Last updated: July 27, 2025

Introduction

Magnesium oxide (MgO) is a high-demand inorganic compound used extensively across various industrial and pharmaceutical sectors. It is primarily recognized for its applications in refractory materials, dietary supplements, agricultural amendments, and pharmaceutical formulations. As global markets evolve, understanding the dynamics governing Magnesium oxide’s supply, demand, and pricing is critical for stakeholders including manufacturers, investors, and healthcare policymakers. This article provides a comprehensive market analysis and detailed price projections for Magnesium oxide, highlighting key factors influencing its economic landscape.

Market Overview

Global Market Size and Growth Trajectory

The global Magnesium oxide market was valued at approximately USD 4.8 billion in 2022 and is projected to reach USD 6.4 billion by 2030, expanding at a compound annual growth rate (CAGR) of roughly 4.3% during 2023–2030. This growth is fueled by expanding uses in refractory industries, increasing demand in healthcare sectors, and rising adoption in agricultural applications. Notably, the Asia-Pacific region dominates market share, accounting for over 50% of global consumption, driven by extensive manufacturing bases in China, India, and Southeast Asia.

Key Application Sectors

- Refractory Materials: Over 60% of magnesium oxide is used as a refractory lining agent in steel, cement, and glass manufacturing. High-temperature stability enhances its critical role.

- Healthcare and Pharmaceuticals: Magnesium oxide serves as an active ingredient and supplement, addressing magnesium deficiencies globally.

- Agriculture: Soil amendment and pH regulation within crop cultivation.

- Construction: As an eco-friendly building material and in fireproofing applications.

Major Producing Countries

China leads global magnesium oxide production, accounting for approximately 70% of output, attributed to abundant raw mineral resources and established manufacturing infrastructure. Other notable producers include India, Russia, and the United States.

Supply Chain Dynamics

Raw Material Availability and Cost Influences

Magnesium oxide production relies mainly on magnesite and dolomite mineral deposits. Fluctuations in mining activities, environmental regulations, and geopolitical considerations impact raw material costs. China's regulatory environment has tightened mining policies, adding volatility to supply and prices.

Manufacturing Technologies and Capacity

Advancements such as caustic calcination and rotary kiln processes have optimized efficiency, reducing costs. However, capacity constraints in raw material extraction and energy-intensive manufacturing processes can lead to supply chain bottlenecks, influencing global prices.

Market Drivers and Challenges

Driving Factors

- Industrial Expansion: Growing steel, cement, and glass industries across emerging economies escalate demand for refractory-grade MgO.

- Healthcare Trends: Rising prevalence of magnesium deficiency diseases has surged demand for pharmaceutical-grade MgO supplements.

- Environmental Regulations: Increased emphasis on eco-friendly building materials boosts demand for MgO-based construction products.

Challenges

- Price Volatility: Raw material shortages and geopolitical tensions create price fluctuations.

- Environmental Concerns: Mining restrictions and emissions regulations may limit production capacity.

- Substitutes: Alternatives such as calcium oxide and other refractory materials could temper growth.

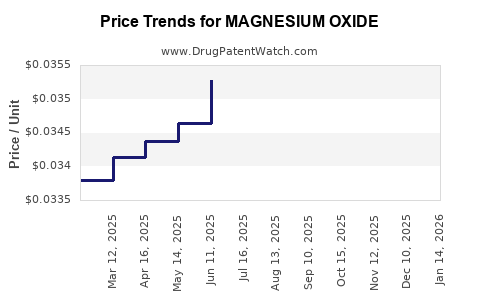

Price Trends and Forecasting

Historical Price Analysis (2018–2022)

Magnesium oxide prices experienced moderate volatility, rising from approximately USD 300 per metric ton in 2018 to peaks near USD 480 per metric ton in 2021, attributed to supply chain disruptions due to the COVID-19 pandemic and raw material shortages. Post-pandemic stabilization has seen prices settle around USD 430–USD 440 per metric ton in 2022.

Forecasted Price Movements (2023–2030)

Aligned with ongoing industry developments, global magnesium oxide prices are anticipated to grow modestly, reaching USD 500–USD 550 per metric ton by 2030. The primary factors influencing this outlook include:

- Steady demand growth across industries, especially in Asia and North America.

- Supply constraints stemming from environmental restrictions and raw material availability.

- Energy costs: Elevated energy prices, primarily electricity and natural gas, will continue impacting production costs, especially in energy-intensive calcination processes.

Regional Price Variations

Prices are expected to remain higher in North America and Europe due to stricter environmental regulations, higher logistic costs, and limited local manufacturing capacities compared to Asia-Pacific.

Competitive Landscape

Leading global players include China National Building Material Company (CNBM), Magnesita Refractories, and China Minmetals. These entities have leveraged scale, technological innovation, and raw material access to maintain pricing power. Smaller regional producers compete primarily on price and quality, influencing niche markets.

Market Risks and Opportunities

Risks

- Raw Material Scarcity: Disrupted mining operations could tighten supply, boosting prices unpredictably.

- Environmental Regulations: Stricter emissions and mining policies may reduce capacity growth potential.

- Global Economic Conditions: Recession or slowdown in major consuming sectors could suppress demand.

Opportunities

- Technological Innovation: Improved calcination technologies could reduce production costs.

- Emerging Markets: Infrastructure development in Africa and Southeast Asia presents new avenues.

- Sustainability Initiatives: Environmentally friendly magnesium oxide products could command premium pricing.

Conclusion: Strategic Outlook

The magnesium oxide market exhibits steady growth prospects with moderate price increases forecasted through 2030. Stakeholders should monitor raw material markets, technological advances, and regulatory changes to navigate volatility effectively. Investment in sustainable production methods and diversification of supply sources will confer competitive advantages amid ongoing market complexities.

Key Takeaways

- Market Size & Growth: Expected to grow at a CAGR of approximately 4.3%, driven by refractory, healthcare, and agricultural demand.

- Pricing Trends: Prices hovered around USD 430–USD 440 per ton in 2022, with projections to reach USD 500–USD 550 by 2030.

- Regional Dynamics: Asia-Pacific dominates production and consumption, with higher prices anticipated in North America and Europe.

- Supply Challenges: Raw material constraints and environmental regulations could create periodic supply shortages, influencing prices.

- Investment Opportunities: Emphasis on sustainable manufacturing and emerging markets can expand growth avenues.

FAQs

Q1: What are the main industrial uses driving magnesium oxide demand?

A1: The primary industrial uses include refractory materials for high-temperature applications in steel, cement, and glass manufacturing; as a dietary supplement in healthcare; and as soil amendments in agriculture.

Q2: How do raw material costs impact magnesium oxide pricing?

A2: Raw materials like magnesite and dolomite directly influence production costs. Fluctuations in mining activities, supply chain disruptions, and environmental restrictions can lead to price volatility in MgO.

Q3: What are the primary regional markets for magnesium oxide?

A3: Asia-Pacific dominates due to extensive manufacturing bases, with China as the largest producer. North America and Europe seek higher-quality and specialty MgO products, often at premium prices.

Q4: How will environmental regulations affect future magnesium oxide prices?

A4: Stricter environmental policies may limit production capacity, tighten supply, and increase operational costs, leading to upward pressure on prices.

Q5: What technological innovations could influence the Magnesium oxide market?

A5: Innovations like energy-efficient calcination processes, recycling, and sustainable mining methods can reduce costs and environmental impact, enhancing supply stability and supporting price management.

References

- Grand View Research, "Magnesium Oxide Market Size, Share & Trends Analysis," 2022.

- MarketsandMarkets, "Inorganic Refractories Market," 2023.

- US Geological Survey, "Mineral Commodity Summaries," 2022.

- International Magnesium Association, "Market Reports," 2022.

- Industry Reports, "Global Refractory Materials Market," 2022.

This article provides strategic insights rooted in current data, emphasizing the importance of market awareness for informed decision-making regarding Magnesium oxide.