Last updated: July 28, 2025

Introduction

Mefloquine Hydrochloride (HCl), an antimalarial medication primarily used for preventing and treating malaria, has maintained a pivotal role within the global malaria control strategy. Its market landscape is shaped by factors such as increasing malaria prevalence, resistance profiles, regulatory developments, and pharmaceutical supply chain dynamics. This analysis provides an in-depth overview of Mefloquine HCl’s market environment, competition, pricing trends, and future price projections to aid stakeholders in strategic decision-making.

Market Overview

Global Malaria Burden and Therapeutic Landscape

Malaria remains a significant public health burden, with the World Health Organization (WHO) reporting approximately 241 million cases and 627,000 related deaths worldwide in 2020 (1). Although vector control and other antimalarials have gained prominence, Mefloquine HCl continues to be a critical prophylactic and treatment agent, especially in regions with chloroquine-resistant strains.

Regionally, Southeast Asia, Sub-Saharan Africa, and parts of Latin America represent primary markets for Mefloquine HCl. The drug's efficacy against multidrug-resistant malaria parasites sustains its relevance despite emerging resistance concerns.

Market Segments and Demand Drivers

- Prophylactic Use: Mefloquine HCl is predominantly prescribed for travelers to endemic regions, particularly where resistance limits other options.

- Therapeutic Use: Its application in active malaria treatment is more restricted but remains vital in specific contexts.

- Supply Chain and Formulation: The demand for generics drives significant manufacturing activity, influencing price competition and market entry barriers.

Regulatory Environment

Global regulatory agencies, such as the FDA and EMA, recognize Mefloquine HCl’s efficacy, but recent safety warnings regarding neuropsychiatric side effects have prompted revised labels and guidelines, impacting prescribing practices (2). Such regulatory developments influence market dynamics, potentially affecting pricing and demand.

Market Competition and Supply Dynamics

Manufacturers and Patent Status

Mefloquine HCl is predominantly produced by generic pharmaceutical companies, with no recent patents expiring beyond the initial patent period, leading to a commoditized market. Major players include Hikma Pharmaceuticals, Teva, Apotex, and others, contributing to intense price competition.

Supply Chain Factors

Global manufacturing capacity, geopolitical stability, and raw material availability impact supply continuity. Disruptions, such as those stemming from the COVID-19 pandemic, have temporarily affected production capacity and distribution channels.

Pricing Landscape

Market prices are typically influenced by:

- Generic Competition: High competition suppresses prices.

- Regulatory Approvals: New regulatory restrictions or labeling changes can reduce demand, affecting price stability.

- Market Demand: Fluctuations in malaria prevalence and prophylactic prescription trends influence volume-driven pricing.

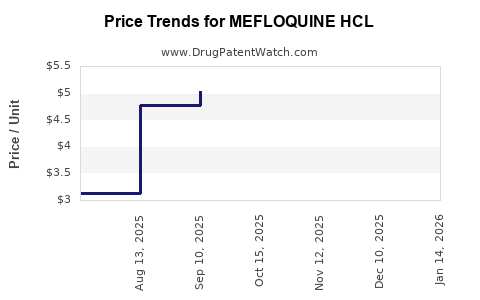

Current Pricing Trends

Data collected from international procurement agencies and market intelligence reports indicate:

- Average Price Range: US$0.30 – US$1.50 per tablet/dose, depending on the formulation, dosage, and purchase volume.

- Bulk Purchase Discounts: Larger orders often secure discounts of 15-30%, mainly used by governments and NGOs.

- Regional Variations: Prices are generally lower in low-income endemic regions due to local manufacturing and subsidies; high-income markets or import-dependent regions can see prices up to 2-3 times higher.

Influencing Factors

- Patent expiration and patent challenges in certain jurisdictions.

- Availability of quality-assured generics.

- Procurement policies favoring lower-cost options.

- Regulatory restrictions on indication and labeling leading to market consolidations or exits.

Future Price Projections

Market Drivers and Constraints

Positive drivers:

- Increasing resistance to other antimalarials (e.g., chloroquine, artemisinin derivatives) sustains demand for Mefloquine HCl.

- Advances in generic manufacturing capacity drive price erosion, making the drug more accessible.

- Support from endemic country governments and international donors, such as WHO, bolster procurement volumes.

Constraints:

- Rising safety concerns and adverse effect profiles may temper prescribing, impacting demand stability.

- Changes in regional regulatory policies could restrict market access.

- Development of alternative prophylactics (e.g., tafenoquine, atovaquone-proguanil) offers competing options.

Price Trajectory Estimates (2023–2030)

Based on historical trends, current market conditions, and projections:

- Short-term (2023–2025):

- Marginal price reductions of approximately 5–10% annually as generic competition intensifies.

- Stabilization around US$0.25 – US$1.20 per tablet in endemic regions.

- Medium-term (2026–2030):

- Continued gradual price erosion leading to a range of US$0.20 – US$1.00 per tablet, subject to regional market maturity.

- Potential premium prices may persist in high-income markets or niche prophylactic applications, possibly maintaining prices at US$2.00 or higher per dose.

- Long-term projections suggest sustained price compression due to market saturation, increased manufacturing capacity, and technological innovations reducing production costs.

Implications for Stakeholders

- Manufacturers should focus on optimizations in production to remain competitive amid Price declines.

- Distributors and governments can capitalize on low prices for bulk procurement, maximizing cost-efficiency in disease control programs.

- Investors and pharma R&D should monitor emerging resistance patterns and regulatory shifts that could pivot market dynamics.

Key Takeaways

- Mefloquine HCl remains a vital component in combating malaria amid rising resistance, with steady global demand.

- The market is highly competitive with widespread generic availability, leading to consistent price declines.

- Current prices range broadly but are trending downward, favoring large-scale procurement and endemic country subsidies.

- Regulatory safety concerns and alternative therapies threaten future market stability but are unlikely to eliminate Mefloquine’s role entirely.

- Price projections from 2023 through 2030 anticipate continued erosion, aligning with trends observed in other generic antimalarials.

FAQs

Q1: How does resistance impact Mefloquine HCl demand?

Resistance—particularly in Southeast Asia—limits efficacy, often leading to an alternative drug regimen. However, in regions with limited resistance, demand remains stable, supported by ongoing prophylactic use and supply of generic formulations.

Q2: Are there safety concerns that could influence pricing or market access?

Yes. Neuropsychiatric side effects have prompted regulatory warnings, leading some health authorities to restrict or reclassify Mefloquine prescriptions, potentially decreasing demand and influencing prices.

Q3: What role do international health agencies play in the Mefloquine market?

Agencies like WHO influence demand through procurement guidelines, disease control strategies, and funding for endemic countries, thereby stabilizing or expanding markets.

Q4: How might technological advancements influence future prices?

Process innovations that reduce manufacturing costs, along with increased generic competition, are likely to further depress prices, making Mefloquine HCl more accessible.

Q5: Could emerging antimalarials replace Mefloquine HCl?

Potentially. New drugs with better safety profiles and efficacy, such as tafenoquine, pose competitive threats. However, cost and regulatory hurdles may limit immediate replacement.

References

- WHO. World Malaria Report 2021. Geneva: World Health Organization; 2021.

- US FDA. Mefloquine Hydrochloride Tablets – Safety Label Revisions. 2020.