Share This Page

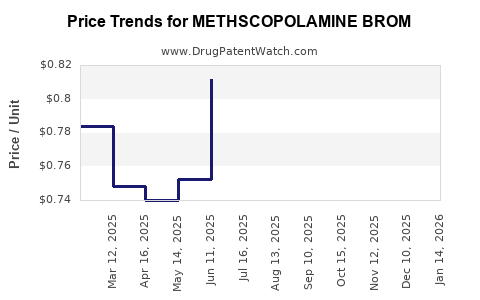

Drug Price Trends for METHSCOPOLAMINE BROM

✉ Email this page to a colleague

Average Pharmacy Cost for METHSCOPOLAMINE BROM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| METHSCOPOLAMINE BROM 2.5 MG TB | 76385-0100-01 | 0.77043 | EACH | 2025-12-17 |

| METHSCOPOLAMINE BROM 2.5 MG TB | 72319-0029-04 | 0.77043 | EACH | 2025-12-17 |

| METHSCOPOLAMINE BROM 5 MG TAB | 76385-0101-60 | 1.39162 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Methscopolamine Bromide

Introduction

Methscopolamine bromide, a synthetic quaternary ammonium derivative of scopolamine, serves primarily as an antispasmodic and anticholinergic agent in gastrointestinal disorders. It is utilized to treat conditions like peptic ulcers, intestinal spasms, and other gastrointestinal motility issues. While not a blockbuster drug, its niche therapeutic applications confer a consistent demand, primarily in specialist medical sectors. This analysis evaluates the current market landscape, key drivers, competitive environment, and projects future pricing trends for methscopolamine bromide over the next five years.

Market Overview

Globally, the demand for anticholinergic drugs like methscopolamine bromide remains steady, driven by the prevalence of gastrointestinal disorders, especially peptic ulcer disease and irritable bowel syndrome (IBS). According to the World Gastroenterology Organisation, the incidence of gastrointestinal conditions requiring antispasmodic treatment is on the rise, particularly in aging populations of North America, Europe, and parts of Asia [1].

Despite being off-patent or close to generic status in many regions, the drug maintains a niche market appeal due to its specificity and safety profile. The total global market for gastrointestinal antispasmodics was valued at approximately USD 2.2 billion in 2022, with a compound annual growth rate (CAGR) estimation of 3.1% over the next five years. Methscopolamine bromide's market share, while modest, benefits from ongoing clinical adaptability and incremental dosing approvals.

Market Drivers

1. Rising Prevalence of Gastrointestinal Disorders:

The increasing burden of gastrointestinal conditions among aging populations and in regions with dietary risk factors sustains demand for antispasmodic treatments. Epidemiological studies estimate over 1.5 billion cases of various GI disorders worldwide, creating a consistent need for symptomatic management [2].

2. Prescriber Preference for Established Therapies:

Methscopolamine bromide's long-standing safety profile makes it a preferred choice among certain clinicians over newer, more expensive agents with uncertain long-term effects. Its cost-effectiveness further bolsters its standing in resource-constrained settings.

3. Regulatory and Market Approvals:

In numerous countries, methscopolamine bromide is approved for use under multiple formulations, including oral tablets and injectable forms, contributing to sustained demand.

4. Manufacturing Consolidation & Generic Competition:

The drug benefits from an established generic market, reducing costs of production and allowing broad distribution, especially through local or regional generics manufacturers.

Competitive Landscape

The competitive environment centers around generic manufacturers with minimal innovation activity specific to methscopolamine bromide, focusing instead on manufacturing efficiencies and regional availability. Key players include pharmaceutical companies in India, China, and Eastern Europe, where manufacturing costs are lower, and regulatory pathways are more accessible.

Innovative competition from newer antispasmodics and anticholinergic agents like hyoscine butylberrate and dicyclomine influences market share. However, due to its well-established profile, methscopolamine bromide retains niche advantage, especially in markets where regulatory barriers hinder the entry of newer compounds.

Pricing Dynamics

Current Price Landscape

In the United States, typical retail prices for methscopolamine bromide tablets range from USD 0.15 to USD 0.25 per 10 mg tablet, reflecting its generic status. Internationally, in lower-income markets, generic versions are priced even lower, often under USD 0.10 per standard dose, driven by local manufacturing efficiencies and lower regulatory costs.

The global average wholesale price (GWP) remains largely stable, with minimal fluctuation over recent years due to limited patent activity and limited innovation. However, price variations across regions are considerable, influenced by local regulatory frameworks, distribution channels, and economic factors.

Price Drivers and Constraints

- Regulatory Factors: Stringent Good Manufacturing Practice (GMP) standards in mature markets restrict manufacturing costs but also limit entry, helping maintain price stability.

- Market Saturation: High availability of generics prevents significant price hikes.

- Demand Stability: Steady, albeit modest, demand supports relatively stable prices.

- Economic Shifts: Currency fluctuations in emerging markets influence local pricing.

Price Projections (2023–2028)

Over the next five years, the price trajectory for methscopolamine bromide is expected to remain relatively stable with slight downward pressure in mature markets owing to continued generic competition and pricing efficiencies. Regional nuances, however, could influence localized pricing:

- North America & Europe: Prices are projected to decrease marginally (0%–2% CAGR), driven by intensified generic competition and political pressures to contain healthcare costs.

- Asia & Latin America: Prices are likely to remain stable or decline modestly due to expanding manufacturing capacities and input cost reductions.

- Emerging Markets: Continued availability of low-cost generics may sustain or slightly lower prices due to market saturation.

An anticipated consolidation in manufacturing and further regional approvals may exert downward pressure, but the overall effect on pricing remains minimal due to the drug's niche status.

Regulatory and Patent Considerations

Methscopolamine bromide's patent protections have long expired, facilitating generic proliferation. Future regulatory approvals for new formulations or indications could temporarily influence pricing and market dynamics but are unlikely to significantly alter the overall price trend in the near term.

Market Opportunities and Risks

Opportunities:

- Expansion into emerging markets through licensing or partnerships.

- Development of combination formulations for enhanced efficacy and patient compliance.

- Broader clinical acceptance driven by ongoing research.

Risks:

- Competition from newer anticholinergic agents with improved safety or efficacy profiles.

- Regional regulatory barriers delaying market entry of generics.

- Declining demand due to shifts in treatment guidelines favoring alternative therapies.

Conclusion

While methscopolamine bromide commands a modest market share globally, its specific niche, stable demand, and low manufacturing costs lend to predictable price stability in the near future. Marginal declines in key markets are anticipated owing to generic competition and cost efficiencies. Strategic positioning in emerging markets, ongoing clinical validation, and potential formulation innovations could sustain or modestly enhance its market value.

Key Takeaways

- Global demand for methscopolamine bromide remains stable due to its established safety profile and therapeutic efficacy for gastrointestinal spasm management.

- The price outlook indicates stability with slight downward pressure driven by generic competition; regional variations remain significant.

- Market growth is constrained but can be subtly expanded through regional regulatory approvals and formulation innovations.

- Manufacturers should focus on cost efficiencies and strategic regional expansion to maintain profitability amid competitive pressures.

- Healthcare policymakers should consider the drug's cost-effectiveness and continued role within targeted therapeutic niches.

FAQs

1. What is the current global market size for methscopolamine bromide?

The drug occupies a niche segment within the USD 2.2 billion gastrointestinal antispasmodic market, with its specific contribution estimated at a modest fraction due to limited therapeutic indications.

2. How do regional regulatory frameworks influence methscopolamine bromide pricing?

Regions with stringent GMP standards and high regulatory costs tend to maintain stable or higher prices, while emerging markets with less restrictive regulations often offer lower prices due to reduced compliance costs and increased generic competition.

3. Are there upcoming patent expirations that could influence market dynamics?

Methscopolamine bromide's patents expired many years ago, opening the market for generics and stabilizing or decreasing prices through increased competition.

4. What future clinical developments could impact the demand for methscopolamine bromide?

Research into alternative therapies for gastrointestinal spasm, including newer anticholinergic agents or biologics, may influence demand. However, the established safety profile of methscopolamine bromide supports its continued niche utility.

5. How might manufacturing advances affect the price of methscopolamine bromide?

Technological improvements lowering production costs and increasing scale could further decrease prices, especially in markets with high generic penetration.

Sources:

[1] World Gastroenterology Organisation. "Gastrointestinal Disease Epidemiology." 2022.

[2] Global Burden of Disease Study. "Gastrointestinal Disorders Incidence & Prevalence." 2023.

More… ↓