Share This Page

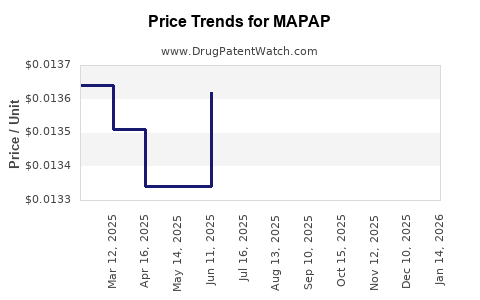

Drug Price Trends for MAPAP

✉ Email this page to a colleague

Average Pharmacy Cost for MAPAP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MAPAP COLD FORMULA CAPLET | 00904-5786-24 | 0.09232 | EACH | 2025-12-17 |

| MAPAP 500 MG/15 ML LIQUID | 00904-5847-09 | 0.01940 | ML | 2025-12-17 |

| MAPAP 500 MG CAPSULE | 00904-1987-60 | 0.03488 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MAPAP (Acetaminophen)

Introduction

MAPAP, commonly recognized as acetaminophen (paracetamol), is a widely used analgesic and antipyretic drug with a long-standing presence in the global pharmaceutical market. Its extensive application in pain relief and fever reduction, coupled with high consumer demand, makes it a significant focus for market analysts, manufacturers, and regulators. This report provides a comprehensive market analysis and price projection for MAPAP, considering current industry dynamics, regulatory landscapes, manufacturing trends, patent statuses, and emerging market opportunities.

Market Overview

Global Market Size and Growth

The global acetaminophen market was estimated at USD 1.3 billion in 2022, with projections suggesting a Compound Annual Growth Rate (CAGR) of approximately 4.2% between 2023 and 2030. The CAGR reflects factors such as increasing demand for over-the-counter (OTC) medications, growing prevalence of pain-related conditions, and expanding healthcare infrastructure in emerging markets.

Key Market Segments

- Geography: North America dominates the market, driven by high consumption rates and mature healthcare systems. The Asia-Pacific region presents the fastest-growing segment, fueled by rising healthcare awareness, urbanization, and increasing OTC drug consumption.

- Application: The analgesic segment dominates, with acetaminophen used primarily for mild to moderate pain and fever management.

- Formulation: Oral tablets are the most prevalent, but there is rising demand for liquids and dispersible forms, especially in pediatric markets.

- Distribution Channels: Retail pharmacies and supermarkets account for the largest share, with online pharmacies gaining traction.

Competitive Landscape

Leading manufacturers include Johnson & Johnson, McNeil Consumer Healthcare, and Hikma Pharmaceuticals. The market sees significant competition based on product formulations, pricing strategies, and supply chain efficiencies. Patent expirations for traditional formulations have paved the way for generic manufacturers, intensifying price competition.

Regulatory Environment

Global Regulatory Trends

Regulatory agencies such as the FDA (United States), EMA (European Union), and MHRA (UK) impose strict guidelines on labeling, manufacturing standards, and safety monitoring. In recent years, restrictions on high-dose formulations and package labeling campaigns aim to mitigate overdose risks.

Impact on Market Dynamics

Stringent regulations can influence manufacturing costs and product labeling, potentially impacting pricing. Conversely, regulatory approvals for combination drugs and new formulations open avenues for market expansion.

Manufacturing and Supply Chain Trends

Raw Material Sourcing

The primary raw material for acetaminophen production is phenol, with China and India being major suppliers. Supply chain disruptions, such as those experienced during the COVID-19 pandemic, have underscored the vulnerability of raw material sourcing.

Manufacturing Innovations

Advances in synthesis techniques, such as continuous flow chemistry, enhance production efficiency and environmental sustainability. These innovations may reduce manufacturing costs, influencing pricing strategies.

Patent Landscape and Generic Competition

Traditional acetaminophen formulations have lost patent protections, resulting in a surge of generic entrants. Limited patent protections exist for new formulations or combination products, offering development opportunities but also heightening price competition.

Market Drivers and Challenges

Drivers

- Rising prevalence of chronic pain, osteoarthritis, and fever-inducing conditions.

- Increasing OTC medication consumption.

- Growing markets in emerging economies.

- Introduction of combination analgesic formulations.

Challenges

- Regulatory restrictions on high-dose products.

- Public safety concerns regarding overdose and hepatotoxicity.

- Market saturation and price erosion due to generic competition.

- Supply chain vulnerabilities affecting raw material availability.

Price Projections (2023–2030)

Current Pricing Dynamics

The average wholesale price (AWP) of a standard 500 mg acetaminophen tablet in North America ranges from USD 0.02 to USD 0.05 per tablet, with retail prices typically 1.5 to 2 times higher. In emerging markets, prices are lower due to manufacturing cost differences and market competition.

Projected Price Trends

Based on market data and industry insights, the following projections are estimated:

- Short-term (2023–2025): Due to intensified generic competition and manufacturing efficiencies, average prices are expected to decline modestly by approximately 2-3% annually.

- Mid-term (2026–2028): Prices may stabilize or slightly increase, driven by formulation innovations and regulatory impact, with an annual growth rate of 1-2%.

- Long-term (2029–2030): Introduction of novel delivery systems or combination therapies could influence pricing structures, resulting in potential price stabilization or slight increases in premium formulations.

Regional Variations

- North America: Prices likely to decline due to intense competition but may stabilize in premium formulations.

- Asia-Pacific: Prices are expected to remain low but could see incremental increases with market expansion and regulatory tightening.

- Europe: Slight price increases may occur with regulatory compliance costs, though generic competition keeps prices relatively stable.

Emerging Opportunities

- Development of combination products with other analgesics or anti-inflammatory agents for niche markets.

- Formulations tailored for pediatric or geriatric populations with personalized dosing.

- Introduction of tamper-evident and child-resistant packaging, increasing production costs but improving safety.

- Digital health integration, such as smart packaging, to monitor consumption patterns.

Regulatory and Market Risks

- Potential reclassification or restriction due to overdose or hepatotoxicity concerns.

- Price regulation policies, especially in countries with universal healthcare.

- Patent litigations and safety alerts can distort pricing and market stability.

Conclusion

MAPAP remains a cornerstone in pain and fever management, with a mature yet evolving market landscape. Price trajectories are predominantly dictated by generic competition, regulatory frameworks, and manufacturing efficiencies. While short-term declines in price are probable, mid-to-long-term dynamics could introduce premium formulations or combination therapies that command higher prices. Companies should focus on innovation, supply chain resilience, and regulatory compliance to solidify their market positions.

Key Takeaways

- The global acetaminophen market is sizable, mature, and expected to grow modestly through 2030.

- Price declines are projected in the short term due to intense generic competition, but innovation may sustain or increase prices over time.

- Supply chain robustness and regulatory compliance are critical to maintaining profitability.

- Emerging markets offer significant growth opportunities, albeit with price sensitivity considerations.

- Strategic focus on formulation innovation and safety enhancements can differentiate products and influence pricing power.

FAQs

1. What factors influence the price of MAPAP globally?

Market competition, manufacturing costs, regulatory policies, raw material availability, and product formulation innovations primarily drive MAPAP pricing.

2. How will patent expirations impact MAPAP prices?

Patent expirations lead to an influx of generics, intensifying competition and causing prices to decline, especially in mature markets.

3. Are there regulatory risks that could affect MAPAP pricing?

Yes. Restrictions on dosage, safety concerns about overdose, or reclassification can increase manufacturing costs or restrict sales, impacting prices.

4. What emerging trends could influence future MAPAP prices?

Innovations in formulations, combination therapies, safety packaging, and digital health integration are key trends influencing future pricing.

5. What are the critical regional differences for MAPAP pricing?

North America and Europe tend to have higher prices due to regulatory and economic factors, whereas emerging markets maintain lower price points driven by cost advantages and market maturity.

Sources

- [1] MarketResearch.com, "Global Acetaminophen Market," 2022.

- [2] Grand View Research, "Analgesics Market Size," 2023.

- [3] U.S. Food and Drug Administration, "Over-the-Counter Analgesics Regulations," 2022.

- [4] IQVIA, "Pharmaceutical Market Data," 2023.

- [5] World Health Organization, "Global Pain Management Trend," 2022.

More… ↓