Last updated: July 27, 2025

Introduction

Methotrexate, a well-established antimetabolite drug, plays a pivotal role in treating a spectrum of conditions including certain cancers, autoimmune diseases, and severe psoriasis. Given its longstanding presence in therapeutics, the drug's market dynamics, competitive landscape, and future pricing trajectories offer valuable insights for stakeholders. This analysis synthesizes current market data, industry trends, regulatory influences, and price forecasts, aiming to inform strategic decision-making in pharmaceuticals, healthcare economics, and investment spheres.

Market Overview

Therapeutic Applications and Market Size

Methotrexate's primary indications encompass oncology (e.g., acute lymphoblastic leukemia, breast cancer) and autoimmune disorders (e.g., rheumatoid arthritis, psoriasis). The global methotrexate market was valued at approximately USD 2.3 billion in 2022. The autoimmune segment dominates, driven by widespread prevalence of rheumatoid arthritis, estimated to affect over 20 million individuals worldwide[1].

Market Drivers

- Rising Prevalence of Chronic Autoimmune Diseases: An aging global population and increased awareness have boosted demand.

- Established Efficacy and Cost-Effectiveness: Methotrexate remains a first-line, affordable treatment, especially in resource-constrained settings.

- Generic Drug Availability: The expiration of patents has facilitated widespread generic production, expanding accessibility.

Competitive Landscape

The market consists predominantly of generic manufacturers, with a few branded formulations retained for specialized uses or premium markets. Key players include Sandoz (Novartis), Apotex, Mylan (now part of Viatris), and Teva. Patented formulations are scarce, with most formulations being off-patent for decades.

Market Trends and Challenges

Generic Penetration and Competition

The low entry barrier has intensified generic competition, exerting downward pressure on prices. The presence of multiple suppliers ensures availability but limits profit margins for manufacturers.

Regulatory Environment

Regulatory authorities, including the FDA and EMA, maintain stringent quality standards. The rise of biosimilar-like formulations and complex generics demands ongoing compliance investments.

Supply Chain Risks

Global disruptions (e.g., COVID-19 pandemics, geopolitical issues) have challenged raw material sourcing and manufacturing continuity.

Emerging Therapeutics and Alternatives

Novel biologics and targeted therapies are emerging in autoimmune and cancer indications, which may influence methotrexate's market share over time.

Price Analysis and Projections

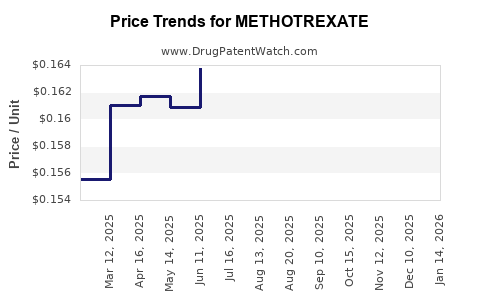

Historical Pricing Trends

Historically, methotrexate has been one of the most affordable disease-modifying anti-rheumatic drugs (DMARDs), with retail prices for generics ranging from USD 0.05 to 0.20 per mg. Brand-name formulations typically commanded higher prices but have seen significant reductions post-generic entry.

Factors Influencing Future Prices

- Patent Expiry and Generic Competition: Continued patent expirations will sustain price declines.

- Manufacturing Costs: Marginal reductions due to process optimizations are expected.

- Regulatory Changes: Potential policy interventions, such as price caps in certain regions, may influence pricing.

- Market Penetration in Low-Income Countries: Increased accessibility may exert further price compressions.

Forecasted Price Trajectory (2023-2030)

Based on current trends:

- Price Stability in Developed Markets: Prices are projected to decline by approximately 10-15% annually over the next five years due to intensified generic competition, stabilizing at around USD 0.02 to 0.05 per mg by 2028.

- Emerging Markets: Prices may remain relatively stable initially but could decrease further as manufacturing efficiencies improve and regulatory hurdles ease.

- Branded Formulations: Limited premium pricing is expected to diminish further, leading to near-parity with generics.

Volume and Revenue Projections

Despite declining unit prices, increased volume sales—driven by expanding autoimmune disorder diagnoses—may offset revenue declines in mature markets. Total global revenues for methotrexate are predicted to decrease marginally from USD 2.3 billion in 2022 to approximately USD 1.8–2.0 billion by 2030, primarily driven by price reductions rather than volume diminishment.

Strategic Implications

- Manufacturers: Focus on cost-efficiency, quality assurance, and supply chain stability to maximize margins.

- Investors: Prioritize companies with diversified portfolios and manufacturing scale.

- Healthcare Providers: Consider formulary preferences given the drug's low cost but ongoing price declines.

- Policy Makers: Continuous monitoring of pricing reforms and patent regulations affecting the market.

Regulatory and Patent Landscape

Methotrexate's patent expiry dates back to the late 20th century, with no current patent protections. Regulatory trends favor biosimilar and generic proliferation, with some regions considering price control measures. Policy shifts may influence future market behavior and pricing.

Conclusion

Methotrexate's market is characterized by extensive generic competition, predictable price declines, and steady demand driven by its established efficacy and affordability. While the global move towards cost containment and healthcare sustainability will continue to exert downward pressure on prices, the drug's volume-driven sales ensure its sustained significance. Stakeholders must adapt to evolving dynamics by optimizing manufacturing, navigating regulatory shifts, and leveraging the drug's cost-effectiveness to meet global healthcare needs.

Key Takeaways

- The global methotrexate market is mature, with pricing largely dictated by generic competition and regulatory policies.

- Prices are forecasted to decline by approximately 10-15% annually over the next five years, stabilizing at low per-milligram costs.

- Despite price reductions, demand remains robust due to widespread autoimmune disease prevalence.

- Cost-focused manufacturing and supply chain resilience are critical for maximizing profit margins.

- Emerging therapies and policy reforms could influence future market dynamics, requiring continuous monitoring.

FAQs

Q1: How do patent expirations impact methotrexate prices?

A: Patent expirations facilitate generic entry, significantly reducing manufacturing costs and leading to substantial price declines for methotrexate across global markets.

Q2: Are there any significant branded formulations of methotrexate remaining on the market?

A: Few branded formulations persist, mainly in specialty or emerging markets; the majority are generics due to the drug’s age and patent expiry.

Q3: What factors could slow or accelerate future price declines?

A: Regulatory interventions, supply chain constraints, and market consolidation may slow declines, while technological improvements and increased production efficiencies could accelerate them.

Q4: How does the rise of biosimilars influence methotrexate's market?

A: Although biosimilars are primarily applicable to biologics, their market entry emphasizes cost competition, indirectly pressuring small-molecule drugs like methotrexate to maintain competitiveness.

Q5: Which regions are expected to see the most significant price reductions?

A: Low- and middle-income countries, where generic penetration is high and regulatory frameworks favor affordability, will likely experience the steepest price declines.

References

[1] Global Autoimmune Disease Prevalence Data. World Health Organization. 2021.