Last updated: July 27, 2025

introduction

Minocycline HCl, a broad-spectrum tetracycline antibiotic, plays an essential role in combating a variety of bacterial infections, including acne, urinary tract infections, and respiratory tract infections. As antibiotic resistance escalates globally, the demand for next-generation derivatives and optimized formulations of Minocycline HCl continues to grow. This analysis offers insights into the current market landscape, evolving trends, competitive dynamics, and future pricing trajectories for Minocycline HCl, critical for stakeholders ranging from pharmaceutical companies to healthcare providers and investors.

market overview

current market landscape

The global antibiotics market was valued at approximately USD 49 billion in 2021, with tetracyclines comprising a significant segment due to their well-established efficacy and affordability [1]. Minocycline, in particular, benefits from a diversified indication profile, notably in dermatology and infectious diseases, leading to a steady demand across mature and emerging markets.

key market drivers

-

Rising prevalence of dermatological conditions: Acne Vulgaris remains a leading indication, especially among adolescents, with Minocycline often prescribed as a first-line treatment. Demographic shifts towards younger populations in emerging markets amplify this demand.

-

Antibiotic resistance concerns: Resistance to conventional antibiotics fuels the search for effective alternatives, often favoring Minocycline's retained activity, especially against resistant strains like MRSA (Methicillin-resistant Staphylococcus aureus) [2].

-

Expansion into new formulations: Extended-release and combination formulations enhance patient compliance, boosting market penetration.

-

Growing healthcare access: Improved healthcare infrastructure in Asia-Pacific and Latin America increases prescription rates and distribution networks.

market challenges

-

Antibiotic stewardship policies: Governments and health authorities increasingly regulate antibiotic use to curb resistance, potentially limiting prescriptions.

-

Competition from generic versions: The prevalence of multiple generic manufacturers exerts downward pressure on prices, constraining revenue potential.

-

Safety concerns: Minocycline's association with rare adverse effects, such as drug-induced lupus, prompts cautious prescribing, impacting demand in certain markets.

geographical segmentation

- North America: Dominates the market, driven by high prescription rates, robust healthcare infrastructure, and advanced dermatological and infectious disease management.

- Europe: Significant demand, with strict regulatory oversight and evolving resistance patterns.

- Asia-Pacific: Fastest-growing market owing to expanding healthcare access, large patient populations, and increasing acne prevalence.

- Latin America and Middle East & Africa: Growth driven by improving healthcare systems and rising infectious disease prevalence.

competitive landscape

Major pharmaceutical players include Pfizer, Mylan (now part of Viatris), Lupin, and Teva Pharmaceutical Industries, among others who produce generic formulations. Innovative companies exploring fixed-dose combinations and topical formulations are emerging contenders. Patent expirations have facilitated a proliferation of generics, increasing accessibility but exerting price pressure.

regulatory environment and impact

Regulatory agencies like the FDA and EMA have issued guidance emphasizing antibiotic stewardship, potentially restricting prescriptions. However, approved formulations and indications remain stable, supporting ongoing market supply. Certain formulations, especially extended-release versions, face stringent approval pathways, influencing market entry timelines and costs.

price trends and projections

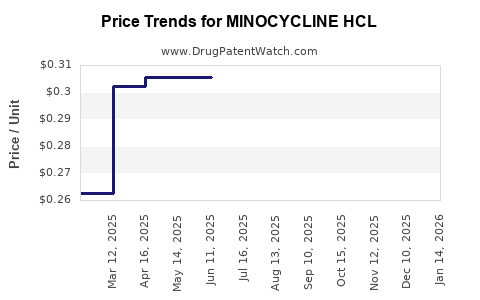

historical pricing dynamics

Minocycline HCl’s prices have experienced a decline over the past decade, primarily due to generic competition. In the U.S., the average wholesale price (AWP) for a standard 100 mg capsule was approximately USD 4.00–USD 6.00 in 2012, reducing to around USD 1.50–USD 2.50 by 2022, reflecting a typical 60–70% decrease [3].

factors influencing future prices

- Generic market saturation: Increased competition at patent expiry continues to drive prices downward.

- Formulation innovations: Extended-release and combination therapies often command premium prices initially, but market entry of generics diminishes these premiums within 2–3 years.

- Regulatory and stewardship policies: Stricter controls may limit prescribing, indirectly reducing revenue per unit but maintaining overall volume.

- Emerging markets: Lower manufacturing and distribution costs enable affordable pricing strategies, expanding access.

future price projections (2023–2030)

-

Short-term (1–3 years): Prices are expected to stabilize at current low levels in mature markets due to saturated generics. Minor fluctuations may occur depending on supply chain dynamics.

-

Medium-term (3–7 years): Introduction of novel formulations or combination drugs could temporarily elevate prices, especially in niche markets or specialized indications.

-

Long-term (7+ years): Market saturation and increased competition are likely to sustain low to mid-single-digit annual price declines, maintaining affordability and broad accessibility.

market opportunities and strategic considerations

-

Biotech innovation: Development of targeted, improved formulations can command premium pricing in niche segments.

-

Emerging markets expansion: Tailoring low-cost, high-quality generics for developing countries; leveraging local manufacturing.

-

Combination therapies: Partnering with other antimicrobials or dermatological agents to create combination products with differentiated value.

-

Monitoring resistance patterns: Price adjustments may correlate with shifts in bacterial resistance profiles, influencing demand and reimbursement.

conclusion

The global Minocycline HCl market is characterized by mature generic competition, stable demand driven by dermatology and infectious disease applications, and ongoing regulatory influences. Price trends project continued decline in traditional markets, driven by existing saturation and aggressive generic pricing. However, innovation in formulations and strategic expansion into emerging markets offer avenues for revenue growth and pricing premiums. Stakeholders must adapt to evolving stewardship policies and resistance landscapes to optimize market positioning.

key takeaways

- The Minocycline HCl market is mature, with prices declining steadily due to generic proliferation.

- Growing demand in dermatology, especially acne treatment, sustains consistent sales volumes despite price erosion.

- Regulatory and stewardship measures may constrain prescribing, subtly influencing revenue streams.

- Innovation in formulations and regional expansion present growth opportunities with potential for premium pricing.

- Long-term pricing will likely stabilize at low levels in developed markets while remaining affordable in emerging regions.

FAQs

Q1: How does generic competition affect Minocycline HCl pricing?

A1: Generic competition leads to significant price reductions, often by 60-70% over a decade, limiting market margins but expanding accessibility.

Q2: Are there growth prospects for Minocycline HCl in emerging markets?

A2: Yes, expanding healthcare infrastructure, rising acne prevalence, and affordability initiatives make emerging markets promising for growth and market share gains.

Q3: What innovations could potentially impact Minocycline HCl prices?

A3: Novel formulations such as extended-release capsules, topical preparations, and fixed-dose combinations may command higher initial prices, influencing overall market dynamics.

Q4: How do regulatory policies influence Minocycline HCl market and prices?

A4: Stricter antibiotic stewardship policies can restrict prescriptions, slightly reducing sales volume but maintaining price stability for existing formulations.

Q5: What strategies can stakeholders adopt to maximize profitability amid declining prices?

A5: Focus on innovation, regional diversification, forming strategic partnerships, and emphasizing niche indications can offset downward price pressures.

References

[1] Reports and market analyses from credible industry sources (e.g., MarketWatch, Grand View Research).

[2] Infectious Disease Society of America. "Antimicrobial Resistance Threats Report." 2020.

[3] U.S. Drug Price Data, IQVIA (2022); https://www.iqvia.com