Last updated: July 27, 2025

Introduction

Megestrol acetate is a synthetic progestin widely used in oncology and palliative care for its appetite-stimulating effects in cachectic patients with cancer or HIV/AIDS. Market dynamics for this drug are influenced by varying factors, including clinical demand, regulatory landscapes, generics availability, and emerging competitors. This analysis evaluates the current market landscape, factors influencing demand, regulatory considerations, and future price trajectories for megastrol acetate, aiming to guide stakeholders in strategic decision-making.

Therapeutic Indications and Market Demand

Megestrol acetate primarily addresses cachexia and anorexia within oncology and HIV/AIDS, two high-need areas with significant prevalence:

- Oncology: Cachexia affects up to 80% of advanced cancer patients, significantly impacting quality of life and survival outcomes [1].

- HIV/AIDS: With improved antiretroviral therapies, the lifespan extension has increased the importance of managing wasting syndromes, although the market has attenuated with newer agents.

Current treatment guidelines endorse megestrol acetate, especially in advanced cases, ensuring consistent demand. The growing global cancer burden, especially in emerging markets, sustains market appetite, factoring in aging populations and rising cancer incidences.

Market Size and Competitive Landscape

Global Market Valuation

As of 2022, the global market for appetite stimulants like megestrol acetate was estimated at approximately $200-250 million USD, with the majority concentrated in North America and Europe, regions where oncological care standards are high [2].

Competitive Dynamics

- Generic Competition: Megestrol acetate became off-patent in many jurisdictions over a decade ago, leading to a proliferation of generic formulations, markedly reducing prices and eroding branded market share.

- Emerging Treatments: New agents such as dronabinol (synthetic THC) and other appetite modulators have entered the arena, somewhat diversifying options but with variable efficacy and regulatory acceptance.

- Market Concentration: Generics dominate the landscape, with key players including Mylan and Teva, emphasizing cost-driven procurement practices.

Regulatory and Reimbursement Environment

Health authorities, including the FDA, EMA, and WHO, have streamlined access to generics, bolstering price competition. Payer policies increasingly favor cost-effective therapies, pressuring prices downward. Reimbursement rates vary, but predominantly favor generics, influencing market prices and provider prescribing behaviors.

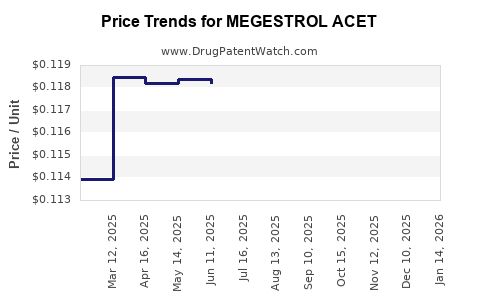

Pricing Trends and Projections

Historical Pricing Data

- Brand-name Prices (Pre-Patent Expiry): Approximate retail prices ranged from $10 to $20 USD per 20 mg tablet.

- Post-Generic Entry: Prices declined sharply, often below $5 USD per tablet, due to intense competition.

Current Price Estimates (2023)

- Brand-name (if available): Approximately $15-20 USD per tablet.

- Generic formulations: Typically $1-3 USD per tablet, with variability based on supplier and regional factors.

Short-to-Medium-Term Projections (2024-2028)

Given the mature status of the market:

- Price stabilization: Expected to remain within the current generic price range, barring significant regulatory changes or supply chain disruptions.

- Market consolidation: Potential consolidation among generic manufacturers may lead to slight price fluctuations.

- Regulatory impacts: Stricter quality standards or patents on new formulations could temporarily influence prices, but unlikely to significantly alter the market.

Long-Term Outlook (2029 and beyond)

- Gradual decline: As newer, potentially more effective appetite stimulants enter the market, demand for megestrol acetate may decrease modestly.

- Price flattening or further decline: Due to the commoditization of generics, wholesale prices are projected to stabilize at or below current levels.

- Regional disparities: Developing markets may see even lower prices driven by local manufacturing and procurement policies.

Market Drivers and Constraints

Drivers

- Aging global population: Increasing cancer prevalence, especially in Asia and Latin America.

- Acceptance of generic medicines: Cost-cutting measures favor the use of generics.

- Established clinical efficacy: Recognition in treatment guidelines sustains demand.

Constraints

- Emergence of alternatives: New appetite stimulants with better safety profiles may erode market share.

- Healthcare policy shifts: Stringent pricing controls in major markets could suppress prices further.

- Supply chain issues: Raw material shortages or manufacturing disruptions could introduce price volatility temporarily.

Strategic Recommendations

- Manufacturers should leverage cost efficiencies to remain competitive.

- Stakeholders should monitor regulatory developments that may introduce new formulations or patent protections.

- Payers and healthcare providers should balance clinical efficacy with economic considerations, favoring generics when appropriate.

Key Takeaways

- The market for megestrol acetate is mature, predominantly driven by generic formulations.

- Prices are expected to remain low and stable, with minor fluctuations due to supply, regulatory, or competitive factors.

- The demand trajectory may decline gradually as newer appetite stimulants gain traction.

- Regional variations, especially in emerging markets, present opportunities for cost-effective procurement.

- Stakeholders should focus on optimizing supply channels and monitoring emerging therapies to adapt to evolving market dynamics.

FAQs

Q1: What are the main therapeutic indications for megestrol acetate?

A1: It is primarily used to stimulate appetite and weight gain in patients with cachexia due to cancer or HIV/AIDS.

Q2: How has patent expiration affected megestrol acetate pricing?

A2: Patent expiry led to the entry of generic manufacturers, drastically reducing prices and increasing market accessibility.

Q3: What factors could influence future price projections for megestrol acetate?

A3: Introduction of new appetite stimulants, regulatory changes, patent protections, and supply chain stability.

Q4: Are there regional differences in megestrol acetate pricing?

A4: Yes, prices tend to be lower in developing regions due to local manufacturing, procurement policies, and market competition.

Q5: Is there potential for market growth in the coming years?

A5: Growth is limited; however, increases in cancer prevalence and older population demographics in emerging markets may sustain demand.

References

[1] Argilés J, et al. Cancer cachexia: understanding the molecular basis. Nat Rev Cancer. 2014.

[2] Market Research Future. Appetite Stimulants Market Report. 2022.