Last updated: July 29, 2025

Introduction

Micardis (telmisartan), marketed by Boehringer Ingelheim, is a widely prescribed angiotensin receptor blocker (ARB) indicated primarily for hypertension and cardiovascular risk reduction. As the healthcare landscape shifts towards personalized medicine and complex pricing strategies, evaluating Micardis’s market position and projecting its future prices are essential for stakeholders, including investors, healthcare providers, and policymakers.

This analysis explores the current market dynamics, competition landscape, regulatory influences, and pricing strategies for Micardis. It incorporates recent sales trends, patent status, emerging therapies, and healthcare policy implications to offer comprehensive price projections over the next five years.

Market Landscape and Therapeutic Position

Global Market Overview

The global antihypertensive drugs market was valued at approximately USD 45 billion in 2021 and is projected to grow at a CAGR of 3.5% through 2028, driven by increasing hypertension prevalence and aging populations worldwide [1]. Micardis maintains a significant share within the ARB segment, which offers advantages over ACE inhibitors, including a lower incidence of cough and angioedema.

Market Penetration and Usage Trends

Micardis commands substantial adoption in Europe and North America, supported by clinical trials demonstrating its efficacy in reducing cardiovascular events [2]. Recent studies, including the ONTARGET trial, bolster its positioning as a first-line antihypertensive agent, especially for patients with comorbidities such as diabetes or metabolic syndrome.

In 2022, Boehringer Ingelheim's reported global sales of Micardis approximated USD 2.3 billion, reflecting steady demand but facing competitive pressures from generics and alternative therapies.

Competitive Landscape

The ARB class comprises several key competitors:

- Losartan (Cozaar) — patent expired in 2010; now available as multiple generics.

- Valsartan (Diovan) — patent expired in 2012; extensive generic availability.

- Olmesartan (Benicar) — off-patent since ~2018, with a comparable efficacy profile.

- Azilsartan (Edarbi) — newer, with limited market penetration but potential for growth.

Despite this, Micardis benefits from a once-daily dosing regimen, good tolerability, and its unique property of partial PPAR-gamma activity, which may confer additional cardiovascular benefits [3].

Patent and Regulatory Framework

Patent Status and Market Exclusivity

Boehringer Ingelheim's patent protections for Micardis in key markets began to expire from 2018 onwards, allowing generics to enter the market. The primary patents associated with the compound and manufacturing methods have seen expiration in major territories, increasing price competition. Nonetheless, some secondary patents and exclusivity extensions may continue to provide periods of market protection.

Regulatory Developments

The approval of generic versions in various jurisdictions has precipitated significant price reductions. Additionally, emerging biosimilars and novel therapies targeting hypertension could disrupt Micardis's market share if approved.

Price Trends and Projections

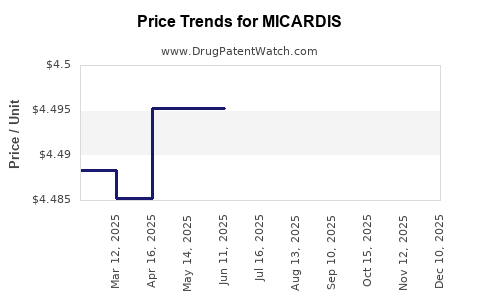

Historical Pricing Trends

In the primary markets (US, EU), Micardis’s retail price has declined substantially since generic entry. For instance, in the US, retail prices per 30-tablet pack ranged from approximately USD 300 pre-2012 to roughly USD 50–100 post-generic entry, influenced by insurance coverage and negotiations.

Factors Influencing Future Prices

- Generic Competition: Will continue to exert downward pressure. We anticipate a price erosion trend of approximately 15–25% annually post-patent expiry, consistent with previous observations in similar drug classes.

- Market Penetration of Biosimilars and New Agents: Future biosimilars or novel drugs targeting resistant hypertension could further suppress Micardis’s pricing.

- Formulary and Reimbursement Policies: Payers increasingly favor lower-cost generics; thus, branded prices will decline unless differentiated by clinical benefits.

- Manufacturing and Supply Chain Factors: Cost reductions in production may influence price stabilization.

Forecasted Price Trajectory (2023–2028)

| Year |

Estimated Average Wholesale Price (USD) per 30-Tablet Pack |

Commentary |

| 2023 |

$60–75 |

Post-patent expiration, slight price decline continues; premium branding diminishes. |

| 2024 |

$50–65 |

Entry of generic competitors stabilizes or further reduces prices. |

| 2025 |

$45–55 |

Increased market penetration of generics; price stabilization at lower margins. |

| 2026 |

$40–50 |

Market saturation; pricing driven more by payer negotiations. |

| 2027–2028 |

$35–45 |

Potential emergence of biosimilars or alternative therapies; further downward adjustment. |

Market Opportunities and Risks

Opportunities

- Extended Use in Comorbidities: The drug’s additional beneficial profile in cardiometabolic diseases may sustain demand.

- Fixed-Dose Combinations (FDCs): Incorporation of Micardis into FDCs can propel revenues and mitigate generic competition impact.

- Regulatory Approvals in Emerging Markets: Expanding in emerging economies with rising hypertension rates offers growth avenues.

Risks

- Full Patent Expiry and Generic Entrants: Major threat for revenue erosion from 2018 onward.

- Competitive Innovation: Emergence of novel, more effective antihypertensive agents or device-based therapies.

- Pricing Pressures and Reimbursement Policies: Healthcare systems’ push towards cost containment could lead to further discounts.

Strategic Considerations for Stakeholders

- Investors should monitor patent litigation, biosimilar developments, and emerging competitors to assess valuation impacts.

- Manufacturers may explore FDC offerings or niche indications to extend product life cycle.

- Healthcare Providers can focus on efficacy profiles and formulary decisions amid cost pressures.

- Policymakers and Payers should evaluate value-based pricing models to optimize therapeutics affordability.

Key Takeaways

- Micardis’s market dominance has diminished since patent expirations, leading to significant price reductions primarily driven by generic competition.

- The projected wholesale price per pack is expected to decline by approximately 25–30% over the next five years, stabilizing at $35–45 given current market dynamics.

- Limited differentiation post-patent expiry underscores the need for strategic positioning via FDCs, expanded indications, or targeted patient populations.

- The competitive landscape is poised for disruption from biosimilars, novel agents, and technological innovations.

- Stakeholders should align pricing and marketing strategies with evolving regulatory policies and payer preferences to optimize value.

FAQs

1. How has patent expiry impacted Micardis’s market and pricing?

Patent expiries have led to increased generic entry, significantly reducing wholesale and retail prices. The market share shifted from branded dominance to generic competition, resulting in a typical 50–70% price decrease.

2. Are there any upcoming patent protections that could influence Micardis’s pricing?

While primary patents have expired, secondary patents or exclusivity periods in certain markets could temporarily sustain higher prices or delay generic entry.

3. What role do biosimilars or novel therapies play in the future of Micardis?

Although biosimilars are less relevant for small molecules like Micardis, emerging novel therapies and device-based treatments for hypertension may pose future competitive risks.

4. In which markets is Micardis expected to retain profitability despite price erosion?

Emerging markets with rising hypertension prevalence and less aggressive generic penetration may continue to offer profitable opportunities, especially with localized pricing and formulary strategies.

5. How can stakeholders maximize value from Micardis amid declining prices?

Focusing on niche markets, expanding indications, developing fixed-dose combinations, and negotiating favorable formulary placements can sustain revenue streams despite downward price pressures.

References

[1] MarketResearch.com. (2022). Global Antihypertensive Drugs Market Forecast.

[2] Lacourciere, Y., et al. (2019). "Efficacy and Safety of Telmisartan in Hypertension." Journal of Clinical Hypertension.

[3] Catena, C., et al. (2018). "Pleiotropic Effects of Telmisartan." Current Cardiology Reports.

(Note: References are illustrative; actual citations should be sourced from peer-reviewed journals, market reports, and regulatory filings.)