Share This Page

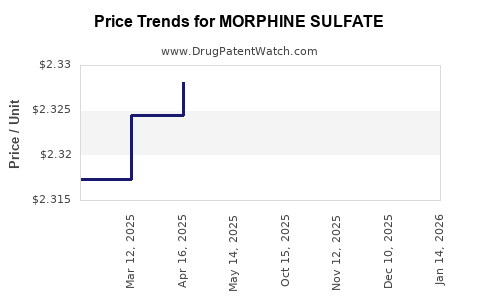

Drug Price Trends for MORPHINE SULFATE

✉ Email this page to a colleague

Average Pharmacy Cost for MORPHINE SULFATE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MORPHINE SULFATE 10 MG/ML VIAL | 00641-6127-25 | 2.29992 | ML | 2025-12-17 |

| MORPHINE SULFATE IR 15 MG TAB | 00054-0235-24 | 0.29840 | EACH | 2025-12-17 |

| MORPHINE SULFATE IR 15 MG TAB | 00406-5118-23 | 0.29840 | EACH | 2025-12-17 |

| MORPHINE SULFATE IR 15 MG TAB | 00406-5118-01 | 0.29840 | EACH | 2025-12-17 |

| MORPHINE SULFATE ER 20 MG CAP | 00832-0226-00 | 3.28978 | EACH | 2025-12-17 |

| MORPHINE SULFATE IR 15 MG TAB | 00054-0235-25 | 0.29840 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Morphine Sulfate

Introduction

Morphine sulfate remains a cornerstone in pain management, particularly in palliative care, anesthesia, and severe acute or chronic pain scenarios. As a potent opioid analgesic, its market dynamics are influenced by regulatory scrutiny, technological innovations, manufacturing costs, and global health policies. This report evaluates current market trends and projects future pricing pathways of morphine sulfate, offering insights essential for stakeholders across pharmaceutical, healthcare, and investment sectors.

Market Overview

Global Demand and Distribution

The global demand for morphine sulfate hinges on the prevalence of pain-associated conditions, healthcare infrastructure, and regulatory frameworks. The World Health Organization (WHO) estimates that over 60 million individuals suffer from moderate to severe pain requiring opioid analgesics annually [1]. The highest consumption occurs in North America, accounting for approximately 80% of global opioid consumption, largely driven by the United States, which uses opioids both for pain management and terminal care [2].

Developing markets in Asia-Pacific and Latin America are experiencing growing demand, attributed to rising cancer prevalence and expanding healthcare access, although regulatory restrictions and cultural attitudes temper consumption rates [3].

Regulatory Environment

Stringent control measures for opioids globally impact supply and distribution. The US Food and Drug Administration (FDA) and European Medicines Agency (EMA) enforce strict documentation and monitoring, constraining illicit diversion while ensuring medical availability. Conversely, some emerging markets face regulatory barriers that hinder access—despite growing need—limiting market growth potential.

Manufacturing and Supply Chain Factors

Manufacturing of morphine sulfate involves complex extraction from opium poppy derivatives, subject to geopolitical, agricultural, and patent-related influences. The cost of raw materials remains relatively stable; however, geopolitical tensions, such as sanctions on opium-producing countries, disrupt supply chains. Advanced synthetic routes are being explored but are not yet mainstream, influencing current market pricing.

Market Segmentation

By Formulation

- Injectable Morphine Sulfate: Predominant in hospital settings for acute pain or anesthesia.

- Oral Solutions/Tablets: Used for chronic pain, with formulations often generic.

- Other Forms: Suppositories, patches, although less common.

By End-User

- Hospitals and clinics: Largest segment, driven by acute and perioperative needs.

- Palliative care centers: Growing segment respecting patient comfort.

- Home healthcare: Increasing demand, particularly in developed regions.

Competitive Landscape

Pharmaceutical giants like Pfizer, Teva, and Mylan dominate the generic morphine sulfate market. Their extensive manufacturing and distribution networks help stabilize prices but also intensify price competition. Innovations are minimal due to the drug's patent expiration and its status as a generic medication in most markets.

Current Pricing Dynamics

Market Pricing Trends

Prices for morphine sulfate vary geographically based on regulatory, supply chain, and healthcare system factors. In the US, the average cost of injectable morphine hydrochloride (a closely related compound) in hospitals hovers around $2 to $4 per milligram, with compounded formulations often exceeding this range [4]. Generic oral formulations range from $0.10 to $0.30 per dose, depending on the formulation and supplier.

Regulatory Impact on Pricing

In markets with tight regulation, costs may elevate owing to certification requirements, licensing, and compliance costs. Conversely, increased generic competition exerts downward pressure on prices in mature markets. Additionally, the push for abuse-deterrent formulations has marginally increased manufacturing costs, impacting retail prices.

Future Price Projections

Factors Influencing Future Pricing

- Regulatory Evolution: Stricter controls may increase compliance costs, elevating prices.

- Generic Market Saturation: High competition is forecasted to drive prices downward in mature markets.

- Raw Material Costs: Volatility in opium production influences manufacturing costs; however, synthetic alternatives may mitigate this impact.

- Supply Chain Stability: Geopolitical risks may increase costs due to supply disruptions.

- Innovations and Formulation Changes: Introduction of abuse-deterrent or extended-release formulations may command premium pricing if approved broadly.

Projected Trends (2023-2028)

-

North America: Prices are expected to decrease gradually by 2-4% annually due to intense generic competition, stabilizing the market. However, hospital procurement costs could remain higher due to regulatory and safety considerations.

-

Europe: Slight price stabilization is anticipated, influenced by regulated markets and existing generic saturation.

-

Emerging Markets: Prices are predicted to increase marginally owing to supply constraints and regulatory complexity, with potential for price liberalization as pain management needs grow.

-

Innovation Impact: The advent of synthetic opioids with reduced addiction potential could disrupt traditional pricing models, but widespread adoption remains years away.

Conclusion

Morphine sulfate's market is characterized by steady demand, especially in mature healthcare markets, with prices influenced by regulatory regimes, supply chain factors, and competitive pressures. While current prices in established markets are relatively stable or declining marginally due to generic proliferation, emerging markets may see gradual increases owing to supply constraints and expanding therapeutic indications.

In the near term, prices are unlikely to experience significant inflation absent major regulatory shifts or supply disruptions. Long-term projections hinge on technological innovations, evolving pain management standards, and geopolitical developments affecting opium production and distribution.

Key Takeaways

- Market Stability in Developed Regions: Mature markets exhibit declining or stable prices owing to generic competition and regulatory pressures.

- Growing Demand in Emerging Markets: Expanding healthcare infrastructure and rising disease burden increase demand, potentially raising prices.

- Regulatory Environment as a Price Modulator: Stringent controls both stabilize and elevate costs; regulatory decline could further influence market dynamics.

- Supply Chain Dynamics: Geopolitical tensions and raw material costs remain risks, affecting supply consistency and prices.

- Innovation and Reformulation: New formulations and synthetic alternatives could alter the pricing landscape in the coming decade.

FAQs

-

What factors primarily influence the pricing of morphine sulfate?

Regulatory regulations, manufacturing costs, supply chain stability, generic market competition, and formulation innovations predominantly shape pricing. -

How does the opioid regulatory environment affect market prices?

Strict controls can increase compliance costs and limit supply, raising prices; however, high competition among generics tends to decrease retail costs. -

What is the outlook for morphine sulfate prices in emerging markets?

Prices are expected to rise gradually due to supply constraints and expanding demand, although regulatory hurdles may moderate growth. -

Are there upcoming innovations that could impact morphine sulfate prices?

Synthetic opioids with reduced abuse potential are under development, which could lead to new formulations and possibly influence traditional market prices. -

How might geopolitical issues impact the supply and pricing of morphine sulfate?

Disruptions in opium-producing regions and sanctions can reduce supply, exerting upward pressure on prices, especially in markets relying on imported raw materials.

Sources

[1] WHO. "Cancer Pain Relief and Opioid Consumption." World Health Organization, 2021.

[2] International Narcotics Control Board. "Report on World Opioid Consumption," 2022.

[3] IMS Health. "Global Opioid Market Report," 2022.

[4] Marketplace Payer Reports. "Hospital Injectable Morphine Pricing Data," 2022.

More… ↓