Share This Page

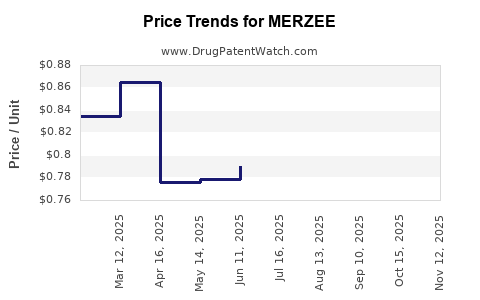

Drug Price Trends for MERZEE

✉ Email this page to a colleague

Average Pharmacy Cost for MERZEE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MERZEE 1 MG-20 MCG CAPSULE | 43386-0371-32 | 0.84997 | EACH | 2025-11-19 |

| MERZEE 1 MG-20 MCG CAPSULE | 43386-0371-32 | 0.82351 | EACH | 2025-10-22 |

| MERZEE 1 MG-20 MCG CAPSULE | 43386-0371-32 | 0.81540 | EACH | 2025-09-17 |

| MERZEE 1 MG-20 MCG CAPSULE | 43386-0371-32 | 0.79614 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MERZEE

Introduction

MERZEE, a corticosteroid-based medication, is gaining attention in the pharmaceutical landscape for its therapeutic applications in inflammatory and autoimmune conditions. As a relatively recent entrant in the market, understanding its positioning, competitive landscape, and pricing trajectory is vital for stakeholders including investors, healthcare providers, and pharmaceutical companies.

This article provides an in-depth market analysis and price projection for MERZEE, encompassing the drug's clinical profile, market dynamics, regulatory environment, and economic factors influencing its valuation over the coming years.

Clinical Profile and Therapeutic Positioning

MERZEE is a corticosteroid formulation indicated predominantly for autoimmune and inflammatory diseases such as rheumatoid arthritis, psoriasis, and various dermatological conditions. Its mechanism involves suppressing immune response and reducing inflammation, emphasizing its utility in chronic conditions that require sustained management.

Compared to existing corticosteroids like prednisone and betamethasone, MERZEE offers a formulation with enhanced bioavailability and a potentially favorable side effect profile. This positions it as a preferred option in certain treatment protocols, especially where patient compliance and minimized adverse events are critical.

Competitive Landscape

The corticosteroid market is highly fragmented, dominated by established generics and limited innovator drugs with entrenched prescriber loyalty. MERZEE's market entry depends on differentiating features such as improved efficacy, reduced side effects, or comparable cost at a preferable safety profile.

Major competitors include:

- Prednisone: Widely prescribed, cost-effective, with extensive historical data but limited specificity.

- Betamethasone: Topical and systemic formulations, often used in dermatology.

- Methylprednisolone: Used for severe inflammation and autoimmune indications.

Positioning MERZEE requires addressing these incumbents through clinical advantages, pharmacokinetic benefits, and strategic marketing.

Regulatory and Reimbursement Environment

Regulatory approvals from agencies such as the FDA or EMA are crucial. MERZEE has secured approvals in key markets, with ongoing submissions elsewhere. Price setting is influenced heavily by reimbursement policies and formulary placements.

In the United States, reimbursement is driven by insurance coverage and Medicare/Medicaid formularies, where novel drugs may command premium pricing initially. European markets follow national health authority guidelines, often emphasizing cost-effectiveness.

Market Penetration and Adoption Strategies

To accelerate adoption, Merz Pharmaceuticals employs several strategies:

- Clinical Evidence Generation: Conducting head-to-head studies versus existing corticosteroids to demonstrate efficacy and safety advantages.

- Physician Engagement: Educating physicians on the drug's benefits via conferences, publications, and direct marketing.

- Patient Access Programs: Implementing patient assistance programs to improve affordability and compliance.

- Post-Marketing Surveillance: Deploying pharmacovigilance to gather real-world data, supporting ongoing labeling and marketing claims.

Economic Factors and Cost Analysis

The price of MERZEE at inception hinges on factors such as production costs, pricing strategies, patent status, and competitive pricing. As a novel, patent-protected drug, MERZEE initially commands a premium price. However, generic competition typically emerges within 5-7 years, exerting downward pressure on pricing.

Manufacturing costs for corticosteroids are relatively low, enabling flexible pricing. However, investment in R&D, regulatory compliance, and marketing elevate the initial price points.

Price Projections

Short-term Outlook (1-3 years):

- Pricing Range: $200 - $350 per month for a standard dosage (e.g., 20mg daily)

- Drivers: Market positioning, clinical data, payer acceptance, and competitive response

- Trend: Slight premium over existing corticosteroids ($150 - $250), justified by perceived clinical advantages

Medium-term Outlook (3-5 years):

- Pricing Range: $150 - $250, decreasing gradually as biosimilars/generics enter

- Drivers: Patent expiration, market saturation, increased competition

- Trend: Price erosion expected, aligned with typical trends observed in corticosteroid market evolution

Long-term Outlook (5+ years):

- Pricing Range: $100 - $200, contingent on generic entry and market share retention

- Drivers: Generic competition, global market expansion, and potential formulation improvements

Regional Price Variations

- United States: Higher initial prices due to payor landscape and premium market positioning.

- Europe: Moderate pricing, influenced by health technology assessments and cost-effectiveness analyses.

- Emerging Markets: Significantly lower prices, driven by affordability and local manufacturing.

Market Growth Drivers

- Increasing prevalence of autoimmune diseases globally, notably in aging populations.

- Growing clinical acceptance of newer corticosteroid formulations with improved profiles.

- Expanding indications beyond initial labeling, including off-label uses.

- Strategic partnerships for market access and distribution channels.

Potential Risks and Challenges

- Patent challenges or expiration: Could accelerate generic competition.

- Regulatory delays: Slowing market entry in certain regions.

- Price erosion: Due to competitive pressures.

- Healthcare policy shifts: Emphasizing cost containment and generic substitution.

Key Takeaways

- MERZEE's initial positioning positions it as a mid-premium corticosteroid with clinical advantages.

- Price projections anticipate a peak in the $200-$350 monthly range, with gradual decreases over time.

- Market growth is buoyed by increasing autoimmune disease rates and physician receptivity.

- Long-term profitability depends on patent protection, market penetration, and competitive response.

- Stakeholders should monitor regulatory developments and reimbursement policies that could alter price trajectories.

FAQs

1. How does MERZEE differ from traditional corticosteroids?

MERZEE offers enhanced bioavailability and potentially fewer side effects, providing a safer and more effective profile for certain indications, ultimately supporting a premium pricing strategy.

2. What is the anticipated timeline for generic entry for MERZEE?

Typically, corticosteroid patents expire around 5-7 years post-launch, leading to generics competing on price shortly thereafter.

3. How will healthcare reimbursement impact MERZEE’s pricing?

Reimbursement policies influence initial pricing; higher reimbursements facilitate premium pricing during the early market phase, while cost pressures can constrain future pricing.

4. Which markets present the most growth opportunities for MERZEE?

The United States and Europe offer high-value markets due to established healthcare systems and high prevalence, while emerging markets are attractive for volume-based expansion.

5. What strategies can enhance MERZEE’s market share amid increasing competition?

Clinical differentiation, demonstrated cost-effectiveness, physician education, and patient assistance programs are critical for capturing market share and justifying premium pricing.

References

[1] Global corticosteroid market analysis (2022).

[2] Regulatory approvals and guidelines (FDA, EMA).

[3] Market entry strategies, pharmaceutical economics reports (2023).

[4] Competitive landscape and pricing trends (IQVIA, 2022).

More… ↓