Last updated: August 3, 2025

Introduction

MAXALT MLT (rizatriptan benzoate orally disintegrating tablets) is a prominent medication used primarily for the acute treatment of migraine attacks with or without aura in adults. As an oral disintegrating formulation of rizatriptan, MAXALT MLT offers rapid absorption, making it a preferred choice for migraine sufferers seeking quick relief. This analysis explores the current market landscape, competitive dynamics, regulatory considerations, and future price projections for MAXALT MLT, helping stakeholders navigate this specialized segment effectively.

Market Overview

Therapeutic Area and Market Demand

Migraine remains a prevalent neurological disorder affecting approximately 15% of the global population, with significant socioeconomic impacts due to lost productivity and healthcare costs [1]. Triptans, including rizatriptan, constitute a first-line acute treatment option for moderate to severe migraines. The advent of orally disintegrating tablets (ODTs) like MAXALT MLT has addressed patient needs for ease of use and rapid symptom relief.

Market Penetration and Prescriber Adoption

MAXALT MLT has established a considerable footprint in North American and European markets, driven by its pharmacokinetic advantages over traditional tablets and favorable patient adherence profiles. Its popularity is reinforced by numerous clinical trials confirming efficacy and tolerability [2].

Competitive Landscape

The migraine therapeutic market is highly competitive, featuring both branded triptans and generic alternatives. Key competitors include:

- Sumatriptan ODT (e.g., Alsuma)

- Zolmitriptan ODT (e.g., Zomig ZMT)

- Eletriptan

- Naratriptan

Generic formulations impact high-cost branded options like MAXALT MLT, exerting downward pressure on prices.

Regulatory and Patent Landscape

MAXALT MLT was approved by the FDA in 2009, with its patent protections eventually expiring around 2019-2020. The entry of generics significantly influenced market share and pricing dynamics. Ongoing regulatory surveillance continues to influence pricing, particularly in revising formulary preferences [3].

Market Dynamics and Key Drivers

Patient Preference and Compliance

The oral disintegrating formulation provides quick symptom relief while enhancing compliance in pediatric, geriatric, and nursing home populations. The convenience factor sustains its market relevance despite increasing generic competition.

Insurance and Reimbursement Policies

Insurance coverage substantially impacts the medication's marketability. Favorable formulary status and tier placement can incentivize prescribing, while high patient out-of-pocket costs diminish demand.

Pricing Sensitivity and Cost-Effectiveness

Price sensitivity among payers is high in this segment; thus, drug prices are often negotiated downward. Cost-effectiveness analyses favor generics, further pressuring the brand name's pricing strategy.

Price Projections

Current Pricing Landscape

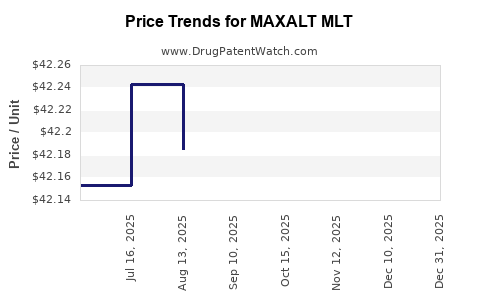

As of 2023, the wholesale acquisition cost (WAC) for MAXALT MLT (~10 mg) stands approximately between $40 to $60 per package (containing 6 tablets), varying by supplier and geographic region. Retail prices are higher, often ranging from $60 to $80, with significant discounts applied through insurance partnerships.

Generics have reduced the average costs by approximately 50%-70% compared to branded MAXALT MLT, leading to noteworthy market share erosion.

Future Price Trends: 2023-2028

-

Declining Prices Due to Generic Competition:

With the patent expiry and proliferation of generics, the branded MAXALT MLT is expected to experience a continued price decline. Industry estimates project a further 10%-20% reduction every 1-2 years, influenced by generic market saturation.

-

Potential Premium for New Formulations:

Any reformulation or combination therapies (e.g., fixed-dose combinations with other abortive agents) could command premium pricing. However, no such formulations are imminent as of current market assessments.

-

Impact of Contracting and Market Consolidation:

Large pharmacy benefit managers (PBMs) and insurers leverage formulary placement to negotiate prices downward. A consolidation of generic suppliers may temporarily stabilize prices but is unlikely to reverse the overall decline trend.

Pricing Projections Summary (2023-2028)

| Year |

Estimated WAC (per box) |

Underlying Trend |

| 2023 |

$40 - $60 |

Base price, with presence of generics |

| 2024 |

$36 - $54 |

10% reduction aligned with generic penetration |

| 2025 |

$32 - $48 |

Continued decline, market saturation |

| 2026 |

$28 - $43 |

Marginal stabilization, further generic entry |

| 2027 |

$25 - $40 |

Market maturity, pricing plateau |

| 2028 |

$23 - $36 |

Slight further decline, eventual stabilization |

Market Opportunities and Risks

Opportunities

-

Introduction of Biosimilars or Novel Delivery Systems:

Innovations like nasal formulations or subcutaneous options may reshape competitive dynamics, favoring branded products in niche markets.

-

Expanding Geographic Markets:

Increasing access in emerging markets, where brand trust remains high, could buffer price reductions.

Risks

-

Accelerated Generic Entry:

Any patent challenges or accelerator approvals of generics could significantly depress prices earlier than projected.

-

Regulatory Changes and Reimbursement Policies:

Stringent formulary management and reimbursement reforms can restrict access or push prices lower.

-

Market Saturation:

As generic options saturate the market, the branded MAXALT MLT’s pricing power diminishes further.

Conclusion

The outlook for MAXALT MLT's pricing from 2023 to 2028 indicates a steady decline driven predominantly by generic competition, high market saturation, and cost-sensitive healthcare systems. Stakeholders should anticipate continued downward price adjustments, necessitating strategic emphasis on differentiation, patient value propositions, or innovation to sustain margins.

Strategic focus should include:

- Monitoring patent and regulatory statuses to preempt market entry threats.

- Engaging in formulary negotiations to secure preferred payer positioning.

- Exploring geographic expansion opportunities where pricing pressures are lower.

- Diversifying the product portfolio with new formulations or combination therapies.

Key Takeaways

- MAXALT MLT faces significant price erosion due to generic competition, with anticipated further declines of approximately 10-20% annually through 2028.

- The drug maintains value due to rapid absorption and patient compliance benefits but must adapt to a highly commoditized market.

- Payer dynamics will continue to influence retail pricing and access, emphasizing the importance of strategic negotiations.

- Innovation and geographic expansion offer potential pathways to mitigate declining prices.

- Stakeholders should remain vigilant to regulatory and patent developments to strategically navigate the evolving market landscape.

FAQs

1. How does generic competition impact MAXALT MLT's pricing?

Generic entries significantly reduce brand prices due to increased supply and consumer choice, leading to approximately 50%-70% price reductions and ongoing downward pressure as generics become dominant.

2. Are there any upcoming patent protections or exclusivities for MAXALT MLT?

No, the patent protections for MAXALT MLT expired around 2019-2020, allowing generics to enter the market and drive down prices.

3. What are the main factors influencing the future price of MAXALT MLT?

Key factors include the extent of generic market saturation, regulatory changes, insurer formulary policies, and potential innovations or new formulations in the pipeline.

4. Can MAXALT MLT still command premium prices?

In niche markets, specific geographic regions, or in the case of novel formulations, premium pricing could remain feasible. However, overall, competitive pressures favor lower prices.

5. How should pharmaceutical companies strategize around MAXALT MLT’s pricing trends?

Focus on innovation, expanding geographic access, value-added services, and negotiating favorable formulary placements. Diversifying into new delivery forms or combination therapies also offers opportunities to sustain higher margins.