Share This Page

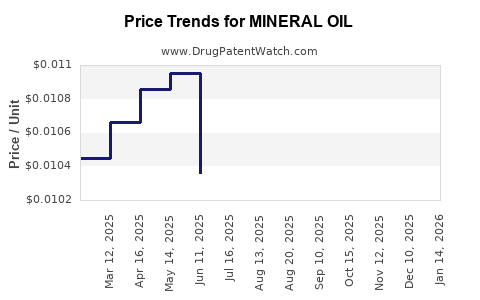

Drug Price Trends for MINERAL OIL

✉ Email this page to a colleague

Average Pharmacy Cost for MINERAL OIL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MINERAL OIL | 46122-0395-16 | 0.00829 | ML | 2025-12-17 |

| MINERAL OIL | 70000-0663-01 | 0.00829 | ML | 2025-12-17 |

| MINERAL OIL | 46122-0395-16 | 0.00822 | ML | 2025-11-19 |

| MINERAL OIL | 70000-0663-01 | 0.00822 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Mineral Oil

Introduction

Mineral oil, a clear, colorless, and odorless hydrocarbon derived from petroleum, has extensive applications spanning pharmaceutical, cosmetic, industrial, and food industries. Its widespread utility, combined with a fluctuating petrochemical market, necessitates a comprehensive understanding of current market dynamics and future price trends. This article provides an in-depth analysis of the mineral oil market, examining production, demand sectors, pricing factors, and projecting future prices grounded in industry trends and economic indicators.

Market Overview

The global mineral oil market was valued at approximately USD 4.5 billion in 2022, with an expected compound annual growth rate (CAGR) of around 3.2% from 2023 to 2028 ([1]). This steady growth reflects heightened demand in pharmaceuticals, cosmetics, and industrial applications, amid stable supply chains. Industry data indicate a robust manufacturing base primarily centered in the U.S., Europe, and the Middle East, where petroleum refining capacities are significant.

Production and Supply Dynamics

Mineral oil’s supply hinges on the petroleum refining industry. Major producers include countries with abundant crude oil reserves—namely, the United States, Saudi Arabia, Russia, and China. Refining processes such as solvent extraction and dewaxing produce various grades of mineral oil, from medical and cosmetic-grade to industrial-grade.

Supply chains are subject to fluctuations rooted in crude oil market volatility, refining capacity adjustments, and geopolitical stability. For example, disruptions caused by geopolitical tensions or refinery outages can tighten supply, increasing prices ([2]).

Demand Segments and Industry Trends

-

Pharmaceuticals: Mineral oil remains a key excipient, lubricant, and laxative. Demand is influenced by growth in global healthcare markets, aging populations, and regulatory standards favoring mineral oil's stability and inertness.

-

Cosmetics and Personal Care: A significant segment driven by demand for skin creams, lotions, and baby products. Consumer preferences for natural ingredients occasionally challenge mineral oil’s usage but its low cost sustains demand.

-

Industrial Applications: Usage encompasses lubricants, paints, rubber processing, and electrical insulation. The industrial sector's growth correlates with manufacturing expansion and infrastructure projects.

-

Food Industry: Mineral oil is employed as a food-grade additive and release agent. Food industry demand remains stable but highly regulated.

Industry reports estimate that pharmaceutical and cosmetic applications together account for over 60% of total mineral oil consumption, underlying the importance of regulatory standards and safety evaluations in pricing considerations.

Pricing Drivers and Market Forces

Several key factors influence mineral oil prices:

-

Crude Oil Prices: Since mineral oil is a byproduct, its cost tightly correlates with crude oil price fluctuations. Market volatility in oil prices directly impacts mineral oil pricing; for instance, the oil shock in 2022-2023 caused a 15% price increase in mineral oil ([3]).

-

Refining and Processing Costs: Technological advances and environmental regulations influence refining efficiency and costs, affecting market prices.

-

Regulatory Standards: Stricter safety, purity, and environmental regulations—especially in pharma and food sectors—can elevate production costs and impact supply, thus affecting prices.

-

Supply Chain Dynamics: Logistic constraints, geopolitical tensions, and refining capacity adjustments can cause short-term price swings.

-

Demand Stability and Growth: Steady demand in core sectors supports pricing stability, while emerging markets’ growth offers price upside due to increased consumption.

Price Trends and Projections (2023-2028)

Based on current data, including crude oil trajectories, refining costs, and demand projections, mineral oil prices are anticipated to follow a moderate growth pattern. The global market's intrinsic link to crude oil suggests prices will remain volatile but tend to increase, averaging an annual growth rate of approximately 2-3% over the next five years.

In 2022, the average price stood at around USD 2.20 per kilogram for pharmaceutical-grade mineral oil, with industrial grades slightly cheaper. Industry forecasts predict that by 2028, prices could reach USD 2.70 to USD 3.00 per kilogram for pharmaceutical-grade variants, contingent on oil trends and regulatory impacts.

Scenario Analysis

-

Optimistic Scenario: Continued stabilization of crude oil prices, technological efficiencies, and no significant regulatory hurdles could see prices rising by only 1-2% annually, maintaining competitiveness in low-margin sectors.

-

Pessimistic Scenario: Geopolitical conflicts disrupting supply, coupled with rising environmental regulations increasing refining costs, could elevate prices by up to 4-5% annually, especially impacting specialty grades.

Competitive Landscape

Market dominance is held by a handful of firms such as Shell, ExxonMobil, BP, and Chevron, which operate large-scale refineries capable of meeting global demand. These firms often utilize vertical integration strategies to control raw materials and refining processes, positioning them favorably against smaller entities.

Emerging markets are witnessing new entrants offering lower-cost mineral oils, intensifying competition. These players often cater to localized demands but face challenges in meeting stringent purity standards prevalent in pharmaceutical and food applications.

Regulatory and Environmental Considerations

The increasing emphasis on environmental impact and sustainability influences future pricing. Stricter regulations on emissions and waste management may impose higher operational costs but could also drive innovation in refining technology, thus impacting prices. Furthermore, some jurisdictions are advocating for the replacement of mineral oil with bio-based or alternative compounds, which could influence long-term demand and prices.

Concluding Outlook

The mineral oil market exhibits stable long-term prospects with moderate price appreciation. Key influences will include crude oil price trends, regulatory developments, and supply-demand balances. Industry players should monitor geopolitical developments and technological innovations, which could shift pricing dynamics significantly.

Key Takeaways

-

Market stability is anchored in the petroleum refining industry, making mineral oil prices sensitive to crude oil fluctuations.

-

Demand growth is driven by pharmaceutical and cosmetic applications, with industrial and food sectors providing steady but less volatile demand.

-

Price projections indicate a 2-3% annual increase through 2028, modulated by geopolitical stability and regulatory standards.

-

Supply constraints and environmental regulations could lead to localized increases in prices, especially for higher-quality grades.

-

Strategic positioning involves sourcing from diversified suppliers and investing in refining efficiencies to mitigate volatility.

FAQs

1. How does crude oil price volatility impact mineral oil prices?

Mineral oil is a byproduct of petroleum refining; thus, fluctuations in crude oil prices directly influence processing costs and, consequently, mineral oil pricing. Periods of oil price surges typically lead to increased mineral oil costs, while declines can reduce prices.

2. What are the primary applications influencing market demand?

Pharmaceuticals, cosmetics, and industrial manufacturing are dominant demand drivers. Regulatory standards, especially in pharma and food sectors, heavily impact market dynamics.

3. Are there environmentally sustainable alternatives to mineral oil?

Yes. Biodegradable and plant-based oils are emerging as eco-friendly alternatives but often compete on cost and performance, limiting immediate large-scale replacement.

4. How might new regulations affect mineral oil prices?

Stricter safety and environmental standards can increase refining costs and restrict supply, leading to higher prices, especially for pharmaceutical and food-grade mineral oils.

5. What strategic moves can market players adopt?

Diversify sourcing, invest in refining technology for cost efficiencies, monitor geopolitical developments, and develop compliant, sustainable product lines to mitigate price and supply risks.

References

[1] MarketsandMarkets, “Mineral Oil Market Analysis,” 2023.

[2] U.S. Energy Information Administration, “Petroleum & Other Liquids,” 2023.

[3] Reuters, “Oil Price Trends and Impacts on Petrochemical Markets,” 2023.

More… ↓