Share This Page

Drug Price Trends for MEDROL

✉ Email this page to a colleague

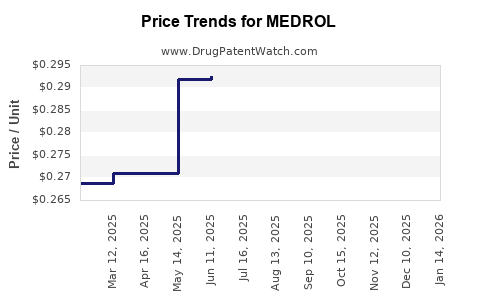

Average Pharmacy Cost for MEDROL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MEDROL 4 MG DOSEPAK | 00009-0056-04 | 0.29145 | EACH | 2025-12-17 |

| MEDROL 4 MG DOSEPAK | 00009-0056-04 | 0.29141 | EACH | 2025-11-19 |

| MEDROL 4 MG TABLET | 00009-0056-02 | 0.21413 | EACH | 2025-11-19 |

| MEDROL 4 MG DOSEPAK | 00009-0056-04 | 0.29149 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MEDROL

Introduction

MEDROL, the brand name for methylprednisolone acetate, is a corticosteroid predominantly used to mitigate inflammation, allergic reactions, and autoimmune conditions. Since its approval by the FDA in 1957, MEDROL has sustained a prominent role within the therapeutic landscape. Its market dynamics are influenced by factors such as clinical demand, regulatory policies, generic entry, and pricing strategies. This analysis provides a comprehensive assessment of MEDROL’s current market landscape and projects future pricing trends, empowering stakeholders to make informed strategic decisions.

Market Overview

Therapeutic Indications and Usage

MEDROL is chiefly prescribed for conditions such as arthritis, severe allergies, multiple sclerosis relapses, and certain dermatological disorders. Its efficacy in suppressing immune responses has maintained consistent demand, particularly in hospital and outpatient settings.

Market Size and Global Reach

The corticosteroid market, including methylprednisolone products, is valued in the billions annually. The global corticosteroid market was estimated to reach USD 15 billion in 2022, with a compound annual growth rate (CAGR) of approximately 3-4% over the next five years (Fortune Business Insights). MEDROL’s share remains significant within this segment, especially in North America, which accounts for more than 40% of corticosteroid prescriptions worldwide.

Competitive Landscape

The primary competition for MEDROL comes from generic methylprednisolone counterparts, which often undercut brand pricing. Notably, Medrol’s patent protection expired decades ago, leading to a saturated generics market. However, brand recognition and formulary preferences often sustain the value of MEDROL, especially for specific formulations.

Regulatory Environment

FDA approvals for different formulations (e.g., tablets, injectable solutions) and ongoing post-market surveillance influence market accessibility and safety profiles. The ongoing transition toward biosimilars in corticosteroids may further shape the competitive landscape.

Pricing Dynamics

Current Price Structure

The average wholesale price (AWP) for MEDROL varies depending on formulation and packaging. As of 2023, a 21-tablet course (4 mg dosage) typically retails around USD 50-75 wholesale, though prices may vary by region and distributor contract. Generics are generally priced approximately 10-25% lower than branded MEDROL, depending on negotiated discounts and insurance coverage.

Reimbursement and Insurance Impact

Insurance formularies and Medicare/Medicaid policies significantly influence patient access and pricing. MEDROL is frequently preferred in formulary lists owing to its longstanding efficacy and familiarity, conferring some pricing stability.

Factors Impacting Price Stability

- Generic Competition: Intensifies downward pressure, leading to significant price erosion over time.

- Manufacturing Costs: Relatively stable given the drug’s long-established manufacturing processes.

- Regulatory Policies: Restrictions on pricing or import/export policies could affect costs and availability.

- Supply Chain Dynamics: Post-pandemic supply chain disruptions can cause temporary price fluctuations.

Market Trends and Future Price Projections

Drivers of Price Trends

-

Increased Generic Penetration: As patents expired, rising generic competition has historically driven prices down. The average price decline for corticosteroids has been approximately 5-7% annually over the past decade, with median price reductions accelerative as new generic entrants emerge.

-

Formulation Innovations and Specialty Use: New formulations or combination products may command premium pricing. However, MEDROL remains primarily a generic staple.

-

Healthcare Policy and Cost Containment: Tighter drug pricing regulations, especially in markets like the European Union and Canada, may impose additional price constraints, while US price growth may be moderated by increased biosimilar competition.

Projected Prices (2023-2028)

Based on historical trends and current market factors, the following projections are reasonable:

-

Short-term (1-2 years): Prices are expected to stabilize around current levels, with minor corrections due to supply chain stabilization and insurance negotiations. Slight reductions of 2-3% annually are anticipated, primarily driven by increased generic competition.

-

Medium-term (3-5 years): Prices could decline by an additional 10-15%, reaching approximately USD 40-65 wholesale per course, depending on formulation and regional market factors.

-

Long-term (5+ years): Market saturation, potential biosimilar entries, and evolving healthcare policies may further compress prices by 20-30%, aligning with historical corticosteroid price reductions.

Potential Upside Factors

- Introduction of proprietary formulations with improved safety or efficacy profiles could support higher prices temporarily.

- Expansion into emerging markets with less generic penetration could offer niche premium pricing opportunities.

Downside Risks

- Aggressive price cuts due to patent expiry and biosimilar competition.

- Policy changes favoring price caps or reimbursement reductions.

- Disruption in supply chains that could impact pricing strategies.

Strategic Implications for Stakeholders

- Manufacturers: Focus on optimizing production efficiencies and exploring formulation innovations to sustain margins. Monitor regulatory shifts to maintain market access.

- Healthcare Providers: Consider cost-effective prescribing by utilizing generics when appropriate, balancing clinical efficacy and affordability.

- Payers: Negotiate favorable formulary placements and consider biosimilar adoption to contain costs.

- Investors: Anticipate short-term stabilization with downside risks from price erosion; long-term growth hinges on pipeline developments and market expansion.

Conclusion

The MEDROL market remains robust within corticosteroid therapeutics, but ongoing generic competition and policy pressures are expected to drive gradual price declines over the next five years. Price stability in the short term will likely give way to modest erosion aligned with historical patterns. Stakeholders should adapt strategic approaches accordingly, emphasizing cost containment, product differentiation, and market expansion in emerging regions.

Key Takeaways

- MEDROL’s long-standing presence and therapeutic efficacy solidify its market position, despite intense generic competition.

- Prices are expected to decline modestly (~5-10%) over the next five years, driven by generics and policy pressures.

- Strategic innovation, formulary positioning, and market expansion are vital to sustaining profitability.

- Healthcare policies favoring cost containment might impose further downward pressure.

- Monitoring biosimilar developments and regional regulatory changes remains critical for accurate pricing forecasts.

FAQs

1. How does the expiration of MEDROL’s patent impact its market price?

Patent expiration typically introduces generic competition, which exerts downward pressure on prices. As multiple manufacturers enter the market, prices tend to decrease by approximately 10-25%, depending on regional factors and formulary preferences.

2. What are the main factors influencing MEDROL’s future pricing?

Key factors include the level of generic competition, regulatory policies, healthcare reimbursement strategies, supply chain stability, and potential innovation in formulation or delivery methods.

3. Can increased biosimilar entries affect MEDROL’s price?

While biosimilars primarily target biologic drugs, the corticosteroid market may see emerging biosimilars or advanced formulations that could affect branded and generic corticosteroid pricing by increasing competition.

4. How does regional variation influence MEDROL pricing?

Pricing disparities exist due to differences in healthcare policies, insurance coverage, procurement practices, and market saturation, leading to higher prices in regions with less generic penetration and more regulatory barriers.

5. What strategies can manufacturers adopt to maintain profitability amid declining prices?

Manufacturers should innovate through new formulations, expand into emerging markets, leverage pharmacovigilance to maintain safety profiles, and negotiate favorable reimbursement terms to offset volume-driven declines.

Sources

[1] Fortune Business Insights. Corticosteroids Market Size, Share & Industry Analysis. 2022.

[2] IQVIA. Pharmaceutical Market Data, 2023.

[3] U.S. Food and Drug Administration (FDA). Drug Approvals and Labeling, 2023.

[4] EvaluatePharma. Pharmaceutical Pricing Trends, 2022.

More… ↓