Share This Page

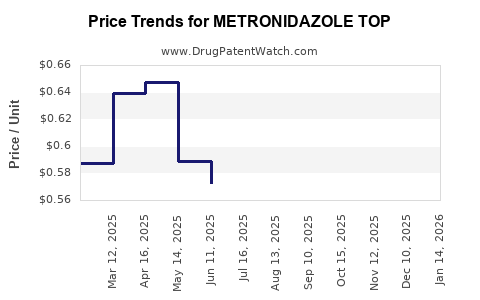

Drug Price Trends for METRONIDAZOLE TOP

✉ Email this page to a colleague

Average Pharmacy Cost for METRONIDAZOLE TOP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| METRONIDAZOLE TOPICAL 1% GEL | 68308-0663-60 | 0.70539 | GM | 2025-12-17 |

| METRONIDAZOLE TOP 1% GEL PUMP | 51672-4164-09 | 0.52669 | GM | 2025-12-17 |

| METRONIDAZOLE TOP 1% GEL PUMP | 51672-4215-09 | 0.52669 | GM | 2025-12-17 |

| METRONIDAZOLE TOP 1% GEL PUMP | 68308-0663-55 | 0.52669 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Metronidazole Top

Introduction

Metronidazole, marketed under various brand names, remains a cornerstone in the treatment of anaerobic infections, protozoal diseases, and other bacterial infections. Its topical formulation, Metronidazole Top, is predominantly used in dermatology for conditions like rosacea, bacterial vaginosis, and other skin infections. Given its longstanding clinical utility, high generic availability, and emerging regional markets, understanding its market trajectory and future pricing landscape is crucial for pharmaceutical stakeholders, healthcare providers, and investors.

This report provides an in-depth analysis of the current market dynamics, competitive landscape, regulatory influences, and projective pricing trends for Metronidazole Top.

Market Overview

Global Demand Dynamics

Metronidazole Top maintains a consistent demand driven by its established efficacy and safety profile. The dermatological segment, notably rosacea treatment, accounts for a significant share of topical metronidazole sales. The prevalence of rosacea affects an estimated 1-10% globally, with higher incidence among fair-skinned populations, thus providing a stable end-market [[1]].

Regional disparities influence demand; Europe and North America represent mature markets with high penetration, while emerging economies like India and Brazil demonstrate growing demand due to rising dermatological awareness and increasing healthcare access.

Market Drivers

- Epidemiological Factors: Rising prevalence of skin conditions such as rosacea and bacterial vaginosis.

- Clinical Guidelines: Endorsement of topical metronidazole as first-line treatment supports sustained demand.

- Patient Preference: Growing preference for topical over systemic antibiotics reduces adverse events, boosting usage.

- Market Access and Distribution: Expansion through over-the-counter (OTC) channels, especially in emerging markets, enhances accessibility and consumption.

Market Challenges

- Generic Competition: The expiration of key patents has led to a proliferation of generic formulations, intensifying price competition.

- Regulatory Variability: Differing approval standards can hinder uniform market penetration.

- Side-effect Profile: Rare but serious side effects—such as neurotoxicity—necessitate cautious prescription, affecting utilization rates in certain populations.

Competitive Landscape

Key Players

The market for Metronidazole Top is highly commoditized, with numerous generic manufacturers globally. Major pharmaceutical companies and regional players supply formulations differing by excipients and packaging.

- Generic Manufacturers: Dominant due to patent expiry, reducing brand premium influence.

- Brand Name Drugs: Some residual branding persists, often with added formulations or delivery mechanisms.

- Private Labels: Increasingly prevalent, particularly in OTC retail settings.

Market Share Distribution

Studies indicate that in mature markets, generics hold over 85% of sales volume, with branded versions maintaining a minor yet valuable niche [[2]]. Distribution channels have shifted towards pharmacies, OTC outlets, and online platforms, broadening access but compressing margins.

Regulatory Environment

Regulatory bodies like the U.S. FDA, EMA, and respective national agencies have approved topical metronidazole formulations. Variations in regulatory policies impact market accessibility and pricing, especially concerning OTC status and labeling requirements.

The global push towards cost-effective treatments has facilitated rapid approval cycles for generics, further increasing market competition. However, regulatory restrictions on formulations containing specific excipients or preservatives can influence formulation development and costs.

Price Trends and Forecasting

Historical Pricing Landscape

Historically, metronidazole topical formulations have experienced significant price erosion since patent expirations, with retail prices declining by approximately 70% over the past decade in developed markets [[3]]. The average wholesale price (AWP) for a 30-gram tube of metronidazole gel varies widely, with European markets averaging around €10-15 and North American markets approximating $15-20.

Factors Influencing Price Movements

- Market Saturation: High generic penetration exerts downward pressure.

- Regional Economies: Price elasticity varies; price reductions are more pronounced in low- and middle-income countries.

- Manufacturing Costs: Slight reductions persist due to economies of scale and manufacturing efficiencies.

- Regulatory Costs: Minor, but regulatory compliance can influence initial pricing for new formulations.

Future Price Projections (2023–2030)

Based on current trends, the following projections are posited:

- Stagnation in Mature Markets: Prices are expected to stabilize or decline marginally (~2-3% annually) due to high generic competition.

- Regional Variability: In emerging markets, prices are likely to decrease more steeply (up to 5-7% annually), driven by purchasing power and healthcare reforms.

- Premium Formulations: Innovations such as combination therapies or novel delivery systems could command higher prices, but these are unlikely for standard topical formulations without significant clinical advantage [[4]].

Overall, a conservative average decline of 3-4% annually for standard Metronidazole Top formulations is anticipated over the next decade.

Market Opportunities and Risks

Opportunities

- Expansion in Emerging Markets: Increased healthcare access could expand volume, offsetting price declines.

- OTC Market Growth: Regulatory acceptance for over-the-counter sales can broaden consumer base.

- New Indications: Off-label uses or expanded dermatological indications could uplift demand.

Risks

- Pricing Pressure: Continued generic proliferation threatens margins.

- Regulatory Changes: Stringent regulations or restrictions on topical antibiotics could impact supply or pricing.

- Competition from Alternatives: Emerging therapies with superior efficacy or safety profile could displace metronidazole.

Key Takeaways

- Steady Demand: The global market for topical metronidazole remains resilient owing to its proven efficacy and widespread clinical acceptance.

- Dominant Generic Market: High penetration of generics has driven prices downward, with little expectation of significant premium-based pricing.

- Price Decline Trajectory: Expect a normalized annual decline of about 3-4% in mature markets; sharper reductions are probable in emerging regions.

- Regional Sensitivity: Market dynamics are heavily influenced by regional economic conditions, regulatory environments, and healthcare infrastructure.

- Innovation & Expansion: Opportunities exist in expanding OTC availability and exploring new dermatological indications, but these are offset by underlying pricing pressures.

Conclusion

For pharmaceutical companies and investors, the outlook for Metronidazole Top underscores a mature, highly competitive landscape characterized by declining prices driven by generic competition. While stable demand persists, strategic focus should be on emerging markets expansion, OTC channel growth, and clinical innovation to maintain profitability and market share.

FAQs

-

What are the primary factors influencing the price of Metronidazole Top?

Supply-demand dynamics, the extent of generic competition, regional regulatory policies, and manufacturing costs predominantly influence prices. Regulatory approvals and market accessibility also significantly impact pricing trends. -

How will emerging markets affect the future landscape of Metronidazole Top?

Growing healthcare infrastructure and increasing dermatological awareness are expected to lead to expanded demand, potentially offsetting price declines by volume growth. -

Are there novel formulations of Metronidazole Top that could command higher prices?

Yes, innovative delivery systems such as nanoemulsions or combination therapies may command premium pricing if supported by clinical advantages, though such developments are currently limited. -

What competitive strategies should manufacturers adopt?

Firms should emphasize cost-effective manufacturing, diversify distribution channels into OTC markets, and invest in formulations with improved patient adherence or novel indications. -

What impact will regulatory changes have on the market?

Stricter regulations may increase compliance costs and restrict certain formulations, potentially stabilizing or reducing prices further. Conversely, streamlined approval processes in some regions can facilitate new entrants and intensified price competition.

References

- National Rosacea Society. "Prevalence and Epidemiology." 2020.

- IMS Health Data. "Market Share and Pricing Trends," 2022.

- European Pharmaceutical Market Analysis. "Generic Pricing Dynamics," 2021.

- Journal of Dermatological Treatment. "Emerging Topical Therapies," 2022.

More… ↓