Share This Page

Drug Price Trends for METHYLPREDNISOLONE SS

✉ Email this page to a colleague

Average Pharmacy Cost for METHYLPREDNISOLONE SS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| METHYLPREDNISOLONE SS 125 MG | 00143-9754-25 | 3.12155 | EACH | 2025-11-19 |

| METHYLPREDNISOLONE SS 125 MG | 63323-0258-03 | 3.12155 | EACH | 2025-11-19 |

| METHYLPREDNISOLONE SS 125 MG | 43598-0129-25 | 3.12155 | EACH | 2025-11-19 |

| METHYLPREDNISOLONE SS 125 MG | 43598-0129-25 | 2.97331 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MethylPrednisolone SS

Introduction

Methylprednisolone Sodium Succinate (Methylprednisolone SS) is a synthetic corticosteroid widely utilized for its potent anti-inflammatory and immunosuppressive effects. Approved for indications such as allergic reactions, multiple sclerosis relapses, severe asthma, and various autoimmune conditions, this intravenous/ injectable corticosteroid sustains significant pharmaceutical demand globally. The current landscape reveals notable growth driven by expanding therapeutic applications, rising prevalence of chronic inflammatory diseases, and emerging biosimilar options. This report synthesizes key market dynamics, competitive landscape, regulatory trends, and future price projections for Methylprednisolone SS.

Market Overview

Global Market Size and Growth Trajectory

The global corticosteroids market, estimated at approximately USD 4.2 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 4.5-6.0% through 2030 [1]. Methylprednisolone SS constitutes a significant fraction, owing to its versatile clinical applications and established safety profile.

The increasing incidence of autoimmune diseases, respiratory disorders, and allergic conditions substantiate sustained demand. For instance, multiple sclerosis affects roughly 2.8 million worldwide [2], with Methylprednisolone serving a primary role in relapse management. Moreover, the COVID-19 pandemic accentuated corticosteroid utilization, including Methylprednisolone, especially in severe cases requiring immunomodulation.

Regional Market Breakdown

-

North America: Commanding the largest market share (~45%), attributed to high healthcare expenditure, advanced medical infrastructure, and broad approval for multiple indications.

-

Europe: Approximately 25%, driven by aging populations and robust healthcare systems.

-

Asia-Pacific: Fastest-growing segment (~8-10% CAGR), propelled by increasing healthcare access, rising disease prevalence, and expanding manufacturing capacities.

-

Rest of the World: Growing markets in Latin America, Middle East, and Africa benefit from expanding pharmaceutical distribution channels.

Competitive Landscape

Major Manufacturers and Suppliers

- Pfizer Inc. – One of the leading players with widespread global distribution networks, offering branded Methylprednisolone formulations.

- Teva Pharmaceuticals – Known for producing cost-effective generic versions, fostering market penetration in emerging regions.

- Sandoz (Novartis) – Focused on biosimilar and generic corticosteroid products.

- Mylan – Active in generic corticosteroid offerings with strategic regional presence.

- Other Regional Players: Local manufacturers in Asia and Latin America, often supplying through partnerships or licensing agreements.

Market Entry Barriers

- Stringent regulatory requirements for injectable corticosteroids.

- High manufacturing standards and quality control.

- Patent protections on specific formulations, although many generics are in the marketplace.

Regulatory and Patent Landscape

Most formulations of Methylprednisolone SS are off-patent or approaching expiration, facilitating increased generic competition. Regulatory agencies such as the FDA (U.S. Food and Drug Administration) and EMA (European Medicines Agency) have established clear pathways for approval, further enabling market entry for generics and biosimilars.

Recent initiatives emphasizing biosimilar adoption aim to reduce healthcare costs and increase accessibility, potentially introducing new market entrants and impacting price points.

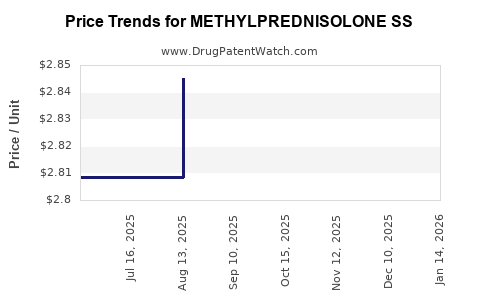

Pricing Dynamics and Projections

Current Price Landscape

- Brand-Name Methylprednisolone SS: Prices typically range from USD 10-15 per vial (valued per unit dose), with variations depending on concentration (40 mg, 125 mg, 250 mg, 500 mg).

- Generic Versions: Offer significant discounts—sometimes 30-50% lower—thus intensifying price competition.

- Regulatory Impact: Price reductions are further driven by government reimbursement policies and procurement practices, especially in healthcare systems emphasizing cost-containment.

Price Drivers

- Manufacturing Costs: Stable, dominated by raw material availability, production efficiencies, and quality standards.

- Market Competition: An influx of generic formulations exerts downward pressure on prices.

- Regulatory Approvals: Expanding indications and biosimilar entries may influence pricing strategies.

- Supply Chain Dynamics: Disruptions or shortages can temporarily inflate prices.

Future Price Projections (2023–2030)

Based on current market trends, economic forecasts, and regulatory developments:

- Year-over-Year Decline: Expect a gradual decline of 2-4% annually in generic vial prices, driven mainly by increased competition.

- Biosimilar Impact: Emergence of biosimilars could precipitate further price reductions, particularly in mature markets.

- Premium Pricing: Branded formulations may retain a slight premium (~10-15%) due to brand recognition and perceived quality, especially in North America and Europe.

By 2030, average vial prices in developed markets could decrease to approximately USD 8-12, with potential further discounts in emerging economies where cost sensitivity remains high.

Market Opportunities and Risks

Opportunities

- Emerging Markets: Increasing healthcare infrastructure and demand for affordable corticosteroids present growth prospects.

- Biosimilar Development: Investment in biosimilar Methylprednisolone SS assets can yield competitive advantages.

- Expanded Indications: New therapeutic areas or delivery formats could unlock additional revenue streams.

Risks

- Regulatory Barriers: Stringent approval processes may delay product launches or restrict access.

- Market Saturation: Intensified competition and price erosion could compress margins.

- Patent Expiries: While many formulations are off-patent, proprietary or combination formulations may retain exclusivity, influencing segment-specific dynamics.

- Supply Chain Disruptions: Raw material shortages or geopolitical factors could cause price volatility.

Strategic Recommendations

- Price Monitoring: Continually track regional pricing trends and regulatory updates to optimize market penetration.

- Lifecycle Management: Focus on biosimilar development and new indications to sustain growth.

- Cost Optimization: Enhance manufacturing efficiencies and supply chain resilience to maintain competitive pricing.

- Market Diversification: Expand into emerging markets and niche therapeutic areas for long-term viability.

Key Takeaways

- Market Size & Growth: The global Methylprednisolone SS market is expanding at a CAGR of approximately 5-6%, driven by increasing demand across various therapeutic indications.

- Pricing Trends: Generic vial prices are anticipated to decline gradually over the next decade, with brand-name products maintaining a slight premium.

- Competitive Dynamics: New biosimilars and expanding generic production are likely to heighten price competition, especially in mature markets.

- Regional Variations: North America and Europe will dominate pricing and sales, but Asia-Pacific presents accelerating opportunities aligned with its expanding healthcare sector.

- Future Outlook: Strategic investments in biosimilars, market diversification, and cost efficiencies are essential for stakeholders aiming to capitalize on projected pricing trends.

FAQs

Q1: How does patent expiration influence Methylprednisolone SS pricing?

Patent expirations facilitate the entry of generics, significantly lowering prices due to increased competition. Most formulations are now off-patent, promoting affordability and market accessibility.

Q2: Are biosimilars expected to impact Methylprednisolone SS prices significantly?

Yes. Biosimilars typically enter at a lower price point and, over time, can lead to substantial discounts, further promoting cost competition.

Q3: Which regions offer the highest growth potential for Methylprednisolone SS?

Emerging markets in Asia-Pacific and Latin America offer significant growth due to rising healthcare demand, coupled with lower entry barriers compared to mature markets.

Q4: What factors may cause short-term price fluctuations?

Supply chain disruptions, raw material shortages, regulatory approvals, and pandemic-related demands can temporarily impact prices.

Q5: How can manufacturers optimize profit margins amid declining prices?

By focusing on cost efficiencies, expanding indications, developing biosimilars, and entering high-growth regional markets, manufacturers can sustain profitability despite price pressures.

References

[1] MarketsandMarkets, "Corticosteroids Market by Type, Application, and Region – Global Forecast to 2030," 2022.

[2] Multiple Sclerosis International Federation, "Global Data Schaum," 2022.

More… ↓