Share This Page

Drug Price Trends for MESALAMINE DR

✉ Email this page to a colleague

Average Pharmacy Cost for MESALAMINE DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MESALAMINE DR 400 MG CAPSULE | 60687-0556-33 | 2.21706 | EACH | 2025-11-19 |

| MESALAMINE DR 1.2 GM TABLET | 00527-3012-48 | 0.88697 | EACH | 2025-11-19 |

| MESALAMINE DR 1.2 GM TABLET | 00591-2245-22 | 0.88697 | EACH | 2025-11-19 |

| MESALAMINE DR 1.2 GM TABLET | 16714-0830-01 | 0.88697 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MESALAMINE DR

Introduction

Mesalamine DR (Delayed Release), a pivotal therapeutic agent in managing inflammatory bowel diseases (IBD), notably ulcerative colitis and Crohn’s disease, has demonstrated significant clinical efficacy. Its unique mechanism of localized anti-inflammatory action in the colon positions it as a cornerstone treatment, supported by established clinical guidelines. This analysis offers an in-depth evaluation of the current market landscape, competitive dynamics, manufacturing trends, regulatory outlook, and future pricing trajectories for Mesalamine DR.

Market Overview

Global Demand and Incidence Trends

The global prevalence of ulcerative colitis, one of the primary indications for Mesalamine DR, continues to rise, especially in North America, Europe, and parts of Asia. Reports indicate that approximately 1.3 million Americans suffer from IBD, with ulcerative colitis constituting a significant portion (CDC, 2022). The rising incidence correlates with increased prescription volumes for Mesalamine formulations, both branded and generic.

Key Therapeutic Indications

- Ulcerative Colitis: Mesalamine DR is primarily indicated for maintenance and induction of remission.

- Crohn’s Disease: Particularly effective in mild-to-moderate cases affecting the colon.

Market Segments

The market is divided into:

- Branded drugs: Such as Apriso, Canasa, Pentasa, and Asacol HD.

- Generics: Substantial market share owing to patent expiries.

- Emerging markets: Notably in Asia-Pacific and Latin America, where IBD diagnosis rates are increasing.

Market Size and Forecast (2022-2027)

Based on recent market research, the global Mesalamine market was valued at approximately USD 1.2 billion in 2022, with a compounded annual growth rate (CAGR) of approximately 6%. This growth is driven by increased prevalence, ongoing treatment adoption, and expanding healthcare infrastructure.

Competitive Landscape

Major Manufacturers

- Eisai Co., Ltd.: Market leader with branded formulations like Pentasa.

- FERRING Pharmaceuticals: Produces Apriso and other formulations.

- Almirall S.A.: Offers Mesalamine-based products.

- SANDOZ and Mylan: Dominant players in the generic segment.

- Other emerging biotech firms are exploring novel delivery mechanisms improving efficacy and patient adherence.

Patent Dynamics and Market Entry

Several patents protecting specific formulations and delivery mechanisms have recently expired, precipitating increased generic competition. The expiry of key patents, such as those covering Apriso and Pentasa, has notably increased generic market penetration, reducing average selling prices and exerting downward pressure on overall market prices.

Manufacturing and Supply Chain Analysis

Manufacturing Trends

The manufacturing of Mesalamine DR involves complex synthesis processes, including controlled-release coating technologies and multi-layered formulations. Advances include:

- Hot-melt extrusion techniques enhancing bioavailability.

- Modified-release polymer coatings improving site-specific delivery.

Supply Chain Considerations

Global supply chains for raw materials—mainly p-aminosalicylic acid derivatives—are concentrated in Asia, primarily China and India. Manufacturing disruptions, geopolitical factors, and quality control issues have occasionally impacted supply stability.

Regulatory Environment

Regulatory agencies such as the FDA, EMA, and PMDA have rigorous standards for generic formulations, often requiring bioequivalence studies. Recent regulatory clarifications have facilitated accelerated approval pathways for improved formulations, potentially impacting market supply.

Regulatory and Pricing Factors

Regulatory Outlook

The approval landscape for Mesalamine formulations remains stable. However, innovation-driven "line-extensions" with improved bioavailability or reduced dosing requirements may alter market dynamics.

Pricing Drivers

Key drivers influencing drug prices include:

- Patent protections and exclusivity rights.

- Market competition from generics.

- Manufacturing costs.

- Reimbursement policies and formulary inclusions.

- Value-based pricing models focusing on patient adherence and health outcomes.

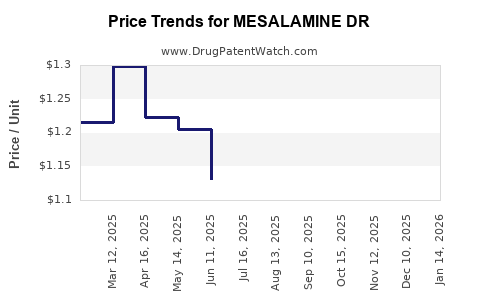

Historical Pricing Trends

- Branded Mesalamine products initially ranged from USD 300 to USD 600 per month.

- Patent expiries initiated a rapid price decline for generics, with prices often falling below USD 150 per month.

- The introduction of multi-source generics has further compressed pricing margins.

Price Projections (2023-2028)

Short-term Trends (2023-2025)

Given patent expiries and increasing generic competition, market prices for Mesalamine DR are projected to decline by approximately 10-15% annually. Strategic manufacturers may maintain higher prices through differentiated formulations (e.g., extended-release, colon-targeted delivery).

Long-term Outlook (2026-2028)

Potential launch of novel delivery systems—such as nanotechnology-based formulations—could command premium pricing due to improved efficacy and reduced dosing frequency. Additionally, regulatory incentives for low-cost generic manufacturing in emerging markets may further dampen global prices.

Impact of Market Dynamics

- Market saturation: Will continue to exert downward pressure.

- Innovation: Will sustain some pricing premiums for advanced formulations.

- Global expansion: Increased adoption in emerging regions with varying reimbursement frameworks.

Projected Price Range

- Branded formulations: USD 250- USD 350 per month (2023); potential decrease to USD 180- USD 250 by 2028.

- Generics: USD 80- USD 150 per month (2023); declining to USD 50- USD 100 by 2028, depending on market competitiveness.

Key Market Drivers and Challenges

Drivers

- Rising prevalence of IBD globally.

- Expanding healthcare coverage and diagnosis.

- Development of improved delivery systems.

- Growing acceptance of maintenance therapy to prevent disease relapse.

Challenges

- Patent expirations leading to price compression.

- Limited innovation in formulation compared to other IBD drugs such as biologics.

- Pricing pressures from healthcare payers and governments.

- Competition from biosimilars and alternative therapies.

Strategic Implications for Industry Stakeholders

- Pharmaceutical companies should prioritize development of enhanced formulations and bioavailability improvements to sustain pricing power.

- Generic manufacturers can capitalize on patent cliffs by offering competitively priced products in emerging markets.

- Investors should monitor regulatory approvals and innovation pipelines, particularly in regions with growing IBD burden.

- Healthcare policymakers must balance cost containment with access to effective therapies, influencing pricing and reimbursement frameworks.

Key Takeaways

- The Mesalamine DR market is expanding steadily, driven by rising IBD incidence, but faces pricing pressure from increased generic competition.

- Patent expiries and technological advancements are shaping a competitive landscape with declining prices and opportunities for innovative delivery systems.

- Short-term projections indicate continued price reductions, while long-term prospects hinge on formulation innovation and regional market growth.

- Stakeholders must adopt strategic positioning—leveraging innovation, cost efficiencies, and market expansion—to sustain profitability.

FAQs

Q1: How do patent expirations impact Mesalamine DR prices?

Patent expirations enable generic manufacturers to enter the market, significantly reducing Prices of branded formulations and intensifying competition.

Q2: What innovations could influence future pricing?

Advances such as targeted colon delivery, nanotechnology-based formulations, and combination therapies can command premium pricing due to enhanced efficacy.

Q3: Which regions present the most growth opportunities?

Emerging markets like India, China, and parts of Latin America offer expanding demand coupled with regional capacity for low-cost manufacturing.

Q4: How do regulatory policies influence pricing strategies?

Regulatory hurdles or incentives determined by agencies like the FDA or EMA can either delay innovation or facilitate faster approval of newer formulations, affecting pricing dynamics.

Q5: Will biologics or biosimilars replace Mesalamine DR?

While biologics are used in more severe IBD cases, Mesalamine remains favored for mild-to-moderate disease control; biosimilars target biologic drugs, not mesalamine, thus complementing rather than replacing it.

References

- Centers for Disease Control and Prevention (CDC). (2022). Inflammatory Bowel Disease Statistics.

- Market Research Future. (2023). Global Mesalamine Market Report.

- IQVIA Data. (2022). Pharmaceutical Market Trends.

- Regulatory Agency Guidelines. (2021). Bioequivalence and Formulation Standards.

- Industry Analysis Reports. (2022). Forthcoming Trends in GI Therapeutics.

More… ↓