Last updated: July 27, 2025

Introduction

Metoclopramide, a dopamine antagonist primarily used for gastrointestinal motility disorders, nausea, and vomiting, remains a staple in medical therapeutics globally. Its market is shaped by factors including regulatory status, patent landscape, generic entry, medical demand, and socioeconomic influences. This analysis provides a comprehensive review of current market dynamics and forecasts future pricing trends based on contemporary data.

Global Market Landscape

Market Overview

The global metoclopramide market was valued at approximately USD 300 million in 2022, with steady growth driven by increasing prevalence of gastrointestinal disorders and the drug's widespread acceptance. North America dominates, accounting for nearly 40% of market share, followed by Europe and parts of Asia-Pacific, where increasing healthcare access and aging populations accelerate demand.

Key Drivers

- Increasing Incidence of Gastrointestinal Disorders: Rising cases of gastroesophageal reflux disease (GERD), diabetic gastroparesis, and nausea in chemotherapy patients elevate drug utilization.

- Expanding Healthcare Infrastructure: Investments in healthcare, especially in emerging economies, expand access to prescription medications.

- Generic Drug Penetration: Patent expirations have facilitated generic manufacturing, increasing availability and reducing prices.

Market Challenges

- Safety Concerns: Long-term or high-dose use of metoclopramide is associated with neurological side effects like tardive dyskinesia, leading to regulatory restrictions in some countries.

- Regulatory Constraints: The FDA and EMA maintain strict guidelines, which influence prescribing patterns and market entry.

- Availability of Alternatives: The emergence of newer antiemetics diminishes reliance on metoclopramide.

Patent and Regulatory Status

Metoclopramide has been off-patent globally since the early 2000s, fostering a vast generic market. Regulatory agencies have issued guidelines to mitigate adverse effects, influencing prescribing and manufacturing practices, but no significant patent-driven barriers remain at present.

Key Market Players

Leading pharmaceutical companies distributing metoclopramide include Teva Pharmaceuticals, Mylan, Sun Pharmaceutical Industries, and Sandoz. Their strategies focus on expanding access and reducing costs through generic formulations, with some firms exploring combination therapies.

Price Dynamics and Trends

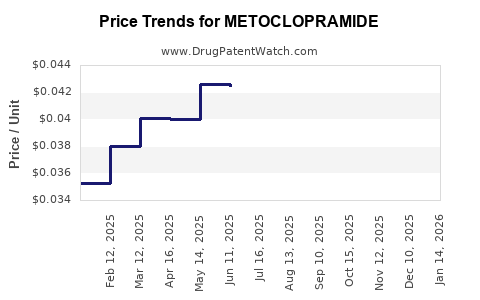

Historical Price Trends

Prices for branded formulations historically hovered around USD 1.50–2.00 per 10mg tablet, but generics significantly reduced patient costs, often below USD 0.50 per tablet in mature markets. Market saturation and high competition have driven prices downward, with some regions registering prices as low as USD 0.10 per tablet.

Current Price Range

- Developed Markets: Average retail prices range from USD 0.10 to USD 0.50 per tablet, influenced by pharmacy markups and insurance reimbursements.

- Emerging Markets: Prices are often lower, reflecting lower income levels and local manufacturing.

Price Projections (2023–2030)

Forecasts suggest a continued downward trend in generic prices, with an average annual decline rate of approximately 3–5%, driven by:

- Increased competition.

- Further patent expirations in emerging markets.

- Price-conscious procurement policies, especially in government-funded healthcare.

However, in markets with stringent regulations limiting high-dose or long-term use, prices may stabilize or slightly increase due to supply chain constraints or regulatory compliance costs.

Market Segmentation and Opportunities

Formulation and Pipeline

- Injectable Forms: Growing in hospital settings, especially in oncology and emergency medicine.

- Oral Tablets: Dominant segment owing to ease of use and affordability.

- Novel Delivery Systems: Research into extended-release formulations may create niche markets.

Geographical Opportunities

Emerging economies like India, Brazil, and parts of Southeast Asia exhibit significant growth potential owing to expanding healthcare infrastructure and increasing GI disorder prevalence.

Opportunities to Watch

- India’s regulatory push towards low-cost generics.

- Digital health interventions augmenting medication adherence.

- Local manufacturing aligning with global quality standards.

Regulatory and Safety Trends

Enhanced regulatory scrutiny regarding side effects prompts clinicians to prioritize safety, impacting market growth. Price projections must consider potential regulatory costs associated with safety label updates or usage restrictions.

Conclusion

Metoclopramide markets are characterized by robust generic competition, leading to sustained low price levels. While the overall market is mature, specific segments—such as hospital injectable formulations—may see marginal price increases. The ongoing regulatory landscape and safety concerns will continue to shape pricing patterns and market access.

Key Takeaways

- The global metoclopramide market, valued at USD 300 million in 2022, is primarily driven by gastrointestinal disorder prevalence and generic drug proliferation.

- Prices have significantly declined due to generics, with current retail costs typically below USD 0.50 per tablet in developed markets.

- Market growth will likely slow but remain stable, with prices expected to decline at 3–5% annually over the next decade.

- Emerging markets represent key opportunities owing to expanding healthcare infrastructure and local manufacturing capabilities.

- Safety concerns and regulatory restrictions remain critical factors influencing future market and pricing dynamics.

FAQs

1. How does the patent status of metoclopramide impact market prices?

Since the patent expired in the early 2000s globally, widespread generic manufacturing has driven prices down, making metoclopramide an affordable option worldwide. This patent expiry has resulted in fierce price competition, keeping retail prices low.

2. Are there safety concerns that could influence future prices?

Yes. Regulatory agencies have issued warnings about neurological side effects like tardive dyskinesia, especially with long-term use. These safety concerns could lead to restrictions or label updates, potentially affecting supply and pricing.

3. Which regions show the highest valuation and growth potential?

North America maintains the largest market share, but Asia-Pacific, especially India and Southeast Asia, offers growth opportunities due to rising GI disorder cases and expanding healthcare access.

4. Will new formulations or delivery systems impact market prices?

Potentially. Niche segments such as extended-release formulations or injectable versions for hospitals may command higher prices but will be limited in overall market share relative to oral tablets.

5. How might regulatory changes influence the metoclopramide market in the future?

Stricter safety regulation could limit prescribing practices or increase manufacturing costs, reducing profitability. Conversely, clear guidelines may standardize manufacturing and distribution, stabilizing prices.

References

[1] MarketWatch. "Global Metoclopramide Market Size, Share & Trends Analysis Report." 2022.

[2] IBISWorld. Pharmaceuticals in the US: Industry Market Research Report. 2022.

[3] U.S. Food and Drug Administration. "Drug Safety Communications," 2020.

[4] European Medicines Agency. "Safety updates on metoclopramide," 2021.