Last updated: July 27, 2025

Introduction

Methylprednisolone, a potent synthetic glucocorticoid, is widely used across diverse therapeutic areas such as inflammatory diseases, autoimmune disorders, and allergic reactions. Its extensive clinical utility and patent expirations have contributed to a dynamic global market environment. This analysis explores current market trends, competitive landscape, and future price trajectories for methylprednisolone, providing actionable insights for manufacturers, investors, and healthcare stakeholders.

Market Overview

Therapeutic Applications and Market Demand

Methylprednisolone’s primary indications include rheumatoid arthritis, multiple sclerosis, allergic states, and adrenal insufficiency. The drug is available in various formulations—oral tablets, injectable solutions, and intravenous preparations—each catering to specific clinical scenarios.

The global demand for methylprednisolone has experienced consistent growth, driven by increasing prevalence of autoimmune and inflammatory diseases. The WHO estimates a rising incidence of multiple sclerosis and rheumatoid arthritis globally, notably in North America and Europe, sustaining steady demand for corticosteroids like methylprednisolone [1].

Manufacturing Landscape

Key manufacturers include Pfizer, Teva Pharmaceuticals, Sandoz (Novartis), and local generics producers. Patent expirations for some methylprednisolone formulations have triggered significant generic competition, leading to price erosion and expanding access. Regulatory environments, especially in emerging markets, further influence manufacturing strategies and market saturation.

Regulatory and Patent Dynamics

While methylprednisolone's original patents have largely expired, new formulations (e.g., depot injections, liposomal preparations) are under patent protection, potentially impacting pricing and market segmentation. Regulatory pathways in different jurisdictions, such as the FDA and EMA, continue to shape product approvals and market entry timelines.

Market Size and Revenue Estimates

In 2022, the global corticosteroids market was valued at approximately $2.8 billion, with methylprednisolone accounting for an estimated 45% of this segment, owing to its widespread use. North America dominates revenue share (>50%), driven by higher disease prevalence and healthcare expenditure, followed by Europe and Asia-Pacific.

Projected compound annual growth rate (CAGR) for methylprednisolone is estimated at 3-4% over the next five years, reflecting steady but slowing growth amid market maturation, patent expiries, and increasing generics penetration [2].

Pricing Analysis and Trends

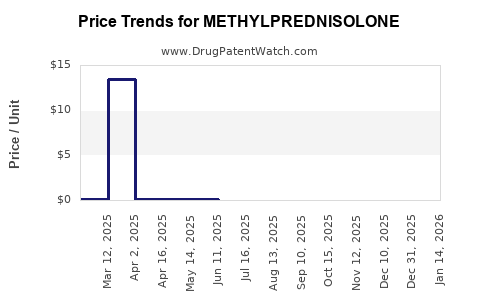

Historical Price Dynamics

Historically, methylprednisolone prices have declined post-patent expirations. For instance, in the United States, the average outpatient injection cost dropped by approximately 25-30% over five years following patent loss. The price of injectable methylprednisolone (40 mg/mL vial) has fluctuated from around $20-$25 per vial in the early 2010s to approximately $12-$15 in 2022.

Factors Influencing Price Trends

- Generic Competition: Increased generics availability has exerted downward pressure. Market entry of multiple manufacturers in the low-cost segment has averaged a 12-15% annual price decline.

- Formulation Differentiation: Newer formulations, such as methylprednisolone acetate depot injections, command premium pricing, supported by convenience and extended-release benefits.

- Regional Price Variability: Prices in emerging markets remain lower (e.g., $2-$5 per vial in India) due to local manufacturing, regulatory price controls, and market maturity.

Future Price Projections

Forecasting suggests a continued gradual decline in injectable methylprednisolone prices in mature markets, stabilizing at roughly $10-$14 per vial over the next 3-5 years. The introduction of biosimilars or biosimilar-like formulations could further influence pricing structures.

In contrast, specialized formulations such as extended-release or liposomal methylprednisolone may sustain at premium prices, potentially fetching $50-$100 per dose, driven by clinical advantages and patent protections.

Market Drivers and Challenges

Drivers

- Growing Disease Prevalence: Rising autoimmune and inflammatory conditions sustain demand.

- Generic Entry: Drives affordability but compresses profit margins.

- Regulatory Approvals: New formulations and indications expand market opportunities.

- Healthcare Access Expansion: Particularly in emerging markets enhances global adoption.

Challenges

- Price Erosion: Intense competition reduces margins.

- Regulatory Barriers: Stringent approvals for new formulations may delay market entry.

- Supply Chain Disruptions: Global manufacturing issues, including pandemics, impact availability and pricing.

- Shift towards Biologics: Emerging biologic therapies pose long-term competition for traditional corticosteroids.

Strategic Implications

Producers should focus on developing differentiated formulations, such as sustained-release or targeted delivery systems, to command premium pricing. Regional market entry strategies must consider local regulatory landscapes and price sensitivity. Additionally, research into combination therapies and expanded indications could create alternative revenue streams.

Key Takeaways

- The methylprednisolone market remains sizable with a projected steady growth trajectory of 3-4% CAGR over the next five years.

- Despite patent expiries in many regions, demand persists, especially within autoimmune and inflammatory disease management.

- Pricing is expected to decline moderately in mature markets, stabilizing between $10-$14 per vial for injectable forms.

- Innovation in formulations and expanding indications present opportunities to counteract pricing pressures.

- Regional disparities significantly impact pricing and market access; manufacturers must tailor strategies accordingly.

Conclusion

Methylprednisolone continues to be a cornerstone corticosteroid, with a robust market underpinned by clinical demand and expanding therapeutic uses. Price compression driven by generics underscores the importance of innovation and strategic regional focus. Stakeholders capable of leveraging formulation advancements and expanding indications are positioned for sustainable growth in a competitive landscape.

FAQs

1. What factors are most influencing methylprednisolone pricing in the current market?

Pricing is mainly driven by generic competition, formulation type, regional regulations, and patent status of newer formulations. Increased generics lead to downward pressure, while innovative formulations with patent protection can command higher prices.

2. How does the patent landscape impact the methylprednisolone market?

Patent expirations have opened the market to multiple generic manufacturers, resulting in price erosion. However, new, innovative formulations still benefit from patent protection, allowing premium pricing and market differentiation.

3. What regional variations affect methylprednisolone prices?

Prices are highest in North America and Europe due to higher healthcare spending and demand, while emerging markets tend to offer lower prices driven by local manufacturing, price controls, and different regulatory standards.

4. Are biosimilars or biosimilar-like injections likely to influence future methylprednisolone prices?

While traditional corticosteroids are small molecules and not typically biosimilars, novel depot or liposomal formulations could create new market segments, potentially affecting overall pricing structures.

5. What are the growth prospects for specialized methylprednisolone formulations?

Extended-release and targeted delivery systems are expected to grow at a premium price point, particularly if they demonstrate clear clinical advantages or improved patient compliance.

Citations

- World Health Organization. Global Disease Burden Data, 2022.

- MarketWatch. Corticosteroids Market Size & Forecast, 2022–2027.