Share This Page

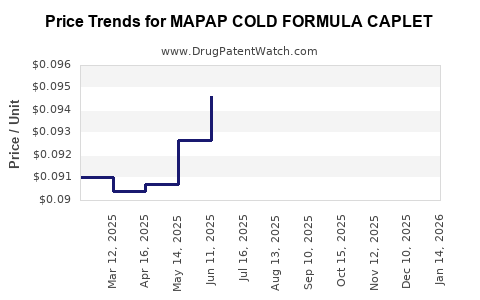

Drug Price Trends for MAPAP COLD FORMULA CAPLET

✉ Email this page to a colleague

Average Pharmacy Cost for MAPAP COLD FORMULA CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MAPAP COLD FORMULA CAPLET | 00904-5786-24 | 0.09232 | EACH | 2025-12-17 |

| MAPAP COLD FORMULA CAPLET | 00904-5786-24 | 0.09454 | EACH | 2025-11-19 |

| MAPAP COLD FORMULA CAPLET | 00904-5786-24 | 0.09637 | EACH | 2025-10-22 |

| MAPAP COLD FORMULA CAPLET | 00904-5786-24 | 0.09700 | EACH | 2025-09-17 |

| MAPAP COLD FORMULA CAPLET | 00904-5786-24 | 0.09740 | EACH | 2025-08-20 |

| MAPAP COLD FORMULA CAPLET | 00904-5786-24 | 0.09655 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MAPAP Cold Formula Caplet

Introduction

MAPAP Cold Formula Caplet, a combination analgesic and antipyretic medication, primarily targets consumers seeking relief from cold symptoms, aches, and fever. Understanding its market dynamics and pricing trajectory is essential for pharmaceutical stakeholders, retailers, and investors contemplating entry or expansion within this segment. This analysis provides a comprehensive overview of the current market landscape, regulatory environment, competitive positioning, and price trend projections for MAPAP Cold Formula Caplet.

Market Overview

Product Composition & Therapeutic Class

MAPAP Cold Formula Caplet typically combines acetaminophen (paracetamol) with other ingredients such as decongestants (pseudoephedrine), antihistamines (chlorpheniramine), and sometimes caffeine or expectorants. Its purpose: to address multiple cold symptoms in a single, convenient oral dosage form.

Consumer Demographics & Usage Trends

Cold relief medications like MAPAP are consumed across broad demographics, notably adults aged 18-65, with spikes during seasonal cold outbreaks—primarily fall and winter months. Trends indicate increasing preference for multi-symptom formulations as consumers seek streamlined, effective remedies.

Market Size & Growth Drivers

Global OTC cold medication market projected to reach USD 12 billion by 2027, growing at a CAGR of approximately 4.5%, bolstered by rising urbanization, increased health awareness, and OTC accessibility. North America remains the dominant market, with growth potential in emerging regions like Asia-Pacific due to expanding OTC channels.

Regulatory and Regional Considerations

Regulatory Landscape

In the U.S., the FDA regulates combination cold medications, emphasizing safety and labeling compliance. In Europe, EMA standards similarly govern OTC products, with regional variations affecting formulation approval and marketing. Stringent regulation may influence product pricing and market entry timelines.

Regional Variability in Demand & Pricing

Market penetration varies by region, influenced by healthcare infrastructure, cultural preferences, and regulatory hurdles. For instance, lower pricing is common in emerging markets to accommodate income levels, whereas North America commands premium pricing due to consumer willingness and regulatory complexity.

Competitive Landscape

Key Players

Major OTC pharmaceutical companies dominate the MAPAP Cold Formula segment, including Johnson & Johnson (TYLENOL Cold), Pfizer (Sudafed PE), and local manufacturers. Store brands and generics also capture substantial market share due to competitive pricing strategies.

Product Differentiation & Market Entry Barriers

Differentiation hinges on formulation efficacy, packaging, brand trust, and marketing. Regulatory approval, manufacturing quality standards, and patent protections serve as significant barriers to entry for new competitors.

Pricing Strategies

Premium brands leverage brand loyalty and perceived efficacy to command higher prices; generics and store brands compete primarily on cost, often priced 20-50% below leading brands.

Price Trends and Projections (2023-2028)

Historical Pricing Analysis

Historically, MAPAP Cold Formula Caplets have maintained stable pricing, with minor fluctuations driven by raw material costs (notably acetaminophen), inflation, and competitive pressures.

Short-term Trends (2023-2024)

- Raw material costs remain volatile, especially if supply chain disruptions persist post-pandemic, potentially causing price increases.

- Regulatory changes or reformulations to enhance safety profiles may impact pricing due to R&D investments or packaging modifications.

Medium to Long-term Projections (2025-2028)

- As ingredient costs stabilize, pricing is expected to follow inflation-adjusted trends, with slight reductions anticipated in highly competitive segments.

- Market commoditization of generics and private label offerings is likely to push down prices further, especially in mass-market retail channels.

- Emerging markets could see a notable reduction in retail prices by 10-15% due to increased local manufacturing and economies of scale.

- Conversely, if new formulations address unmet needs or incorporate novel delivery mechanisms, premium pricing may emerge.

Inflation & Cost-Pressure Impacts

Projected moderate inflation (approximately 2-3% annually) will influence retail prices. Factors such as packaging costs, regulatory fees, and import tariffs could further impact pricing structures.

Distribution Channels & Pricing Implications

- Pharmacy Chains & Mass Retailers: Dominant channels offering competitive pricing, often accompanied by promotional discounts and private label options.

- Online Pharmacies: Growing share, enabling price comparison and often lower prices due to reduced overheads.

- Hospital & Clinic Supply: Limited, mainly for OTC provisions within outpatient care, with pricing influenced by bulk purchasing contracts.

The shift toward online purchasing is expected to exert downward pressure on retail prices, especially for standardized formulations like MAPAP Cold Formula Caplet.

Key Market Dynamics & Risks

- Raw Material Volatility: Fluctuations in acetaminophen prices due to sourcing or regulatory constraints (e.g., restrictions on certain chemical sources).

- Regulatory Changes: New safety regulations, such as limits on acetaminophen dosage, could necessitate reformulations, impacting manufacturing costs and pricing.

- Competitive Innovations: Introduction of combination products with improved safety profiles or novel delivery forms (liquid gels, dissolvable tablets) could erode traditional caplet pricing.

- Market Penetration & Consumer Preferences: Growth in self-medication and OTC trust assist price stability; however, demographic shifts or health concerns might influence demand.

Conclusion & Strategic Recommendations

The market for MAPAP Cold Formula Caplet remains resilient, supported by consistent consumer demand, broad demographic appeal, and mature distribution networks. Price projections indicate stable to modestly declining trends over the next five years, emphasizing the importance of cost management, supply chain stability, and regulatory compliance. Companies should focus on differentiating their formulations, optimizing supply chains, and leveraging online retail channels to maintain competitiveness amid pricing pressures.

Key Takeaways

- The global OTC cold medication market will continue to grow, driven by urbanization and consumer preferences for multi-symptom formulations like MAPAP Cold Formula Caplet.

- Price stability prevails, with moderate downward pressures anticipated due to increased generic competition and online retail proliferation.

- Regulatory considerations, especially regarding safety and ingredient sourcing, significantly influence pricing strategies.

- Emerging markets present opportunities for lower pricing, bolstered by manufacturing scale and local regulation adaptations.

- Innovation in formulation and delivery methods remain critical for maintaining premium pricing and consumer relevance.

FAQs

1. How does raw material cost fluctuation affect the pricing of MAPAP Cold Formula Caplet?

Raw material costs, notably acetaminophen, directly impact manufacturing expenses. Supply shortages or regulatory restrictions can increase costs, leading to price adjustments either through increased retail prices or reduced margins.

2. What factors most influence the future pricing of combination cold medications?

Regulatory changes, raw material costs, competitive intensity, patent expirations, and consumer demand for safety and efficacy determine future pricing trajectories.

3. Are generic versions of MAPAP Cold Formula Caplet likely to enter the market?

Yes, due to the widespread use and patent expirations on many formulations, generics and store-brand equivalents are common, exerting downward pressure on overall prices.

4. How significant is the online retail channel for pricing strategies?

Online channels enable firms to offer competitive prices, gather consumer data, and execute targeted marketing, making them increasingly influential in shaping price trends.

5. What innovations could disrupt current pricing models for OTC cold medications?

Innovations such as long-acting formulations, novel delivery systems, or combination products with enhanced safety profiles could command premium prices and shift current market dynamics.

Sources

- IQVIA. "Global Over-the-Counter (OTC) Healthcare Market Report," 2022.

- Statista. "Cold & Flu Medicine Market Size and Forecast," 2022.

- U.S. Food and Drug Administration. "OTC Drug Monograph Rule," 2021.

- European Medicines Agency. "Guidelines on the Qualification of Medical Products," 2022.

- MarketWatch. "OTC Cold and Flu Market Trends," 2023.

More… ↓