Share This Page

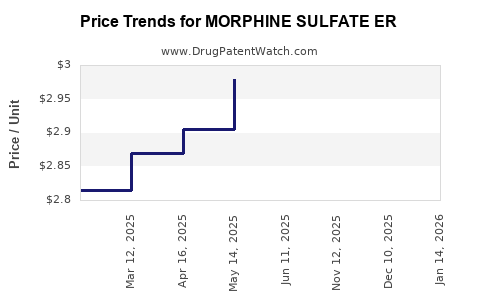

Drug Price Trends for MORPHINE SULFATE ER

✉ Email this page to a colleague

Average Pharmacy Cost for MORPHINE SULFATE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MORPHINE SULFATE ER 20 MG CAP | 00832-0226-00 | 3.28978 | EACH | 2025-12-17 |

| MORPHINE SULFATE ER 20 MG CAP | 00832-0226-00 | 3.24288 | EACH | 2025-11-19 |

| MORPHINE SULFATE ER 20 MG CAP | 00832-0226-00 | 2.94195 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Morphine Sulfate ER

Introduction

Morphine sulfate extended-release (ER) remains a cornerstone in opioid analgesics, primarily addressing severe chronic pain management. As the global opioid market evolves—affected by regulatory shifts, public health concerns, and innovations—understanding pricing trajectories and market dynamics for Morphine Sulfate ER becomes crucial for pharmaceutical companies, healthcare providers, and investors. This analysis explores current market conditions, competitive landscape, regulatory impacts, and future price projections for Morphine Sulfate ER.

Market Overview

Global Market Size and Trends

The global opioid analgesics market, valued at approximately USD 20 billion in 2022, projects a Compound Annual Growth Rate (CAGR) of roughly 3.5% through 2030, driven by rising chronic pain prevalence, aging populations, and expanding healthcare infrastructure in emerging markets [1].

Morphine Sulfate ER specifically accounts for a significant share within this segment, serving as a standard of care for moderate to severe pain in conditions such as cancer, post-surgical pain, and palliative care. Its formulation offers sustained analgesia, reducing dosing frequency and improving patient compliance.

Key Market Players

Leading manufacturers include:

- Pfizer (e.g., MS Contin)

- Oncology and pain management specialty firms

- Emerging generic manufacturers, due to patent expirations

Generic market share has increased substantially, fostering price competition and impacting brand-name pricing strategies.

Regulatory Environment

Regulatory agencies, notably the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), have heightened scrutiny following the opioid crisis. Policies focusing on prescription monitoring, risk mitigation, and scheduling have influenced both supply dynamics and prescribing behaviors [2].

Additionally, patent expirations for key formulations have opened avenues for generic competition, exerting downward pressure on average selling prices (ASPs).

Market Drivers and Challenges

Driving Factors

- Chronic Pain Management Need: The aging global population sustains demand.

- Cost-Effective Alternatives: Generics offer affordability, leading to increased utilization.

- Reimbursement Policies: Favor cost-effective medications, incentivizing generic uptake.

Barriers

- Regulatory Constraints: Stringent controls on opioid distribution.

- Public Health Initiatives: Campaigns to curb opioid misuse leading to prescription restrictions.

- Supply Chain Disruptions: Recent sanctions and manufacturing issues can impact availability and pricing.

Current Price Landscape

Brand-Name vs. Generic Pricing

In the United States, the MSRP (Manufacturer’s Suggested Retail Price) for brand-name Morphine Sulfate ER products like MS Contin ranges from USD 100 to USD 200 per 100 mg tablet (monthly supply). Conversely, generics are priced significantly lower—USD 20 to USD 50 per 100 mg unit—reflecting intense competition.

Price Fluctuations

Recent years have seen stabilization in brand-name prices due to supply constraints and regulatory tightening. Conversely, generic prices fluctuate based on manufacturing capacity, raw material costs, and market entry of new competitors.

Reimbursement Trends

Insurance coverage and Medicaid/Medicare programs predominantly favor generics, further pressuring prices of branded formulations.

Future Price Projections (2023-2030)

Short-Term Outlook (2023-2025)

- Prices are expected to remain relatively stable or decline slightly due to increasing generic competition.

- Regulatory pressures may limit dosage strengths available on the market, affecting pricing structures.

- Mitigation strategies by brand manufacturers might include value-added services or improved formulations to justify premium pricing.

Mid to Long-Term Outlook (2026-2030)

- Moderate price erosion anticipated, with generic prices stabilizing at 60-70% of brand-name costs.

- Emerging markets could see substantial growth, potentially elevating average global prices due to higher demand and lower regulatory barriers.

- Potential for biosimilar-like products or abuse-deterrent formulations may influence future pricing, possibly sustaining higher prices for specialized formulations.

Influence of Policy and Innovation

- Opioid stewardship policies could result in lower prescribed doses, diminishing total market size but maintaining unit prices.

- Development of abuse-deterrent formulations (ADFs) may command premium pricing, offsetting revenue declines from generics.

Assessment Summary

| Aspect | Projection |

|---|---|

| Brand-name prices | Slight decline (~5-10% annually) in North America; steady or slight increase in emerging markets |

| Generic prices | Continued decline, stabilizing at approximately 60-70% of brand names by 2030 |

| Market volume | Moderate growth, constrained by regulatory efforts and alternative therapies |

Regional Variations in Pricing

- United States: Highest prices driven by regulatory and legal environments, with pricing heavily influenced by Medicare and Medicaid reimbursement policies.

- European Union: Slightly lower prices due to robust generic markets and price regulation.

- Emerging markets: Prices are generally lower but expected to rise due to increased demand and improving healthcare access.

Competitive Landscape and Implications

The increasing prominence of generics coupled with a critical regulatory environment positions Morphine Sulfate ER as a high-volume, low-margin product. Manufacturers need to innovate through improved formulations, such as abuse-deterrent technology, to sustain margins.

Market entry barriers include manufacturing complexities and significant regulatory hurdles, especially in jurisdictions with strict control measures. Strategic partnerships, licensing, and differentiation will be key to maintaining profitability.

Conclusion

Morphine Sulfate ER’s market will experience moderate price erosion over the next decade, primarily driven by generic penetration and regulatory pressures. While volume growth in emerging markets offers revenue opportunities, cost containment and innovation will be essential for sustaining margins in mature markets.

Key Takeaways

- The global Morphine Sulfate ER market is characterized by a shift toward generics and regulatory tightening, leading to stabilizing or declining prices.

- Brand-name products may retain premium pricing margins through abuse-deterrent formulations and value-added features.

- Price decline is expected to plateau around 30-40% of current levels by 2030, especially in North America, where prices are highest.

- Market growth in emerging economies provides opportunities, albeit with lower initial price points.

- Companies should focus on innovation, strategic partnerships, and compliance to navigate a competitive, regulated landscape.

FAQs

Q1: How will regulatory changes impact Morphine Sulfate ER pricing?

A1: Stricter regulations on opioid prescribing and distribution are likely to reduce market volume and suppress prices, especially in mature markets like the U.S. and Europe. Conversely, regulatory hurdles may slow generic entry, supporting higher prices temporarily.

Q2: What role do generic manufacturers play in future price trends?

A2: The proliferation of generics drives significant price erosion, favoring lower but more accessible prices. Manufacturers that innovate with abuse-deterrent formulations can maintain higher margins.

Q3: Are there notable regional differences in Morphine Sulfate ER pricing?

A3: Yes. Prices are highest in North America due to regulatory practices and reimbursement systems. Emerging markets offer lower prices but are expected to grow with increased healthcare access.

Q4: How might technological advancements influence pricing?

A4: Innovations like abuse-deterrent and sustained-release formulations can command premium prices and market differentiation, offsetting generic competition.

Q5: What market strategies should companies adopt to remain competitive?

A5: Focus on regulatory compliance, develop innovative formulations, forge strategic partnerships, and expand into emerging markets, balancing cost control with value-added features.

Sources:

[1] MarketWatch. “Global Opioid Analgesics Market Size, Share & Trends Analysis Report.” 2022.

[2] FDA. “Opioids: What You Need to Know.” 2023.

More… ↓