Last updated: July 30, 2025

Introduction

MIRAPEX ER (pramipexole extended-release) is a dopamine agonist primarily indicated for the treatment of Parkinson’s disease and restless legs syndrome (RLS). Developed by Boehringer Ingelheim, MIRAPEX ER offers an extended dosing interval compared to the immediate-release formulation, providing improved patient compliance and symptom management. This analysis explores the drug's current market landscape, competitive positioning, regulatory environment, and future price trajectory.

Market Landscape

Global and U.S. Market Dynamics

The Parkinson's disease treatment market was valued at approximately USD 7.5 billion in 2022 and is projected to reach USD 10.5 billion by 2027, growing at a compound annual growth rate (CAGR) of around 6–7% (IQVIA, 2022). The rising prevalence of Parkinson’s, driven by aging populations—particularly in North America, Europe, and parts of Asia—marks strong demand growth.

The U.S. dominates the market share, with Parkinson’s affecting over 1 million Americans, while RLS affects an estimated 7-10% of the population (American Parkinson Disease Association, 2021). The increased diagnosis rates and a preference for long-acting formulations bolster demand for MIRAPEX ER.

Competitive Landscape

MIRAPEX ER faces competition from:

- Immediate-Release Pramipexole (e.g., Mirapex): Its primary alternative, with established prescribing habits but requiring multiple daily doses.

- Other Dopamine Agonists: Ropinirole (Requip), rotigotine (Neupro), and apomorphine.

- Novel Therapeutics: Monoamine oxidase B inhibitors (rasagiline, safinamide) and COMT inhibitors for symptomatic management.

- Non-Dopaminergic Agents: NMDA receptor antagonists (amantadine) and emerging disease-modifying therapies.

While MIRAPEX ER's patent exclusivity expired in 2020, patent litigations and formulations' exclusivity influence pricing and market penetration strategies.

Regulatory and Market Access Factors

USP and Regulatory Approvals

MIRAPEX ER received FDA approval in 2015 (FDA, 2015), capitalizing on patient adherence benefits of extended-release formats. Regulatory pathways favored the drug's positioning as an improvement over immediate-release options, which justified premium pricing in initial years.

Insurance Coverage and Reimbursement

Reimbursement policies vary: in the U.S., Medicare and Medicaid cover dopamine agonists, though formulary positioning and formulary limits influence patient access and pricing strategies. Favorable coverage enhances market penetration, especially in the elderly Parkinson’s demographic.

Generic Competition and Price Erosion

Post-patent expiration, generic versions of pramipexole emerged in 2020, exerting downward pressure on prices. However, MIRAPEX ER's unique extended-release profile retains some premium positioning for specific patient segments.

Price Trajectory and Forecast

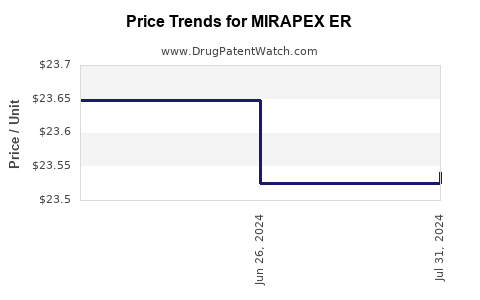

Historical Pricing Trends

- Brand Price (Pre-Expiration): At launch, MIRAPEX ER's average wholesale price (AWP) was approximately USD 800–USD 900 per month (DRG, 2015).

- Post-Patent Expiry: Generic pramipexole's entry in 2020 caused wholesale prices to decline by roughly 30–40%. Currently, generics retail for around USD 400–USD 500 per month.

Future Price Projections (2023-2030)

Factors influencing future pricing include:

- Market Penetration of Generics: Increasing generic adoption will continue to erode brand prices, especially outside the U.S.

- Formulation Differentiation: MIRAPEX ER's sustained-release formulation allows for niche premium pricing among patients requiring less frequent dosing, potentially maintaining prices near USD 600–USD 700 per month for certain patient segments.

- Regional Variability: In Europe and Asia, prices are dictated by national pricing policies; in some regions, price controls can limit increases despite demand.

- Innovative Therapeutic Alternatives: Advances in disease-modifying treatments could shift demand away from dopamine agonists, impacting pricing.

By 2025, wholesale prices of MIRAPEX ER are predicted to stabilize around USD 600–USD 700 per month for branded formulations, with generics dominant and priced around USD 400–USD 500. By 2030, the proliferation of biosimilars and potential custom formulations may further commoditize the drug, exerting continued downward pressure.

Market Opportunities and Challenges

Opportunities

- Growing Parkinson’s Population: Aging demographics will sustain demand.

- Extended-Release Benefits: Clinical benefits of reduced dosing frequency can justify premium or niche pricing.

- Combination Therapy Potential: Integration into multi-drug regimens presents upselling opportunities.

Challenges

- Generic Competition: Market share migration to generics directly affects pricing power.

- New Therapeutic Agents: Emerging treatments that potentially alter disease progression or symptom profile could diminish dopamine agonist usage.

- Regulatory and Reimbursement Constraints: Health policies in major markets might limit drug pricing flexibility.

Conclusion

MIRAPEX ER remains a relevant therapeutic amidst a competitive and evolving landscape. While patent expiration and generics have diminished its price from peak levels, its differentiated extended-release formulation sustains a niche market segment. Future pricing will largely depend on regional regulatory environments, demographic trends, and the pace of therapeutic innovation.

Strategic Focus: Companies should monitor regional reimbursement policies and optimize formulations or delivery mechanisms to maintain value. For stakeholders, understanding the competitive shift towards generics and emerging therapies is vital for investment and market development decisions.

Key Takeaways

- The global Parkinson’s disease treatment market projects consistent growth driven by aging populations.

- MIRAPEX ER’s premium positioning hinges on clinical adherence benefits; however, generic competition substantially pressures prices.

- Wholesale prices are expected to stabilize around USD 600–USD 700 per month by 2025 for branded formulations.

- Regional variability and regulatory policies significantly influence future pricing trajectories.

- Innovation, combination therapies, and emerging treatments will shape the long-term market dynamics of MIRAPEX ER.

FAQs

1. How does MIRAPEX ER compare to immediate-release formulations in clinical efficacy?

MIRAPEX ER offers comparable efficacy with the benefit of once-daily dosing, which improves adherence, particularly in long-term management of Parkinson’s and RLS.

2. What has been the impact of generic pramipexole on MIRAPEX ER pricing?

The entry of generics in 2020 led to a significant reduction in wholesale prices of both formulations, with the ER version retaining some premium due to its extended-release profile.

3. Are there regional differences in MIRAPEX ER pricing?

Yes, pricing varies globally, influenced by local reimbursement policies, regulatory frameworks, and market competition.

4. What are the prospects for MIRAPEX ER's market share in the next decade?

While facing stiff generic opposition, MIRAPEX ER's niche utility and patient adherence advantages could sustain a modest market share, particularly in specific patient populations or regions.

5. Could emerging therapies displace dopamine agonists like MIRAPEX ER?

Potentially. Advances in disease-modifying treatments and novel agents could shift therapeutic paradigms, impacting demand and pricing for dopamine agonists.

References

[1] IQVIA. (2022). World Review and Forecast of the Parkinson’s Disease Market.

[2] American Parkinson Disease Association. (2021). Parkinson’s Disease Statistics.

[3] FDA. (2015). FDA approves extended-release formulation of Mirapex for Parkinson's.

[4] DRG. (2015). Average Wholesale Price Analysis.