Last updated: July 27, 2025

Introduction

Mesalamine, also known as 5-aminosalicylic acid (5-ASA), is a critical therapeutic agent used primarily to manage inflammatory bowel diseases (IBD), including ulcerative colitis and Crohn’s disease. Its targeted anti-inflammatory properties have secured its position as a first-line treatment for mild to moderate cases of these chronic conditions. Given the rising incidence of IBD globally, spanning North America, Europe, and parts of Asia, market dynamics for mesalamine are poised for significant shifts, driven by factors such as patent expirations, the emergence of generics, evolving competitive landscapes, and innovative drug delivery systems.

Current Market Landscape

Market Size and Growth Drivers

The global mesalamine market was valued at approximately USD 1.45 billion in 2022[1]. The compound annual growth rate (CAGR) is projected to be around 4.2% over the next five years (2023–2028), reaching an estimated USD 1.75 billion by 2028[2]. Key drivers include:

- Increasing Incidence of IBD: According to the Crohn’s & Colitis Foundation, IBD affects approximately 3 million Americans, with rising prevalence in Europe and Asia, thereby escalating demand for effective therapies like mesalamine.

- Chronic Disease Management: Mesalamine's safety profile makes it suitable for long-term management, fostering consistent demand.

- Generic Drug Entry: Patent expirations for several mesalamine formulations have led to a surge in generic options, increasing market accessibility and volume.

- Patient Preference for Oral and Rectal Formulations: Innovations in drug delivery, including delayed-release capsules and suppositories, bolster treatment adherence and expand market segments.

Competitive Landscape

Major players include Pfizer, Ferring Pharmaceuticals, Dr. Reddy’s Laboratories, Sun Pharmaceuticals, and Teva Pharmaceuticals. Patent protected formulations, such as Pfizer’s Asacol, have historically commanded premium pricing; however, patent expirations have diminished exclusivity, substantially reducing prices and accelerating generic competition.

Regional Market Dynamics

- North America: Leading market, accounting for circa 45% of global sales in 2022, driven by high prevalence rates and advanced healthcare infrastructure.

- Europe: Second-largest market, with significant demand fueled by recognized treatment protocols and an aging population.

- Asia-Pacific: Fastest growth rate (~5.6% CAGR), propelled by increasing IBD prevalence, urbanization, and improvement in healthcare services.

Pricing Trends and Projections

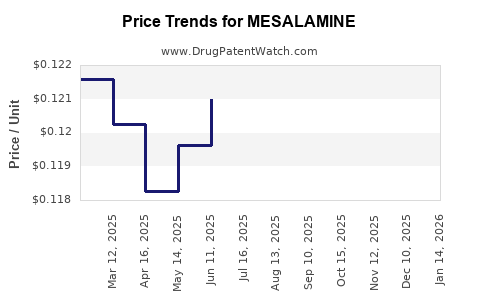

Historical Price Trends

In premium branded formulations, retail prices for mesalamine products ranged from USD 4.00 to USD 8.00 per gram for branded products in the U.S. market prior to patent expiry[3]. Post-generic entry, prices have decreased approximately 50–70%, with generic formulations selling at USD 1.00 to USD 2.00 per gram. The variations depend on the formulation, brand, and pharmacy distribution channels.

Future Price Trends

- Market Consolidation Effects: Increased competition from generics will continue to exert downward pressure on average prices, with projections indicating a further 20–30% price reduction over the next three years.

- Innovative Delivery Systems: Sustaining premium pricing are novel formulations such as multi-matrix systems or targeted-release capsules, which could command a 10–15% higher price point compared to traditional generics.

- Regional Price Disparities: Economic factors and healthcare policies will influence regional pricing, with emerging markets expected to experience sharper price declines due to affordability concerns.

Projected Price Range (2028)

Considering current trends, average wholesale prices for mesalamine are expected to fall to approximately USD 0.80–USD 1.50 per gram across most markets—down from branded prices exceeding USD 4.00 per gram in peak patent years[4]. Premium formulations with advanced delivery mechanisms may retain prices at USD 2.00–USD 3.00 per gram.

Market Risks & Opportunities

Risks

- Patent Cliff and Price Erosion: Expiration of key patents accelerates generic entry, compressing margins for branded drug producers.

- Regulatory Pressure: Stringent quality standards and pricing regulations, especially in developing economies, can disrupt supply chains and profitability.

- Competitive Innovations: Development of novel therapeutics, including biologics and small-molecule drugs with superior efficacy, may threaten mesalamine’s market share.

Opportunities

- Formulation Innovation: Investment in drug delivery technologies could enable sustained-release and targeted therapies, justifying premium pricing.

- Expanding Market Footprint: Increasing IBD prevalence in Asia-Pacific offers growth potential, particularly with affordable generic options.

- Combination Therapies: Combining mesalamine with other agents (e.g., probiotics, immunomodulators) opens new treatment paradigms and revenue streams.

Regulatory and Patent Landscape

- Patent Expirations: Multiple patents on mesalamine formulations expired between 2018 and 2022, fueling generic proliferation in key markets.

- Regulatory Approvals: Agencies such as FDA and EMA have approved numerous generic versions, facilitating market entry.

- Biosimilar Evolution: While biosimilars are more relevant to biologic drugs, emerging formulations aim to capture niche segments of IBD management.

Conclusion

The mesalamine market stands at a pivotal junction, characterized by robust demand, significant price competition, and innovation-driven opportunities. While patent expirations will continue to pressure traditional pricing models, the sector’s evolution toward advanced delivery systems and regional expansion, especially in Asia, ensures sustained growth. Strategic positioning around formulation innovation and market diversification will be essential for stakeholders to navigate this dynamic environment effectively.

Key Takeaways

- The global mesalamine market is expected to grow CAGR of approximately 4.2% through 2028, driven by rising IBD prevalence.

- Patent expiries have led to substantial generic price reductions, with anticipated further declines enhancing patient access but reducing overall margins.

- Innovative formulations and targeted delivery systems present premium pricing opportunities amidst ongoing price compression.

- Emerging markets, notably Asia-Pacific, offer high-growth potential, accelerated by increasing disease burden and healthcare infrastructure improvements.

- Navigating patent landscapes, regulatory changes, and competitive innovations will be critical for market participants aiming for sustainable growth.

FAQs

1. How has patent expiration affected mesalamine prices globally?

Patent expirations have facilitated the entry of multiple generic manufacturers, leading to significant price reductions—approximately 50–70%—as competition intensifies, especially in mature markets like the U.S. and Europe.

2. What innovations are driving future growth in mesalamine formulations?

Advancements in drug delivery, including controlled-release capsules, rectal enema formulations with improved bioavailability, and targeted-release systems, are poised to maintain premium pricing and improve patient adherence.

3. Which regions are expected to dominate mesalamine sales over the next decade?

North America and Europe will continue to dominate due to high disease prevalence and established healthcare systems. However, Asia-Pacific is projected to witness the fastest growth owing to rising IBD cases and increasing healthcare investments.

4. How will emerging competitors impact the mesalamine market?

New formulations with superior efficacy or convenience could fragment the market, while biologic therapies targeting different disease pathways could divert some patient segments, pressuring mesalamine’s market share.

5. What strategic steps should pharmaceutical companies consider regarding mesalamine?

Investing in formulation innovation, exploring regional opportunities, and maintaining cost-efficient manufacturing practices are key. Additionally, monitoring patent statuses and regulatory policies will inform timely market entry or diversification strategies.

Sources:

- MarketWatch, "Global Mesalamine Market Size," 2022.

- ResearchAndMarkets, "Mesalamine Market Forecast," 2023–2028.

- MediPrice, "Average Mesalamine Price Trends," 2022.

- IQVIA, "Impact of Patent Expirations on Mesalamine Pricing," 2022.