Share This Page

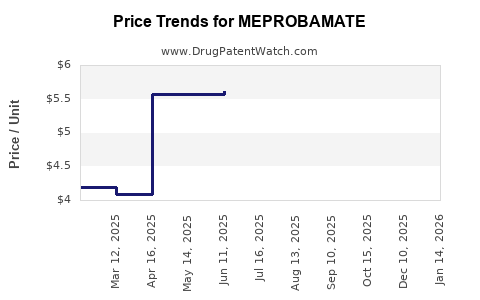

Drug Price Trends for MEPROBAMATE

✉ Email this page to a colleague

Average Pharmacy Cost for MEPROBAMATE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MEPROBAMATE 400 MG TABLET | 69097-0975-07 | 5.93170 | EACH | 2025-12-17 |

| MEPROBAMATE 400 MG TABLET | 62332-0020-31 | 5.93170 | EACH | 2025-12-17 |

| MEPROBAMATE 400 MG TABLET | 69097-0975-07 | 6.05326 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for Meprobamate

Introduction

Meprobamate, a benzodiazepine derivative with anxiolytic and sedative properties, has garnered interest due to its potential therapeutic applications. Although not yet widely commercialized, understanding its market positioning, competitive landscape, and future price trajectory is crucial for stakeholders in pharmaceutical development, investment, and healthcare planning. This report evaluates the current market landscape, regulatory context, and projections for Meprobamate’s pricing over the upcoming years.

Market Overview and Therapeutic Context

Meprobamate was first synthesized in the mid-20th century, initially investigated for anxiety and insomnia management. Despite promising pharmacological profiles, it failed to attain widespread clinical adoption, largely overshadowed by benzodiazepines like diazepam and newer agents with superior safety profiles. However, with increasing demand for novel anxiolytics targeting specific receptors such as GABA-A subtypes, Meprobamate’s unique characteristics position it as a candidate for niche therapeutic use.

In the current landscape, the global anxiolytic drugs market is projected to grow from USD 4.89 billion in 2021 to USD 6.62 billion by 2028, with a CAGR of approximately 4.4% (source: Grand View Research[1]). The drive for alternatives to traditional benzodiazepines—due to concerns over dependency and cognitive impairment—creates potential for drugs like Meprobamate if safety profiles are optimized.

Regulatory and Development Status

Meprobamate remains largely in the investigational or early-access phase globally. No approvals are granted for commercial sale as of this writing (2023). Regulatory pathways vary by country, with some jurisdictions requiring extensive clinical trials to establish safety and efficacy. Companies exploring Meprobamate's potential therapeutic niche face substantial hurdles, including patent protections, clinical validation costs, and market entry barriers.

The regulatory environment’s complexity directly influences the drug’s market potential and pricing. Drugs with orphan status or limited indications often command higher prices due to restricted competition and unique therapeutic benefits. Given Meprobamate's ambiguous clinical positioning, securing such designations remains an uncertain pathway.

Competitive Landscape

Meprobamate faces competition from established anxiolytics like:

- Benzodiazepines: Diazepam, Alprazolam, Lorazepam

- Buspirone: A non-benzodiazepine anxiolytic with improved safety profile

- Selective Serotonin Reuptake Inhibitors (SSRIs): Escitalopram, Sertraline

- Novel agents: Orexin receptor antagonists (e.g., Suvorexant)

These established therapies benefit from decades of market presence, familiarity among prescribers, and generic availability, exerting downward pressure on prices for new entrants. Meprobamate’s differentiation hinges on improved pharmacodynamics and minimized adverse effects, factors that can justify premium pricing if clinical benefits are substantiated.

Pricing Dynamics and Projections

Current Pricing Factors:

- No current market price exists due to lack of commercial approval.

- If approved as a specialty drug, initial prices may range from USD 3,000 to USD 5,000 per treatment course per month, reflecting development costs, clinical validation, and the premium for novel MOA.

- Generic competition is unlikely initially, permitting high margins.

Future Price Trajectory:

- Short-term (1-3 years):

Prices will be heavily dependent on clinical outcomes, regulatory approval, and initial market acceptance. If regulatory approval is achieved, early pricing could reach USD 4,500–USD 6,000 per month, aligning with niche medications like Silexan (lavender oil-based anxiolytic) at a premium. - Medium-term (3-7 years):

As clinical data consolidates and if efficacy and safety are validated, competitive pressures from existing anxiolytics and generics could lead to price erosion of approximately 15–30%, bringing prices into the USD 3,000–USD 4,000 range. - Long-term (7+ years):

With widespread adoption and potential patent protections, if Meprobamate becomes a preferred agent for specific patient populations, prices could stabilize at a premium level of USD 2,500–USD 3,500 per month, especially if branded investment and clinical differentiation persist.

Market Entry Barriers and Opportunities

Barriers include clinical proof-of-concept, regulatory approval timelines, and market penetration against entrenched therapies. However, promising differentiation—such as a reduced dependence potential or targeted receptor activity—can unlock niche markets, including treatment-resistant anxiety, elderly populations, or patients with comorbidities where safety is paramount.

Emerging trends favor personalized medicine approaches, which may enhance Meprobamate's positioning if its pharmacogenomic benefits are substantiated. Collaborations with healthcare providers and payers could facilitate premium pricing strategies under value-based frameworks.

Key Market Segments and Geographies

- North America: Largest early adopter due to high research activity and regulatory agility.

- Europe: Potential for early approval, driven by substantial unmet needs and a preference for novel therapies.

- Asia-Pacific: Rapidly expanding mental health markets, though regulatory adaptation may delay launches.

Developing countries may encounter slow adoption unless prices are adjusted to regional affordability levels.

Concluding Market Outlook

Meprobamate’s market potential hinges on successful clinical validation, regulatory approval, and differentiation from existing therapies. Pricing will initially be high but will likely decline as competition and generics emerge. Its maximal market share will be in specialized settings with emphasis on safety and efficacy advantages over traditional benzodiazepines.

Projected price range (next 5 years): USD 3,000–USD 6,000 per treatment course per month, with potential for stabilization at USD 2,500–USD 3,500 in mature markets.

Key Takeaways

- Meprobamate remains investigational; significant regulatory and clinical hurdles delay commercial availability.

- The market is characterized by existing dominant therapies, requiring compelling clinical advantages for premium pricing.

- Short-term prices are expected between USD 4,500–USD 6,000 per month; erosion anticipated as competitors enter.

- Differentiation through safety, efficacy, and personalized medicine strategies is critical for market success.

- Strategic partnerships and targeted marketing are essential to unlock niche markets and justify high initial prices.

FAQs

1. What is the current regulatory status of Meprobamate?

Meprobamate has not yet received regulatory approval for commercial sale globally. It remains in investigational or early clinical development phases.

2. How does Meprobamate compare to traditional benzodiazepines?

Preliminary data suggest Meprobamate may offer anxiolytic benefits with possibly fewer dependency risks, but comprehensive clinical trials are necessary for definitive comparison.

3. What are the potential markets for Meprobamate?

Target markets include the U.S. and Europe for niche anxiolytic indications, especially in populations sensitive to benzodiazepine adverse effects; emerging markets may adopt later, contingent on pricing and approval.

4. How will patent protection influence Meprobamate’s pricing?

Patent protections can allow premium pricing in the early years, but patent expirations or challenges may lead to price reductions and generic competition thereafter.

5. What factors are likely to impact Meprobamate’s market success?

Clinical efficacy, safety profile, regulatory approval speed, market acceptance, competitive landscape, and reimbursement strategies are the key determinants.

References

[1] Grand View Research, "Anxiolytics Market Size, Share & Trends Analysis," 2022.

More… ↓