Last updated: July 29, 2025

Introduction

Meperidine, also known by its former brand name Demerol, is a synthetic opioid analgesic historically employed for moderate-to-severe pain management and preoperative sedation. Although its clinical use has declined due to safety concerns and the availability of alternative medications, its market persists, primarily driven by pharmaceutical manufacturing, regulatory, and geopolitical factors. This analysis explores the current market landscape for meperidine and projects future pricing trends, considering regulatory shifts, manufacturing dynamics, and global demand.

Regulatory Landscape and Market Impact

The regulatory environment significantly influences meperidine's market stability. Agencies such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) have issued warnings against its use owing to neurotoxicity risks, including seizures linked to metabolite accumulation [1]. As a result, many countries have tightened restrictions or phased out approvals, constraining supply and influencing market pricing.

In the United States, the Drug Enforcement Administration (DEA) classifies meperidine as a Schedule II controlled substance, underlining its potential for abuse and dependence. This classification imposes stringent manufacturing, distribution, and prescribing regulations, translating into increased compliance costs for producers, which may be reflected in higher prices.

Conversely, some emerging markets with less restrictive regulatory environments continue to produce and utilize meperidine, sustaining regional demand and affecting global pricing dynamics.

Manufacturing and Supply Chain Dynamics

Meperidine is primarily synthesized through complex chemical processes requiring specialized facilities and raw materials. Major manufacturers, such as pharmaceuticals like Pfizer and domestic generic producers, have largely reduced or ceased production due to safety concerns and declining demand. Remaining supply predominantly stems from a limited number of generic drug manufacturers operating in countries with fewer regulatory constraints.

Supply chain disruptions—exacerbated by geopolitical tensions, pandemics such as COVID-19, and raw material shortages—have recently constrained available inventory. These factors, combined with the dwindling number of producers, contribute to upward pressure on unit prices.

Market Demand and Usage Trends

Historically, meperidine saw widespread use; however, clinical guidelines have shifted away from its use due to safety profiles, leading to a precipitous decline in prescription volumes. The CDC and other health authorities recommend against routine use, favoring drugs with better safety profiles, such as morphine and fentanyl [2].

Despite this decline, residual demand persists in specific regions and clinical scenarios, such as in countries with less regulatory oversight or where alternative options are limited. Emergency use and preoperative veterinary applications also maintain niche markets. The overall demand trajectory indicates a continuing decline, but episodic or regional pockets may sustain certain manufacturing scales.

Price Projections: Short to Long Term

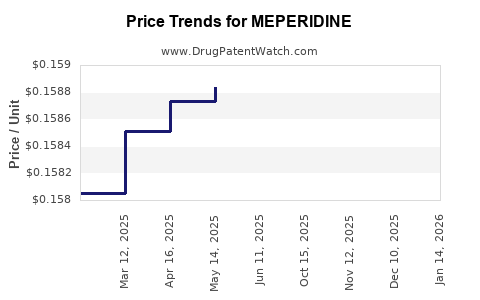

Current Pricing Landscape

In the U.S., generic meperidine vials typically range from $10 to $25 per 100 ml vial, reflecting decreased market competition and supply restrictions. In emerging markets, prices may be lower, approximating $5–$15 per vial, driven by local manufacturing costs and less regulatory oversight.

Near-term Outlook (1–3 Years)

Given the ongoing decline in clinical demand, combined with regulatory tightening and supply chain disruptions, prices are expected to remain relatively stable or progressively increase within niche markets. Shortages could cause brief price spikes, potentially up to 30–50% higher than current levels, especially if supply constraints persist [3].

Mid- to Long-term Outlook (3–10 Years)

Projections suggest further market contraction, with prices potentially stabilizing or decreasing as supply diminishes. However, due to regulatory and manufacturing constraints, prices may sustain at elevated levels in certain regions, especially if alternative treatments are limited. The transition away from meperidine is likely to be complete by 2030 in most developed countries, leading to near-total market withdrawal and potential obsolescence.

Influencing Factors

- Regulatory Restrictions: Stricter controls and bans reduce market viability, diminishing production and curtailing prices.

- Manufacturing Costs: Increased production costs, including compliance and raw materials, exert upward pressure.

- Regional Demand: Regions with lax regulation or ongoing use sustain limited markets, impacting global pricing.

- Supply Chain Stability: Disruptions can momentarily elevate prices due to scarcity.

Competitive Landscape

The diminishing presence of meperidine manufacturers leads to limited competition, augmenting market power for remaining suppliers. This oligopolistic tendency enhances pricing stability and inflation potential in niche markets but diminishes overall market size.

Global pharmaceutical companies have largely phased out production in favor of safer alternatives, reducing the likelihood of new entrants and the potential for price competition. Generic manufacturers continue to operate in select jurisdictions, maintaining minimal market presence.

Concluding Remarks

While meperidine's overall market contraction is imminent due to safety concerns and regulatory policies, regional variations and supply constraints may produce localized price volatility. The drug's scarcity—especially in markets with strict controls—could temporarily elevate prices. Nonetheless, long-term projections forecast continued decline in demand, eventual phase-out, and normalization of prices to near-zero levels globally.

Key Takeaways

- Market Decline: Meperidine's global market is contracting due to safety concerns and clinical guidelines advising against its use.

- Pricing Trends: Prices are stable or rising temporarily due to supply constraints but will likely decrease as the drug phases out completely.

- Regulatory Influence: Stricter legislation and control schedules restrict production and elevate compliance costs, impacting prices.

- Supply Chain Constraints: Raw material shortages and geopolitical issues exacerbate scarcity, influencing pricing in select regions.

- Future Outlook: The long-term prognosis points toward market obsolescence, with prices approaching negligible levels as usage diminishes worldwide.

FAQs

1. Why is the clinical use of meperidine declining?

Clinical guidelines discourage meperidine use due to its neurotoxicity risks, such as seizures, and the availability of safer, more effective opioids.

2. Which regions still utilize meperidine?

Limited regional markets, primarily in countries with less restrictive regulations, continue to use meperidine, sustaining residual demand.

3. How do regulatory changes impact meperidine prices?

Stricter regulations and scheduling elevate manufacturing and compliance costs, often leading to higher prices in permitted markets while limiting overall supply.

4. Is there a market for generic meperidine?

Yes, mainly in regions with fewer restrictions; however, the overall market share diminishes as use declines globally.

5. What is the projected future of meperidine?

Global market contraction is expected, with prices decreasing toward near-zero as the drug is phased out, replaced by safer analgesics.

References

[1] U.S. Food and Drug Administration. "Safety Alerts for Medication: Meperidine and Neurotoxicity." FDA Website, 2021.

[2] Centers for Disease Control and Prevention. "Guidelines for the Use of Opioid Analgesics in Chronic Pain." CDC, 2016.

[3] MarketWatch. "Pharmaceutical Supply Chain Disruptions and their Impact on Drug Prices." 2022.