Share This Page

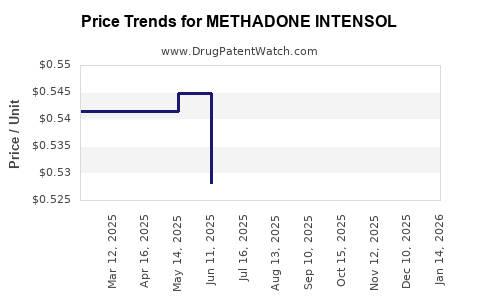

Drug Price Trends for METHADONE INTENSOL

✉ Email this page to a colleague

Average Pharmacy Cost for METHADONE INTENSOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| METHADONE INTENSOL 10 MG/ML | 00054-3553-44 | 0.54072 | ML | 2025-12-17 |

| METHADONE INTENSOL 10 MG/ML | 00054-3553-44 | 0.53916 | ML | 2025-11-19 |

| METHADONE INTENSOL 10 MG/ML | 00054-3553-44 | 0.54150 | ML | 2025-10-22 |

| METHADONE INTENSOL 10 MG/ML | 00054-3553-44 | 0.53715 | ML | 2025-09-17 |

| METHADONE INTENSOL 10 MG/ML | 00054-3553-44 | 0.53356 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Methadone Intensol

Introduction

Methadone Intensol, a liquid formulation of methadone hydrochloride, serves a crucial role in opioid dependence treatment and pain management. Approved by regulatory authorities such as the FDA, Methadone Intensol is widely used in clinical settings for opioid substitution therapy (OST). As the opioid crisis persists and healthcare systems increasingly prioritize addiction treatment, understanding the market dynamics and pricing strategies for Methadone Intensol becomes essential for manufacturers, healthcare providers, and investors.

This report provides a comprehensive analysis of the current market landscape, demand drivers, competitive environment, and price projection trends for Methadone Intensol over the next five years.

Market Overview

Global Market Landscape

The global pharmaceutical market for opioid treatment medications, including methadone formulations, is characterized by steady growth driven by escalating opioid addiction rates and increased awareness of treatment options. North America, particularly the United States, constitutes the largest market due to high opioid addiction prevalence and well-established opioid dependence treatment infrastructure. Europe and Asia-Pacific are emerging markets, with growing acceptance and regulatory approval for methadone use.

Regulatory Environment

Methadone Intensol's regulatory approval varies across jurisdictions; in the US, it is classified as a Schedule II controlled substance, subject to strict dispensing regulations. Compliance requirements influence supply chain dynamics, pricing, and market accessibility. Reimbursement policies and government-led opioid dependence programs heavily impact demand.

Market Segments

- Opioid Dependence Treatment: The primary segment, driven by addiction therapy programs.

- Pain Management: Used in chronic and severe pain cases, though less predominant.

- Hospital and Clinic Use: Administration in controlled settings with trained personnel.

Market Drivers

- Rising Opioid Use Disorder (OUD): A global increase in OUD cases amplifies demand for methadone therapies.

- Government Programs: Expansion of Medicaid and public health initiatives subsidize methadone treatment.

- Regulatory Support: Policies favoring methadone as an essential medication for OUD management.

- COVID-19 Pandemic: Accelerated telemedicine and take-home dosing options have expanded access, indirectly supporting demand.

Market Challenges

- Regulatory Constraints: Stringent controls on distribution and administration impact supply.

- Stigma: Social stigma surrounding opioid treatment can hinder patient access.

- Supply Chain Disruptions: Manufacturing or logistical issues affect availability.

- Alternatives: Buprenorphine and other medications offer competing treatments.

Market Size and Growth Projections

Current Market Size

As of 2022, the global market for methadone formulations, including Methadone Intensol, is estimated at approximately USD 1.2 billion, with North America accounting for over 70%. The US alone captures nearly USD 860 million, driven by extensive opioid dependence treatment programs [1].

Future Growth Trends

The compound annual growth rate (CAGR) for the global methadone market is projected at approximately 4.5% from 2023 to 2028. This growth is propelled primarily by increasing OUD prevalence, expanding treatment access, and evolving healthcare policies supportive of methadone therapy. The Asia-Pacific region is expected to witness the fastest growth, with CAGR reaching around 6%, influenced by rising addiction rates and improving regulatory environments.

Demand Forecast

By 2028, the global demand for Methadone Intensol is projected to reach roughly USD 1.7 billion, assuming continued expansion of opioid treatment programs and stable regulatory conditions.

Competitive Landscape

Major players include:

- Eli Lilly and Company: Previously a pioneer, now via licensing agreements.

- LCP Chemicals: Provides generic methadone formulations.

- Eipico: Major producer in the Middle East.

- Other generic manufacturers expanding their portfolios.

Patent expirations for some formulations have increased generic competition, exerting downward pricing pressure. The focus on maintaining quality and regulatory compliance remains critical for market incumbents.

Price Analysis and Projections

Current Pricing Trends

The wholesale acquisition cost (WAC) for Methadone Intensol varies by region. In the US, the average retail price per 10 mg/1 mL bottle ranges from USD 2.00 to USD 4.00, depending on supplier and pharmacy markups. Price variability also depends on insurance coverage and reimbursement policies.

Factors Influencing Pricing

- Regulatory Compliance: Strict controls and quality standards add to manufacturing costs.

- Market Competition: Increased generic availability has driven prices downward.

- Supply Chain Stability: Disruptions may temporarily inflate prices.

- Reimbursement Policies: Coverage by public and private insurers influences effective patient costs.

- Global Currency Fluctuations: Impact import/export costs, especially in emerging markets.

Price Projections (2023–2028)

Considering these factors, the forecast anticipates:

- Stable to Slightly Decreasing Prices: Due to intensified generic competition, prices are expected to decline by approximately 1–2% annually in mature markets.

- Regional Variability: In developing markets, prices may stabilize or increase modestly, driven by transportation costs and regulatory licensing fees.

- Premium Pricing in Controlled Settings: Hospitals and clinics with strict compliance requirements may command higher prices, maintaining a premium segment.

Estimated Future Pricing Ranges

| Year | US Price per 10 mg/1 mL (USD) | Global Average Price (USD) |

|---|---|---|

| 2023 | 2.50 – 4.00 | 2.20 – 3.80 |

| 2025 | 2.45 – 3.90 | 2.15 – 3.70 |

| 2028 | 2.30 – 3.80 | 2.05 – 3.50 |

Note: These are approximate ranges, subject to regional and market-specific factors.

Strategic Implications

- Pricing Strategy: Companies investing in Methadone Intensol should focus on efficient manufacturing and regulatory compliance to sustain margins amid downward price pressures.

- Market Expansion: Targeting emerging markets with growing opioid treatment programs can offer new revenue streams.

- Partnerships & Licensing: Collaborations with government health agencies may facilitate favorable procurement terms and bulk purchasing agreements.

- Diversification: Developing fixed-dose combinations or alternative formulations might capture additional clinical niches.

Conclusion

The market for Methadone Intensol remains robust, primarily driven by ongoing opioid dependence treatments globally. While prices are expected to trend downward due to rising generic competition, strategic positioning and compliance with regulatory standards will be critical to maintaining profitability. Market participants should monitor regional policy shifts, supply chain stability, and emerging competitors to optimize pricing and supply strategies.

Key Takeaways

- Steady Growth: The global methadone market is projected to grow at approximately 4.5% CAGR through 2028, fueled by rising opioid dependence.

- Pricing Trends: Prices are likely to decline modestly (~1-2% annually) due to increasing generic competition, with regional differences influencing specific pricing strategies.

- Regulatory Impact: Stringent controls elevate manufacturing and distribution costs but are essential for market access.

- Market Opportunities: Emerging markets in Asia-Pacific offer substantial growth potential amid evolving regulatory landscapes.

- Competitive Advantage: Success hinges on compliance, quality, and forming strategic partnerships with healthcare systems and government agencies.

FAQs

1. How does regulatory variability affect Methadone Intensol pricing globally?

Regulatory differences influence manufacturing costs, distribution restrictions, and reimbursement mechanisms. Countries with stringent controls may incur higher compliance costs, elevating prices, whereas relaxed regulations can lead to more competitive pricing and broader access.

2. What is the potential impact of alternative opioid treatments on Methadone Intensol demand?

Alternative therapies like buprenorphine and extended-release naltrexone are gaining popularity, potentially challenging methadone’s market share. However, methadone’s affordability and established efficacy sustain its demand, especially within comprehensive opioid treatment programs.

3. Are there any upcoming regulatory changes that could influence the Methadone market?

Regulatory shifts focusing on safety, prescribing limits, and distribution controls are anticipated in many jurisdictions. Enhanced monitoring or restrictions could impact supply and pricing, while streamlined approval processes might facilitate market expansion.

4. How will the COVID-19 pandemic influence Methadone Intensol’s demand and pricing?

The pandemic accelerated telemedicine adoption and take-home dosing policies, increasing access to methadone treatments. Though demand remains steady, logistic disruptions could temporarily impact pricing and supply, balanced by increased health system prioritization.

5. What strategies can manufacturers adopt to maintain profitability amid declining prices?

Focusing on operational efficiencies, expanding into emerging markets, establishing long-term government contracts, investing in quality enhancements, and innovating formulation options will be vital for sustaining margins.

Sources

[1] Research and Markets. "Global Opioid Dependence Treatment Market," 2022.

More… ↓