Share This Page

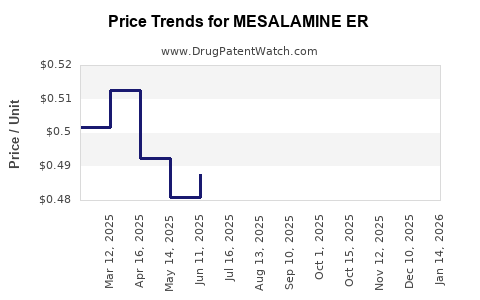

Drug Price Trends for MESALAMINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for MESALAMINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MESALAMINE ER 0.375 GRAM CAP | 60687-0650-32 | 0.44655 | EACH | 2025-12-17 |

| MESALAMINE ER 0.375 GRAM CAP | 50268-0577-11 | 0.44655 | EACH | 2025-12-17 |

| MESALAMINE ER 0.375 GRAM CAP | 59651-0397-08 | 0.44655 | EACH | 2025-12-17 |

| MESALAMINE ER 0.375 GRAM CAP | 00093-9224-89 | 0.44655 | EACH | 2025-12-17 |

| MESALAMINE ER 0.375 GRAM CAP | 50268-0577-15 | 0.44655 | EACH | 2025-12-17 |

| MESALAMINE ER 0.375 GRAM CAP | 00378-1375-78 | 0.44655 | EACH | 2025-12-17 |

| MESALAMINE ER 0.375 GRAM CAP | 00832-6056-12 | 0.44655 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MESALAMINE ER

Introduction

Mesalamine Extended Release (ER), marketed under brand names such as Apriso, Pentasa, and Lialda, is a pivotal therapeutic agent for inflammatory bowel diseases, notably ulcerative colitis and Crohn's disease. As a cornerstone in the treatment landscape, the drug’s market dynamics and pricing trajectory are shaped by clinical demand, patent statuses, competitive forces, regulatory environments, and evolving healthcare policies. Understanding these factors enables stakeholders to navigate the complex pharmaceutical market effectively.

Market Overview

Therapeutic Demand and Clinical Significance

Mesalamine ER is a first-line therapy for maintaining remission in ulcerative colitis, a chronic condition affecting an estimated 1 million Americans and millions globally ([2]). The drug’s extended-release formulations aim to optimize mucosal contact, improve patient adherence, and reduce systemic absorption, thereby enhancing efficacy and safety profiles.

The global inflammatory bowel disease (IBD) therapeutics market, estimated at approximately $7.3 billion in 2021, is projected to grow at a CAGR of around 4-6% over the next five years ([3]). Mesalamine ER maintains a significant market share within this segment due to its established clinical efficacy, safety record, and formulary integration.

Market Drivers

- Incidence & Prevalence: Rising IBD prevalence, particularly in North America and Europe, sustains steady demand.

- Treatment Guidelines: Favorable guidelines endorsing mesalamine as a first-line maintenance therapy bolster sales.

- Patient Compliance: Extended-release formulations improve convenience, enhancing adherence.

- Healthcare Reimbursement: Favorable reimbursement policies promote prescription and accessibility.

Market Challenges

- Generic Competition: Entry of generic formulations post patent expiry diminishes pricing power.

- Patient Preference: Shift towards biologic therapies for severe cases influences market share.

- Regulatory Constraints: Varying approval standards and evolving safety regulations can impact market dynamics.

Patent and Regulatory Landscape

Patent Status

Brand-name formulations such as Lialda (manufactured by Shire/Janssen) and Pentasa (AbbVie) historically held patents extending into the late 2010s or early 2020s. The expiration of key patents has led to a surge in generic versions, intensifying price competition.

Regulatory Environment

The U.S. Food and Drug Administration (FDA) classifies mesalamine ER as a drug with multiple approved formulations, paving the way for generic competition but also enabling new drug applications (NDAs) for innovative delivery methods or combination therapies.

Competitive Landscape

Major Players

- Brand Manufacturers: Shire/Janssen, AbbVie, Valtris, and Takeda.

- Generic Producers: Multiple manufacturers have entered the market post-patent expiry, significantly pressuring prices.

- Emerging Biologics: While biologics target more severe IBD cases, their rising use affects the overall mesalamine market footprint.

Market Share Dynamics

Generic versions command over 70% of prescriptions in the U.S. as of recent data ([4]). Brand formulations retain premium pricing primarily due to patient convenience and physician preference for established products.

Price Projections

Historical Pricing Trends

- Brand Formulations: Historically priced at approximately $400 - $600 per month per patient in the U.S.

- Generics: Post-patent expiration, prices have sharply declined, with average retail prices dropping to approximately $100 - $200 per month.

Near-Term Outlook (Next 3-5 Years)

- Pricing Stabilization: The intense generic competition suggests a further decline in prices by 15-25%, depending on market penetration and supply chain factors.

- Innovative Formulations: Potential launches of next-generation mesalamine products with improved delivery could command premium prices, offsetting generic price erosion.

- Pricing Trends Influenced by Policy: U.S. healthcare policies emphasizing cost containment and value-based pricing could further suppress prices, especially for branded drugs.

Long-Term Projections (Next 5-10 Years)

- Market Consolidation: Larger pharmaceutical companies may leverage portfolio strategies to maintain some pricing power through combination therapies or improved formulations.

- Patient Access Programs: Manufacturers might adopt patient assistance programs, affecting net pricing.

- Emerging Markets: Expansion into Asian and Latin American markets could introduce new revenue streams at lower price points.

Overall, average prices for mesalamine ER are expected to decline by approximately 20-30% over the next five years, driven by widespread generic availability and healthcare cost pressures.

Market Opportunities and Risks

Opportunities

- Innovative Delivery Systems: Developing once-daily formulations or targeted delivery may allow premium pricing.

- Expansion into Adjacent Indications: Investigating efficacy in other gastrointestinal disorders could broaden market reach.

- Digital and Monitoring Technologies: Integration with digital adherence tools may enhance value proposition.

Risks

- Patent Litigation and Patent Trolls: Potential legal challenges could delay or restrict generic entry.

- Regulatory Hurdles: Stringent approval processes or safety concerns could impact market stability.

- Market Saturation: Predominance of generics may limit profit margins unless differentiated strategies are employed.

Key Takeaways

- Demand Persistence: The growing prevalence of IBD and reliance on mesalamine ER as standard maintenance therapy sustain market demand.

- Price Decline Trajectory: Anticipate a 20-30% reduction in average drug prices within the next five years, primarily due to generic competition.

- Competitive Strategy: Manufacturers should focus on innovative formulations and value-added services to command premium pricing.

- Regulatory Influence: Policy developments and patent landscapes critically influence future pricing and market entry.

- Market Diversification: Expanding into emerging markets presents growth opportunities, albeit at lower price points.

FAQs

1. How has patent expiration affected mesalamine ER pricing?

Patent expirations have significantly increased generic market entries, leading to substantial price reductions—often by over 50%—making the drug more accessible but reducing profits for brand manufacturers.

2. What factors could potentially stabilize mesalamine ER prices?

Innovations in drug delivery, brand loyalty, regulatory exclusivities, or formulation patents for next-generation products could help sustain higher prices.

3. Are there emerging therapies threatening the mesalamine ER market?

Biologic agents and small-molecule drugs targeting different inflammatory pathways are increasingly used for severe IBD, but mesalamine ER remains a mainstay for maintenance in mild-to-moderate cases.

4. How do healthcare policies impact future pricing of mesalamine ER?

Policies emphasizing cost-effectiveness and promoting generic use will likely continue to pressure prices downward, whereas value-based drug procurement programs could influence pricing strategies.

5. What is the outlook for mesalamine ER in global markets?

While established in North America and Europe, growth in emerging markets depends on regulatory approvals, pricing policies, and local healthcare infrastructure but generally follows global price decline trends.

References:

- [2] Crohn’s & Colitis Foundation. "About IBD."

- [3] Grand View Research. "Inflammatory Bowel Disease (IBD) Therapeutics Market Size & Trends."

- [4] IQVIA. "Pharmaceutical Market Data, 2022."

More… ↓