia-Pacific where increasing surgical procedures expand demand.

Pricing Landscape

- Variations exist across regions due to regulatory factors, but wholesale acquisition costs (WAC) for a standard 10mg IR morphine tablet typically hover around USD 0.20–0.50 per tablet in the U.S.

- Cost pressures stem from raw material prices, such as opium-based alkaloids, which have experienced volatility due to geopolitical factors.

Competitive Landscape

Major Players

- Sun Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Hospira (a Pfizer subsidiary)

- Amneal Pharmaceuticals

- Lannett Company

Market Strategies

- Product Differentiation: Focus on formulation enhancements and bioavailability.

- Pricing Strategies: Competitive pricing in response to generic competition.

- Regulatory Navigation: Ensuring compliance to prevent market disruptions.

- Distribution Networks: Strengthening logistics to maintain supply stability.

Future Price Projections

Factors Influencing Future Pricing

- Raw Material Cost Fluctuations: Opium alkaloid supplies are sensitive to geopolitical tensions, impacting input costs.

- Regulatory Changes: Potential restrictions could reduce supply availability, elevating prices.

- Generic Competition: Expiration of patents spurs generic entry, exerting downward pressure.

- Market Demand Shifts: Increasing emphasis on multimodal pain management may moderate demand growth.

- Healthcare Policy Evolutions: Policies aimed at curbing opioid misuse may tighten dispensing limits.

Projected Price Trends (2023–2030)

- Short-term (2023–2025): Expect stabilization or minor reductions due to generic proliferation, with prices ranging from USD 0.20 to 0.35 per tablet.

- Mid-term (2026–2028): Prices may experience mild increments, averaging USD 0.25–0.40 per tablet, influenced by supply chain constraints and regulatory reforms.

- Long-term (2029–2030): Prices could plateau or see slight elevation (USD 0.30–0.50), especially if stricter regulations limit supply or if raw material costs surge.

Note: These projections are contingent upon regulatory environments and market dynamics, with actual prices subject to regional variability.

Strategic Implications for Stakeholders

- Pharmaceutical Manufacturers: Focus on operational efficiencies and diversification to mitigate raw material risks.

- Distributors and Suppliers: Establish resilient logistics to manage regulatory delays and demand fluctuations.

- Healthcare Providers: Optimize prescribing practices to balance effective pain relief with responsible opioid stewardship.

- Policy Makers: Implement balanced regulations that curb misuse while ensuring access for legitimate clinical use.

Key Takeaways

- The global market for morphine sulfate IR is sizable, with steady growth driven by ongoing clinical needs, especially in hospital settings.

- Price stability in the short term is anticipated, with slight downward pressure from generic competition, balanced by supply chain and regulatory risks.

- Raw material cost volatility and regulatory reforms are the primary drivers influencing future pricing.

- Stakeholders must adapt to evolving legal and market landscapes, emphasizing responsible use and supply chain resilience.

- Strategic diversification and compliance efforts will be key to maintaining competitiveness and profitability.

FAQs

1. What factors most significantly impact the pricing of morphine sulfate IR?

Raw material costs, regulatory restrictions, generic competition, and supply chain stability are primary influences on pricing.

2. How is the market for morphine sulfate IR expected to evolve over the next decade?

Market growth will likely slow due to increased regulation and the shift toward multimodal pain management, with prices tending toward stabilization but with potential upward pressures from supply constraints.

3. Are there emerging alternatives to morphine sulfate IR that could impact its market?

Yes, non-opioid analgesics and novel pain therapies, including nerve blocks and non-addictive medications, could reduce dependence on traditional opioids.

4. How do regional regulations affect morphine sulfate IR pricing?

Regions with stricter opioid controls tend to have limited supply and higher procurement costs, influencing retail prices locally.

5. What strategic considerations should manufacturers focus on amid these market trends?

Manufacturers should prioritize compliance, diversify supply sources, innovate formulations, and engage in responsible marketing to sustain market presence.

References

[1] Markets and Markets. Opioid Analgesics Market Report 2022-2027.

[2] IQVIA. Global Pain Management Market Data 2022.

[3] FDA. Regulatory Guidelines for Opioid Analgesics.

[4] Deloitte. Pharmaceutical Supply Chain Trends 2023.

[5] IMS Health. Pain Management Therapeutics Market Dynamics.

More… ↓