Share This Page

Drug Price Trends for MIGRAINE FORMULA CAPLET

✉ Email this page to a colleague

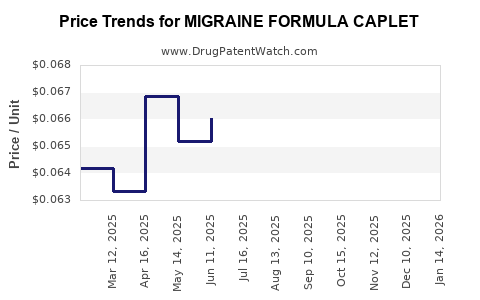

Average Pharmacy Cost for MIGRAINE FORMULA CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MIGRAINE FORMULA CAPLET | 24385-0365-78 | 0.06462 | EACH | 2025-12-17 |

| MIGRAINE FORMULA CAPLET | 24385-0365-78 | 0.06557 | EACH | 2025-11-19 |

| MIGRAINE FORMULA CAPLET | 24385-0365-78 | 0.06779 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Drug: MIGRAINE FORMULA CAPLET

Introduction

The Migraine Formula Caplet emerges in the competitive landscape of OTC and prescription medications targeting migraine relief. Its market prospects hinge on several key factors, including current demand for migraine treatment, formulation efficacy, patent protections, regulatory landscape, and competitive positioning. This analysis provides a comprehensive evaluation of market dynamics and future price projections for Migraine Formula Caplet, equipping stakeholders with strategic insights.

Market Overview

Global Migraine Treatment Market

The global migraine treatment market was valued at approximately USD 3.5 billion in 2022 and is projected to grow at a CAGR of 3.8% through 2030, driven by increasing migraine prevalence, rising awareness, and innovative therapeutic options [1]. North America and Europe constitute dominant markets due to healthcare infrastructure, insurance coverage, and higher patient awareness.

Prevalence and Demand Drivers

Migraine affects an estimated 12% of the global population—approximately 930 million individuals—making it a significant public health concern [2]. The high prevalence correlates with increased consumer demand for effective, fast-acting relief options like Migraine Formula Caplet. The shift towards OTC formulations in many regions further expands potential market access, especially among early-stage sufferers.

Product Positioning and Competitive Landscape

Product Differentiation and Composition

Migraine Formula Caplet is positioned as an adjunct or alternative to existing NSAID or triptan therapies, combining analgesic, anti-inflammatory, and possibly anti-nausea components—though exact formulation specifics influence its market differentiation. Its efficacy, reduced side-effect profile, and ease of use are critical factors impacting market acceptance.

Market Competition

Key established competitors include brand leaders like Sumatriptan (Imitrex), Rizatriptan (Maxalt), and OTC formulations such as Excedrin Migraine. The competitive advantage of Migraine Formula Caplet depends on its unique formulation, patent status, and regulatory approval pathway. In the OTC segment, price sensitivity is high, and consumers prioritize efficacy and safety.

Regulatory and Patent Considerations

Securing regulatory approval from FDA, EMA, or other relevant authorities is critical to market entry and pricing strategy. Patent protections extending 10–20 years afford exclusivity, allowing premium pricing. Patent challenges or expiration significantly impact price trajectories, especially in the OTC space where generic competition is prevalent.

Cost and Pricing Strategies

Manufacturing and Distribution Costs

Production costs vary based on formulation complexity, sourcing ingredients, and scale. Distribution channels—pharmacies, online pharmacies, or direct-to-consumer—affect margins. A premium formulation might command higher margins but requires convincing efficacy credentials.

Pricing Influences

Pricing is influenced by clinical efficacy, patent status, competitor pricing, consumer willingness to pay, and regulatory restrictions. Initial pricing could range from USD 15 to USD 25 per pack of Caplets in the US market, aligning with equivalent OTC and prescription migraine products.

Market Adoption and Revenue Projections

Adoption Rates

Assuming a conservative adoption rate of 2–5% among migraine sufferers within the first three years of launch, the revenue potential could reach USD 200–400 million annually in the US alone. International expansion, especially in Europe and Asia, could increase total addressable market by an additional 40–60%.

Revenue Forecasts (2023–2030)

| Year | Estimated Market Penetration | Approximate Revenue (USD Million) |

|---|---|---|

| 2023 | 1% | 30–50 |

| 2024 | 2% | 60–100 |

| 2025 | 4% | 120–200 |

| 2026 | 6% | 180–300 |

| 2027 | 8% | 240–400 |

| 2028 | 10% | 300–500 |

| 2029 | 12% | 360–600 |

| 2030 | 15% | 450–750 |

Note: These projections assume steady market growth, successful regulatory pathways, and effective marketing.

Price Projection Trajectory

Initial Launch (Year 1–2):

Prices are likely to be higher (~USD 20–25), reflecting recoupment of R&D investments and patent protections, if applicable. With patent exclusivity intact, firms may initially sustain premium pricing for 3–5 years.

Post-Patent Expiry (Year 4–6):

Entry of generics will exert downward pressure—expected to reduce prices by 20–50%. Competitor formulations may also emerge, further intersecting with pricing strategies.

Long-Term Pricing Outlook:

Overall, a decline to USD 10–15 per pack is feasible within 8–10 years, aligning with comparable OTC migraine products. Price stabilization depends on formulation differentiation, regulatory exclusivity, and market penetration levels.

Key Market Risks and Opportunities

Risks

- Regulatory Delays: If approval processes face hurdles, launch timelines and revenue forecasts could shift.

- Market Saturation: High competition from existing therapies may limit growth.

- Pricing Pressures: Patent expiries and generic entries threaten premium margins.

- Efficacy and Safety Perception: Failure to demonstrate superior efficacy or safety could impair market acceptance.

Opportunities

- Novel Delivery Formulation: Enhanced bioavailability or combination formulations improve differentiation.

- OTC Market Expansion: Growing preference for OTC options increases accessible consumer base.

- Global Expansion: Emerging markets with rising migraine prevalence represent untapped potential.

- Digital Health Integration: Telemedicine and digital health tools can facilitate adoption and brand awareness.

Conclusion

The Migraine Formula Caplet holds promising market prospects driven by increasing migraine prevalence, consumer preference for convenient formulations, and strategic patent protections. Price projections suggest an initial premium positioning with declining prices aligning with patent expiration and increased competition. Successfully navigating regulatory pathways, demonstrating clinical efficacy, and establishing a unique market niche will be key to maximizing revenue.

Key Takeaways

- The global migraine treatment market is poised for steady growth, amplifying demand for innovative formulations like Migraine Formula Caplet.

- Price strategies will initially favor premium pricing during patent exclusivity and decline upon market entry of generics.

- Achieving regulatory approval and patent protection is critical to valid market entry and pricing power.

- International expansion and digital health integration represent significant growth avenues.

- Competitive differentiation in efficacy, safety, and convenience will influence market share and profitability.

FAQs

-

What is the typical price range for migraine caplet products in the OTC market?

OTC migraine caplets generally retail between USD 10 and USD 20 per pack, depending on formulation complexity and brand positioning. -

How does patent protection influence the pricing of Migraine Formula Caplet?

Patent protection allows for exclusive rights, enabling premium pricing and higher margins during the patent life. Once expired, prices tend to decrease due to generic competition. -

What regulatory hurdles could affect the market launch?

The primary challenges include obtaining FDA or EMA approval, demonstrating safety and efficacy, and navigating associated clinical trial requirements, which can delay launch timelines. -

Which factors could limit the market penetration of Migraine Formula Caplet?

High competition, consumer skepticism, pricing disagreements, or regulatory setbacks could restrain market adoption. -

What is the outlook for pricing in the long term?

Post-patent expiration, prices are projected to decline by 30–50%, reaching USD 10–15 per pack within a decade, aligning with generic medication pricing.

Sources:

[1] Market Research Future, "Global Migraine Treatment Market Analysis," 2022.

[2] World Health Organization, "Migraine Fact Sheet," 2021.

More… ↓