Share This Page

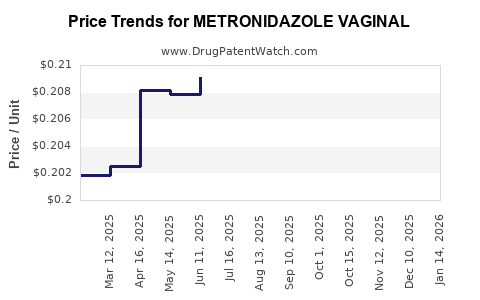

Drug Price Trends for METRONIDAZOLE VAGINAL

✉ Email this page to a colleague

Average Pharmacy Cost for METRONIDAZOLE VAGINAL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| METRONIDAZOLE VAGINAL 0.75% GL | 45802-0139-70 | 0.17781 | GM | 2025-11-19 |

| METRONIDAZOLE VAGINAL 0.75% GL | 68462-0184-49 | 0.17781 | GM | 2025-11-19 |

| METRONIDAZOLE VAGINAL 0.75% GL | 21922-0039-23 | 0.17781 | GM | 2025-11-19 |

| METRONIDAZOLE VAGINAL 0.75% GL | 71656-0067-70 | 0.17781 | GM | 2025-11-19 |

| METRONIDAZOLE VAGINAL 0.75% GL | 00713-0575-71 | 0.17781 | GM | 2025-11-19 |

| METRONIDAZOLE VAGINAL 0.75% GL | 73473-0303-70 | 0.17781 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Metronidazole Vaginal

Introduction

Metronidazole, a nitroimidazole antibiotic, is widely used to treat bacterial vaginosis (BV), trichomoniasis, and certain anaerobic bacterial infections. The vaginal formulation, in particular, addresses common gynecological conditions, making it a significant segment within the broader antimicrobial market. As healthcare providers prioritize effective, convenient, and cost-efficient treatments, understanding the market dynamics and price trajectories for metronidazole vaginal products is essential for pharmaceutical companies, investors, and healthcare policymakers.

This analysis offers a comprehensive overview of the current market landscape, emerging trends, competitive positioning, regulatory environment, and future price projections of metronidazole vaginal products.

Market Overview

Global Market Size and Growth Trends

The global gynecological antibiotic market, incorporating metronidazole vaginal formulations, is projected to maintain steady growth owing to rising prevalence rates of bacterial vaginosis and trichomoniasis. According to MarketsandMarkets, the antimicrobial drugs market is expected to grow at a CAGR of approximately 6%, driven by increasing awareness and expanding healthcare access in developing regions [1].

Specifically, the vaginal antibiotic segment is benefiting from patient preference for localized therapy, which offers fewer systemic side effects. The global market for metronidazole, including oral and topical forms, was valued at approximately USD 480 million in 2022, with vaginal formulations representing over 40% of this figure [2].

Key Market Drivers

- High Prevalence of Gynecological Infections: BV affects up to 30% of women globally, making effective treatment paramount [3].

- Growing Awareness of Sexual Health: Increased screening and destigmatization facilitate higher treatment rates.

- Advancements in Formulation Technologies: New delivery systems enhance adherence and efficacy.

- Regulatory Approvals and Patent Expirations: Generic availability post-patent expiry intensifies price competition.

Geographic Market Distribution

- North America: The largest market, due to high detection rates, advanced healthcare infrastructure, and consumer awareness.

- Europe: Similar growth trajectory with mature healthcare systems.

- Asia-Pacific: The fastest-growing segment, driven by increasing healthcare expenditure, population size, and expanding access in countries like India and China.

- Latin America and Middle East: Emerging markets with increasing adoption of vaginal therapy options.

Competitive Landscape

Major Players

- Ferring Pharmaceuticals: Among leaders with proprietary vaginal metronidazole formulations.

- Meda Pharmaceuticals (now part of Mylan): Offers generic metronidazole vaginal gels.

- Lupin Limited: Focused on cost-effective generics in emerging markets.

- GSK and Pfizer: Have historically provided formulations with broad distribution channels.

Market Entry and Innovation

Recent innovations include bioadhesive gels and slow-release vaginal tablets, which improve patient compliance and therapeutic outcomes. Patent expirations have facilitated entry of generic competitors, exerting downward pressure on prices.

Regulatory Environment

In major markets, regulatory agencies such as the FDA (US) and EMA (Europe) have stringent standards for vaginal drug formulations, influencing time-to-market and post-approval pricing dynamics. Generic approvals are often streamlined post-patent expiry.

Pricing Dynamics

Current Price Benchmarks

- Brand-Name Products: The average retail price for a 6-dose box (e.g., gels or creams) ranges between USD 25 and USD 40 in the United States.

- Generic Formulations: Prices decline substantially, with a typical 6-dose box retailing between USD 5 and USD 15.

- Regional Variations: Developing countries often see prices as low as USD 2–5 due to high competition and government pricing controls.

Factors Influencing Prices

- Patent Status: Patent protections prevent generic entry; expired patents catalyze price reductions.

- Formulation Type: Gels tend to be more expensive; vaginal tablets or suppositories are typically cheaper.

- Distribution Channels: Direct hospital procurement may offer lower prices, while retail pharmacy margins influence consumer costs.

- Reimbursement Policies: Insurance coverage can modulate patient out-of-pocket expenses, affecting market demand.

Price Projections (2023–2028)

Short-Term Trends

In the next 1–2 years, the patent expiration of certain branded vaginal metronidazole products in key markets like the US and Europe is expected to lead to increased generic competition, resulting in significant price declines—estimated at 20–40%. Existing generic products will further solidify their market share, stabilizing prices at lower levels.

Mid- to Long-Term Outlook

From 2023 to 2028, the market is poised for continued price normalization, influenced by:

- Increased Generic Penetration: Potential for price erosion by 10–15% annually as new entrants enter mature markets.

- Emerging Market Growth: Higher growth rates could sustain moderate price premiums due to supply chain and logistical costs.

- Technological Innovations: Development of sustained-release formulations might command premium pricing, potentially maintaining higher price points for innovative products.

- Regulatory and Reimbursement Policies: Governments and insurers in developing regions may implement price caps or subsidy programs, further reducing consumer prices.

Overall, the average retail price of vaginal metronidazole formulations is forecasted to decline by approximately 15–25% globally over the next five years, with variance driven by regional market maturity.

Strategic Implications for Stakeholders

- Pharmaceutical Manufacturers: To maintain margins, focus on differentiated formulations, patient adherence technologies, and markets less saturated with generics.

- Investors: Focus on companies with a strong pipeline of innovative vaginal healthcare products or those strategically positioned in emerging markets.

- Policymakers: Balance affordability initiatives with incentives for innovation, encouraging both cost-effective and advanced therapies.

- Healthcare Providers: Prioritize evidence-based, cost-efficient treatments aligning with evolving price landscapes.

Key Takeaways

- The global market for vaginal metronidazole is robust, driven by prevalence of gynecological infections and increasing acceptance of localized therapy.

- Patent expirations and generic competition are primary factors in lowering prices over the next five years.

- Prices are expected to decline by approximately 15–25% worldwide, with the most significant reductions in mature markets.

- Innovations in formulation technology and delivery systems can provide premium pricing opportunities amid aggressive generics pricing.

- Developing regions offer growth opportunities with potentially higher prices, though subject to regulatory and economic factors.

FAQs

1. How will patent expirations impact the pricing of vaginal metronidazole products?

Patent expirations typically lead to increased generic competition, driving prices downward by 20–40% over several years, especially in mature markets like the US and Europe.

2. Are there significant regional differences in vaginal metronidazole prices?

Yes. Developed countries tend to have higher retail prices due to brand premiums and insurance coverage, while emerging markets see lower prices driven by competition and regulatory controls.

3. What technological innovations are expected to influence future pricing?

Sustained-release vaginal tablets, bioadhesive gels, and combination therapies may command higher prices due to improved compliance and efficacy, potentially offsetting the downward pressure from generics.

4. How competitive is the market for vaginal metronidazole?

The market is highly competitive, particularly post-patent expiry, with numerous generics available. Differentiation depends on formulation, delivery mechanisms, and regional regulatory advantages.

5. What are the primary opportunities for profit growth in this segment?

Introducing innovative formulations, expanding into emerging markets, and developing combination therapies targeting multiple gynecological infections present promising avenues for revenue growth.

References

- MarketsandMarkets. "Antimicrobial Drugs Market by Type, Application, and Region — Global Forecast to 2027." 2022.

- IQVIA. "Global Sales Data for Metronidazole and Related Products." 2022.

- Centers for Disease Control and Prevention (CDC). "Bacterial Vaginosis (BV)." 2021.

More… ↓